Thursday, April 21st 2016

AMD Reports 2016 First Quarter Results

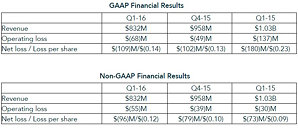

AMD today announced revenue for the first quarter of 2016 of $832 million, operating loss of $68 million, and net loss of $109 million, or $0.14 per share. Non-GAAP operating loss was $55 million and non-GAAP net loss was $96 million, or $0.12 per share.

"Our strategy to build a strong business foundation and improve financial performance through delivering great products is beginning to show benefits," said Lisa Su, AMD president and CEO. "We continued to strengthen the performance of our Computing and Graphics business as our customers and partners show a growing preference for AMD. We are optimistic about our growth prospects in the second half of the year across our businesses based on new product introductions and design wins."Q1 2016 Results

AMD licensed high-performance processor and SoC technology to a newly-created JV it has formed with THATIC (Tianjin Haiguang Advanced Technology Investment Co., Ltd.) to develop SoCs tailored to the Chinese server market that will complement AMD's own offerings. The $293 million licensing agreement is a meaningful step in AMD's IP monetization strategy intended to accelerate the Company's growth and better monetize its valuable assets. Payments are contingent upon the JV achieving certain milestones. AMD also expects to receive royalty payments from the JV's future product sales.

"Our new licensing agreement is a great example of leveraging our strong IP portfolio to accelerate the adoption of our technologies more broadly," said Dr. Su. "The joint venture with THATIC provides AMD with a differentiated approach to help gain share in the fastest growing region of the server market."

Recent Highlights

For Q2 2016, AMD expects revenue to increase 15 percent, plus or minus 3 percent, sequentially.

"Our strategy to build a strong business foundation and improve financial performance through delivering great products is beginning to show benefits," said Lisa Su, AMD president and CEO. "We continued to strengthen the performance of our Computing and Graphics business as our customers and partners show a growing preference for AMD. We are optimistic about our growth prospects in the second half of the year across our businesses based on new product introductions and design wins."Q1 2016 Results

- Q1 2016 was a 13-week fiscal quarter.

- Revenue of $832 million, down 13 percent sequentially and down 19 percent year-over-year. The sequential decrease was primarily due to lower sales of semi-custom SoCs. The year-over-year decline was primarily due to lower sales of semi-custom SoCs and client notebook processors.

- Gross margin of 32 percent, up 2 percentage points sequentially, due primarily to a richer product mix and the mix of revenue between business segments.

- Operating expenses of $344 million, compared to $332 million for the prior quarter. Non-GAAP operating expenses of $332 million, compared to non-GAAP operating expenses of $323 million in Q4 2015, primarily due to increased R&D expenses related to new products, partially offset by lower SG&A expenses.

- Operating loss of $68 million, compared to an operating loss of $49 million for the prior quarter. Non-GAAP operating loss of $55 million, compared to non-GAAP operating loss of $39 million in Q4 2015, primarily due to lower sales.

- Net loss of $109 million, loss per share of $0.14, and non-GAAP net loss of $96 million, non-GAAP loss per share of $0.12, compared to a net loss of $102 million, loss per share of $0.13 and non-GAAP net loss of $79 million, non-GAAP loss per share of $0.10 in Q4 2015.

- Cash and cash equivalents were $716 million at the end of the quarter, down $69 million from the end of the prior quarter, due to lower sales and higher debt interest payments, partially offset by $52 million of cash received related to our newly announced IP licensing agreement.

- Total debt at the end of the quarter was $2.24 billion, flat from the prior quarter.

- Computing and Graphics segment revenue of $460 million decreased 2 percent sequentially and decreased 14 percent from Q1 2015. The sequential decrease was primarily due to decreased sales of client desktop processors and the year-over-year decrease was driven primarily by decreased sales of client notebook processors.

Operating loss was $70 million, compared with an operating loss of $99 million in Q4 2015 and an operating loss of $75 million in Q1 2015. The sequential improvement was primarily driven by lower operating expenses. The year-over-year improvement was primarily driven by lower operating expenses.

Client processor average selling price (ASP) decreased sequentially driven by a lower desktop processor ASP and decreased year-over-year primarily due to a lower notebook processor ASP.

GPU ASP decreased sequentially driven by lower consumer GPU ASPs and increased year-over-year due to higher channel and professional graphics ASPs. - Enterprise, Embedded and Semi-Custom segment revenue of $372 million decreased 24 percent sequentially and 25 percent year-over-year. The decreases were primarily driven by lower sales of semi-custom SoCs.

