TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 16,219 (2.27/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

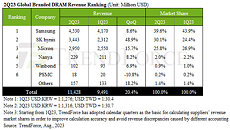

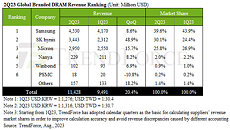

TrendForce reports that rising demand for AI servers has driven growth in HBM shipments. Combined with the wave of inventory buildup for DDR5 on the client side, the second quarter saw all three major DRAM suppliers experience shipment growth. Q2 revenue for the DRAM industry reached approximately US$11.43 billion, marking a 20.4% QoQ increase and halting a decline that persisted for three consecutive quarters. Among suppliers, SK hynix saw a significant quarterly growth of over 35% in shipments. The company's shipments of DDR5 and HBM, both of which have higher ASP, increased significantly. As a result, SK hynix's ASP grew counter-cyclically by 7-9%, driving its Q2 revenue to increase by nearly 50%. With revenue reaching US$3.44 billion, SK hynix claimed the second spot in the industry, leading growth in the sector.

Samsung, with its DDR5 process still at 1Ynm and limited shipments in the second quarter, experienced a drop in its ASP by around 7-9%. However, benefitting from inventory buildup by module houses and increased demand for AI server setups, Samsung saw a slight increase in shipments. This led to an 8.6% QoQ increase in Q2 revenue, reaching US$4.53 billion, securing them the top position. Micron, ranking third, was a bit late in HBM development. However, DDR5 shipments held a significant proportion, keeping their ASP relatively stable. Boosted by shipments, its revenue was around US$2.95 billion, a quarterly increase of 15.7%. Both companies saw a reduction in their market share.

Overall, due to the continued decline in contract prices for various products, suppliers continue to report negative operating profit margins. In Q2, Samsung's operating margin improved from -24% to -9%. SK hynix witnessed simultaneous growth in revenue and ASP, narrowing its operating profit margin significantly from -50% to -2%. On the other hand, Micron's operating profit margin improved slightly from -55.4% to -36%. TrendForce anticipates that the DRAM industry's revenue will continue to grow in the third quarter. After suppliers reduce production, there's a diminished inclination to drop prices, which means that contract prices are stabilizing, and future declines will be limited. As a result, the losses incurred from inventory price drops are anticipated to lessen, with operating profit margins expected to shift from losses to gains.

Nanya's shipments have been declining for over four consecutive quarters. However, boosted by TV orders in the second quarter, its revenue increased by approximately 8.2%. Winbond's revenue for the second quarter grew by 6.9%, primarily benefiting from the release of tenders in China and the added capacity from the KH factory, which has provided greater pricing flexibility, leading to an increase in order volume. PSMC primarily accounts for revenue from its in-house produced consumer DRAM products, excluding DRAM foundry services. Affected by subdued demand and a somewhat backward manufacturing process that lacks competitive pricing advantages, DRAM revenue declined by around 10.8%. This makes PSMC the only supplier with a decline this quarter. When factoring in DRAM foundry revenue, the decline stands at 7.8%.

View at TechPowerUp Main Site | Source

Samsung, with its DDR5 process still at 1Ynm and limited shipments in the second quarter, experienced a drop in its ASP by around 7-9%. However, benefitting from inventory buildup by module houses and increased demand for AI server setups, Samsung saw a slight increase in shipments. This led to an 8.6% QoQ increase in Q2 revenue, reaching US$4.53 billion, securing them the top position. Micron, ranking third, was a bit late in HBM development. However, DDR5 shipments held a significant proportion, keeping their ASP relatively stable. Boosted by shipments, its revenue was around US$2.95 billion, a quarterly increase of 15.7%. Both companies saw a reduction in their market share.

Overall, due to the continued decline in contract prices for various products, suppliers continue to report negative operating profit margins. In Q2, Samsung's operating margin improved from -24% to -9%. SK hynix witnessed simultaneous growth in revenue and ASP, narrowing its operating profit margin significantly from -50% to -2%. On the other hand, Micron's operating profit margin improved slightly from -55.4% to -36%. TrendForce anticipates that the DRAM industry's revenue will continue to grow in the third quarter. After suppliers reduce production, there's a diminished inclination to drop prices, which means that contract prices are stabilizing, and future declines will be limited. As a result, the losses incurred from inventory price drops are anticipated to lessen, with operating profit margins expected to shift from losses to gains.

Nanya's shipments have been declining for over four consecutive quarters. However, boosted by TV orders in the second quarter, its revenue increased by approximately 8.2%. Winbond's revenue for the second quarter grew by 6.9%, primarily benefiting from the release of tenders in China and the added capacity from the KH factory, which has provided greater pricing flexibility, leading to an increase in order volume. PSMC primarily accounts for revenue from its in-house produced consumer DRAM products, excluding DRAM foundry services. Affected by subdued demand and a somewhat backward manufacturing process that lacks competitive pricing advantages, DRAM revenue declined by around 10.8%. This makes PSMC the only supplier with a decline this quarter. When factoring in DRAM foundry revenue, the decline stands at 7.8%.

View at TechPowerUp Main Site | Source