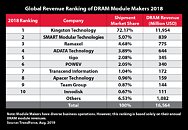

Kingston Technology Remains Top DRAM Module Supplier for 2021

Kingston Technology Company, Inc., a world leader in memory products and technology solutions, today announced it has been ranked top third-party DRAM module supplier in the world, according to the latest rankings by revenue from analyst firm TrendForce (formerly DRAMeXchange). Kingston retains its number 1 position with an estimated 78.7% market share on $14.2B (USD) revenue. TrendForce states that Kingston increased revenue by 8% YoY marking the 19th consecutive year that Kingston has held the top spot.

According to the report, the world's top five memory module houses accounted for 90% of total sales in 2021 with Kingston holding nearly 80% of that market. As one of the leading buyers of DRAM chips in the world, Kingston provides a highly customized production model which has led to continuous growth in shipment scale and drove increased revenue by 8%. TrendForce states that pandemic-induced lifestyle changes and the demand for distance learning grew in the past two years, driving the growth of DRAM module shipments. Kingston took the approach to be prepared for those segments. Kingston's success is largely attributed to their working attitude of 'Kingston Is With You,' which solidifies the dominant force the company holds among consumers and organizations alike looking to upgrade new and existing systems.

According to the report, the world's top five memory module houses accounted for 90% of total sales in 2021 with Kingston holding nearly 80% of that market. As one of the leading buyers of DRAM chips in the world, Kingston provides a highly customized production model which has led to continuous growth in shipment scale and drove increased revenue by 8%. TrendForce states that pandemic-induced lifestyle changes and the demand for distance learning grew in the past two years, driving the growth of DRAM module shipments. Kingston took the approach to be prepared for those segments. Kingston's success is largely attributed to their working attitude of 'Kingston Is With You,' which solidifies the dominant force the company holds among consumers and organizations alike looking to upgrade new and existing systems.