Operating income was $16 million compared with $59 million in Q4 2015 and $45 million in Q1 2015. The sequential and year-over-year decrease was primarily due to lower sales and higher R&D expenses associated with new product investments, partially offset by a $7 million IP licensing gain. - All Other category operating loss was $14 million compared with operating losses of $9 million in Q4 2015 and $107 million in Q1 2015. The year-over-year decrease was primarily due to the absence of restructuring and other special charges associated with the exit from the dense server systems business.

AMD licensed high-performance processor and SoC technology to a newly-created JV it has formed with THATIC (Tianjin Haiguang Advanced Technology Investment Co., Ltd.) to develop SoCs tailored to the Chinese server market that will complement AMD's own offerings. The $293 million licensing agreement is a meaningful step in AMD's IP monetization strategy intended to accelerate the Company's growth and better monetize its valuable assets. Payments are contingent upon the JV achieving certain milestones. AMD also expects to receive royalty payments from the JV's future product sales.

"Our new licensing agreement is a great example of leveraging our strong IP portfolio to accelerate the adoption of our technologies more broadly," said Dr. Su. "The joint venture with THATIC provides AMD with a differentiated approach to help gain share in the fastest growing region of the server market."

Recent Highlights

- AMD's Assembly, Test, Mark and Pack (ATMP) JV transaction received approval from Nantong Fujitsu Microelectronics Co., Ltd. shareholders and the transaction remains on track to close in Q2 2016.

- AMD momentum continued for its mobile client solutions and technologies, starting shipments of the 7th Generation AMD A-Series Processors (codenamed "Bristol Ridge") and securing notable commercial and consumer design wins.

AMD 7th Generation APUs are equipped with advanced video, graphics performance, security and energy efficiency features and will first appear in the HP ENVY x360, with other ultrathin notebook, convertible, and all-in one OEM designs planned to launch throughout the year.

AMD secured new HP notebook design wins and continued to expand in the commercial PC market with new large-scale enterprise deployments for its 6th Generation PRO A-Series mobile processors. - AMD launched new desktop component solutions, including the flagship AMD Wraith Cooler and its fastest APU ever, the AMD A10-7890K. Other new additions to the 2016 Desktop processor family include the new AMD A10-7870K and AMD A10-7860K APUs, and new AMD Athlon X4 880K and AMD Athlon X4 845 CPUs.

- AMD disclosed its upcoming GPU architecture roadmap, including "Vega" featuring High Bandwidth Memory 2, which the company plans to follow with the release of "Navi" which will be designed with scalability and next-generation memory.

- AMD demonstrated its "Polaris" 10 and 11 next-generation GPUs, with Polaris 11 targeting the notebook market and "Polaris" 10 aimed at the mainstream desktop and high-end gaming notebook segment. "Polaris" architecture-based GPUs are expected to deliver a 2x performance per watt improvement over current generation products and are designed for intensive workloads including 4K video playback and virtual reality (VR).

- AMD continued to expand its leadership position in VR, unveiling new technologies and collaborations across a variety of sectors, including gaming, education, and media.

AMD introduced the Radeon Pro Duo GPU, part of the world's most powerful platform for VR designed for creating and consuming VR content. AMD's Radeon Pro Duo GPU with its LiquidVR SDK is a platform aimed at most all aspects of VR content creation: from entertainment to education, journalism, medicine, and cinema.

20th Century Fox, New Regency, Ubisoft Motion Pictures, and VR development studio Practical Magic chose the AMD Radeon Pro Duo GPU featuring the AMD LiquidVR SDK to bring the upcoming ASSASSIN'S CREED movie VR experience to life.

Sulon Technologies announced the Sulon Q, the world's only all-in-one, tether-free "wear and play" headset for VR, Augmented Reality (AR) and spatial computing -- powered by the AMD FX-8800P processor.

AMD joined with The Associated Press to create a new VR experience channel to fuel next-generation journalism.

AMD announced it is helping colleges and universities create dedicated AMD Radeon graphics-equipped VR labs as Crytek's exclusive technology partner for the VR First initiative.

AMD released the Radeon Software Crimson Edition 16.3.2 Driver with support for the Oculus Rift SDK v1.3 -- offering AMD's most stable and compatible driver for developing VR experiences on the Rift to-date. - AMD demonstrated its continued dedication to enabling gamers and game developers with the best possible graphics experiences.

MD's performance leadership in DirectX 12 was re-affirmed through the Ashes of the Singularity benchmark. AMD also announced its association with several DirectX 12 games including Hitman and Total War: Warhammer. - AMD further established its presence in the professional graphics market with the introduction of new technologies, design wins, and relationships.

