- Joined

- Dec 6, 2011

- Messages

- 4,784 (1.06/day)

- Location

- Still on the East Side

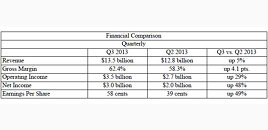

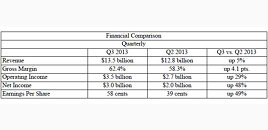

Intel Corporation today reported third-quarter revenue of $13.5 billion, operating income of $3.5 billion, net income of $3.0 billion and EPS of $0.58. The company generated approximately $5.7 billion in cash from operations, paid dividends of $1.1 billion, and used $536 million to repurchase 24 million shares of stock.

"The third quarter came in as expected, with modest growth in a tough environment," said Intel CEO Brian Krzanich. "We're executing on our strategy to offer an increasingly broad and diverse product portfolio that spans key growth segments, operating systems and form factors. Since August we have introduced more than 40 new products for market segments from the Internet-of-Things to datacenters, with an increasing focus on ultra-mobile devices and 2 in 1 systems."

Q3 Key Financial Information and Business Unit Trends

Business Outlook

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures or other investments that may be completed after October 15.

Q4 2013

For additional information regarding Intel's results and Business Outlook, please see the CFO commentary at: www.intc.com/results.cfm.

View at TechPowerUp Main Site

"The third quarter came in as expected, with modest growth in a tough environment," said Intel CEO Brian Krzanich. "We're executing on our strategy to offer an increasingly broad and diverse product portfolio that spans key growth segments, operating systems and form factors. Since August we have introduced more than 40 new products for market segments from the Internet-of-Things to datacenters, with an increasing focus on ultra-mobile devices and 2 in 1 systems."

Q3 Key Financial Information and Business Unit Trends

- PC Client Group revenue of $8.4 billion, up 3.5 percent sequentially and down 3.5 percent year-over-year.

- Data Center Group revenue of $2.9 billion, up 6.2 percent sequentially and up 12.2 percent year-over-year.

- Other Intel architecture operating segments revenue of $1.1 billion, up 13.3 percent sequentially and down 9.3 percent year-over-year.

- Gross margin of 62.4 percent, 1.4 percentage points above the midpoint of the company's prior expectation of 61 percent.

- R&D plus MG&A spending of $4.7 billion, slightly below the company's prior expectation of approximately $4.8 billion.

- Tax rate of 25 percent versus the company's prior expectation of 26 percent.

Business Outlook

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures or other investments that may be completed after October 15.

Q4 2013

- Revenue: $13.7 billion, plus or minus $500 million.

- Gross margin percentage: 61 percent, plus or minus a couple of percentage points.

- R&D plus MG&A spending: approximately $4.7 billion.

- Amortization of acquisition-related intangibles: approximately $70 million.

- Impact of equity investments and interest and other: approximately zero.

- Depreciation: approximately $1.7 billion.

- Restructuring and asset impairment charges: approximately $100 million.

- Tax rate: approximately 25 percent.

- Full-year capital spending: $10.8 billion, plus or minus $300 million.

For additional information regarding Intel's results and Business Outlook, please see the CFO commentary at: www.intc.com/results.cfm.

View at TechPowerUp Main Site