- Joined

- Oct 9, 2007

- Messages

- 47,895 (7.38/day)

- Location

- Dublin, Ireland

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | Gigabyte B550 AORUS Elite V2 |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 16GB DDR4-3200 |

| Video Card(s) | Galax RTX 4070 Ti EX |

| Storage | Samsung 990 1TB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

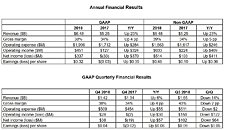

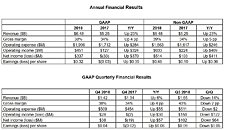

AMD (NASDAQ:AMD) today announced revenue for fiscal year 2018 of $6.48 billion, operating income of $451 million, net income of $337 million and diluted earnings per share of $0.32. On a non-GAAP basis, operating income was $633 million, net income was $514 million and diluted earnings per share was $0.46.

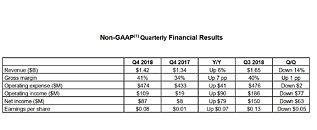

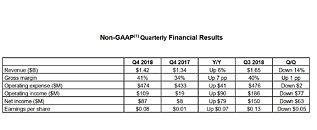

For the fourth quarter of 2018, the Company reported revenue of $1.42 billion, operating income of $28 million, net income of $38 million and diluted earnings per share of $0.04. On a non-GAAP basis, operating income was $109 million, net income was $87 million and diluted earnings per share was $0.08.

"In 2018 we delivered our second straight year of significant revenue growth, market share gains, expanded gross margin and improved profitability based on our high-performance products. Importantly, we more than doubled our EPYC processor shipments sequentially and delivered record GPU datacenter revenue in the quarter," said Dr. Lisa Su, AMD president and CEO."Despite near-term graphics headwinds, 2019 is shaping up to be another exciting year driven by the launch of our broadest and most competitive product portfolio ever with our next-generation 7nm Ryzen, Radeon, and EPYC products."

2018 Annual Results

For the first quarter of 2019, AMD expects revenue to be approximately $1.25 billion, plus or minus $50 million, a decrease of approximately 12 percent sequentially and 24 percent year-over-year. The sequential decrease is expected to be primarily driven by continued softness in the graphics channel and seasonality across the business. The year-over-year decrease is expected to be primarily driven by lower graphics sales due to excess channel inventory, the absence of blockchain-related GPU revenue and lower memory sales. In addition, semi-custom revenue is expected to be lower year-over-year while Ryzen, EPYC and Radeon datacenter GPU product sales are expected to increase. AMD expects non-GAAP gross margin to be approximately 41 percent in the first quarter of 2019. In addition, the Company expects to record a $60 million IP licensing gain which will be a benefit to operating income and recorded on the licensing gain line of the P&L.

For full year 2019, AMD expects high single digit percentage revenue growth driven by Ryzen, EPYC and Radeon datacenter GPU product sales as the Company ramps 7nm products throughout the year. AMD expects non-GAAP gross margin to be greater than 41 percent for 2019.

View at TechPowerUp Main Site

For the fourth quarter of 2018, the Company reported revenue of $1.42 billion, operating income of $28 million, net income of $38 million and diluted earnings per share of $0.04. On a non-GAAP basis, operating income was $109 million, net income was $87 million and diluted earnings per share was $0.08.

"In 2018 we delivered our second straight year of significant revenue growth, market share gains, expanded gross margin and improved profitability based on our high-performance products. Importantly, we more than doubled our EPYC processor shipments sequentially and delivered record GPU datacenter revenue in the quarter," said Dr. Lisa Su, AMD president and CEO."Despite near-term graphics headwinds, 2019 is shaping up to be another exciting year driven by the launch of our broadest and most competitive product portfolio ever with our next-generation 7nm Ryzen, Radeon, and EPYC products."

2018 Annual Results

- Revenue of $6.48 billion was up 23 percent year-over-year primarily driven by higher revenue in the Computing and Graphics segment.