AMD revealed the world's first hardware virtualized GPU products -- AMD FirePro S-Series GPUs with Multiuser GPU (MxGPU) technology that enables a precise, secure, high performance, and enriched graphics user experience.

AMD FirePro graphics were selected to drive fast, cost-effective GPU-compute installations for the Canadian Hydrogen Intensity Mapping Experiment, global geophysical services and equipment company CGG, and the Institute of System Research of the Russian Academy of Sciences.

For Q2 2016, AMD expects revenue to increase 15 percent, plus or minus 3 percent, sequentially.

31 Comments on AMD Reports 2016 First Quarter Results

some sorta evil sorcery going on here....

That might be hard for a "fan" of AMD to swallow, but you shouldn't expect a corporate entity to have the same ideals/goals as a person.

Jesus want more money in entry level? Sell an athlon whatever black edition for am1 and ramp the graphics up a hair you know using the mobile cpus they sell as bga only and share the socket.

Want more money mid range? Sell the ps4 cpu/gpu for fm2+ plenty of people would buy an 8 core jaguar based cpu with a 7870 glued to it.

Want more money top end? Mix the server market into the fx crap. It's a server based chip. Can't beat Intel with single ipc so just give everyone more cores. There is no reason single socket g34 shouldn't allow overclocking and there should not be fx series 16 core cpu's with real quad channel no more of this pr made up nonsense quoting dual, dual channel controllers as quad channel. It doesn't work like that and memory bandwidth proves this.

I'm sorry amd as of late you have had some cool trinkets, but you killed yourself from within.

Financial Segment Summary

Operating loss was $70 million, compared with an operating loss of $99 million in Q4 2015 and an operating loss of $75 million in Q1 2015. The sequential improvement was primarily driven by lower operating expenses. The year-over-year improvement was primarily driven by lower operating expenses.

Client processor average selling price (ASP) decreased sequentially driven by a lower desktop processor ASP and decreased year-over-year primarily due to a lower notebook processor ASP.

GPU ASP decreased sequentially driven by lower consumer GPU ASPs and increased year-over-year due to higher channel and professional graphics ASPs.

Operating income was $16 million compared with $59 million in Q4 2015 and $45 million in Q1 2015. The sequential and year-over-year decrease was primarily due to lower sales and higher R&D expenses associated with new product investments, partially offset by a $7 million IP licensing gain.

Overall AMD products are decent and get the job done (especially in low-to-mid budget segment), but they need to stop doing at least 2 things:

1) Blame competitors and third-party reviewers for biased point of view, and using the same defensive stance in marketing

2) Use their own shamelessly biased foundation and directed misinformation to do marketing

Just like with FX-8800P redemption campaign, just like with APU gaming, and even like the latest Polaris demo.

Haven't been following AMD server hardware, but I'm pretty sure there are some signs of marketing foul-play in there too.

Simply marketing their products for what they are would've been much better, probably for both consumer and enterprise market segment.

I think their PR department has been doing just fine this year, TBH. Putting graphics into RTG really seems to have paid off from a PR standpoint, and people that I've spoken seem to have an impression now that they're serious about being leaders in their field. Which, to be fair, they always were, they just had their marketing department let their imaginations run a bit too wild on several occasions.

All I have to say is I hope zen is good but judging from the tight lips broadwell probably performs better.

I also don't think that AMD needs to compete with Intel directly. There's absolutely no need for the grunt that modern CPUs offer at this point; software is where the real difference can be made. Both AMD and Intel are in the land of diminishing returns when it comes to performance by dropping nodes, and AMD specifically is limited by the fabs they have access to that are affordable. I have ben wanting AMD to move GPU production away from TSMC for many many years, but the fact of the matter is that TSMC has been the sole option they have had in the past, and today TSMC isn't the sole supplier of GPUs for AMD.

So while AMD's marketing isn't that appealing to us, it is obviously appealing the newer users and those that follow their social media, and they are trying to make improvements where they can. Unfortunately, they don't have access to finds to truly become the company that many want them to be, and I can't hold that against them. They got the console wins, they got great GPUs, and they have great potential to be a long-lasting part of the industry, even while not making a profit. It's been a long time (like nearly a decade) since AMD has posted true profits consistently, and not all of that is their fault. They won their lawsuit against Intel for underhanded business practices, and that alone had an effect on their potential today and forever.

I can't believe I'm defending AMD myself, but it's not all bad, so I don't mind.

Proof that AMD is near bankruptcy