- Gross margin was 38 percent compared to 34 percent for the prior year. Non-GAAP gross margin was 39 percent compared to 34 percent in the prior year. Gross margin expansion was primarily driven by our new Ryzen, EPYC and Radeon products.

- Operating income was $451 million compared to $127 million in the prior year. Non-GAAP operating income was $633 million compared to $224 million in the prior year. The operating income improvement was primarily due to higher revenue and gross margin expansion partially offset by higher operating expenses.

- Net income was $337 million compared to a net loss of $33 million in the prior year. Non-GAAP net income was $514 million compared to $103 million in the prior year.

- Diluted earnings per share was $0.32 compared to a loss per share of $0.03 in 2017. Non-GAAP diluted earnings per share was $0.46 compared to $0.10 in the prior year.

- Cash,cash equivalents and marketable securities were $1.16 billion at the end of the year, down slightly from $1.18 billion at the end of2017.

- Free cash flow was -$129 million for the year due to higher inventory related to new products and to the timing of collections.

- Revenue of $1.42 billion was up 6 percent year-over-year primarily driven by the Computing and Graphics segment. Revenue was down 14 percent compared to the prior quarter as a result of lower revenue in the Enterprise, Embedded and Semi-Custom segment. Third quarter 2018 included approximately $125 million of IP-related revenue.

- Gross margin was 38 percent compared to 34 percent a year ago and 40 percent in the prior quarter. Fourth quarter gross margin included a $45 million charge related to older technology licenses that are no longer being used. Non-GAAP gross margin was 41 percent compared to 34 percent a year ago and 40 percent in the prior quarter. Gross margin improvements were primarily driven by Ryzen and EPYC processor sales.

- Operating income was $28 million compared to an operating loss of $2 million a year ago and operating income of $150 million in the prior quarter. On a non-GAAP basis, operating income was $109 million compared to $19 million a year ago and $186 million in the prior quarter. The year-over-year improvement was primarily due to the ramp of higher margin products in the Computing and Graphics segment. The decrease compared to the prior quarter was primarily due to seasonally lower Enterprise, Embedded and Semi-Custom segment revenue and the absence of IP-related revenue, partially offset by the benefit of new Ryzen, EPYC and Radeon products.

- Net income was $38 million compared to a net loss of $19 million a year ago and net income of $102 million in the prior quarter. On a non-GAAP basis, net income was $87 million compared to $8 million a year ago and $150 million in the prior quarter.

- Diluted earnings per share was $0.04 compared to a loss per share of $0.02 a year ago and diluted earnings per share of $0.09 in the prior quarter. On a non-GAAP basis, diluted earnings per share was $0.08 compared to $0.01 a year ago and $0.13 in the prior quarter.

- Cash,cash equivalents and marketable securities were $1.16 billion at the end of the quarter as compared to $1.06 billion at the end of the prior quarter.

- Free cash flow was $79 million for the quarter

For the first quarter of 2019, AMD expects revenue to be approximately $1.25 billion, plus or minus $50 million, a decrease of approximately 12 percent sequentially and 24 percent year-over-year. The sequential decrease is expected to be primarily driven by continued softness in the graphics channel and seasonality across the business. The year-over-year decrease is expected to be primarily driven by lower graphics sales due to excess channel inventory, the absence of blockchain-related GPU revenue and lower memory sales. In addition, semi-custom revenue is expected to be lower year-over-year while Ryzen, EPYC and Radeon datacenter GPU product sales are expected to increase. AMD expects non-GAAP gross margin to be approximately 41 percent in the first quarter of 2019. In addition, the Company expects to record a $60 million IP licensing gain which will be a benefit to operating income and recorded on the licensing gain line of the P&L.

For full year 2019, AMD expects high single digit percentage revenue growth driven by Ryzen, EPYC and Radeon datacenter GPU product sales as the Company ramps 7nm products throughout the year. AMD expects non-GAAP gross margin to be greater than 41 percent for 2019.

View at TechPowerUp Main Site