- Joined

- Aug 19, 2017

- Messages

- 2,232 (0.91/day)

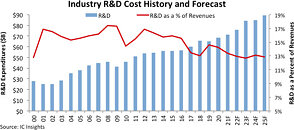

Research and development spending by semiconductor companies worldwide is forecast to grow 4% in 2021 to $71.4 billion after rising 5% in 2020 to a record high of $68.4 billion, according to IC Insights' new 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. Total R&D spending by semiconductor companies is expected to rise by a compound annual growth rate (CAGR) of 5.8% between 2021 and 2025 to $89.3 billion.

When the world was hit by the Covid-19 virus health crisis in 2020, wary semiconductor suppliers kept a lid on R&D spending increases, even though total semiconductor industry revenue grew by a surprising 8% in the year despite the economic fallout from the deadly pandemic. Semiconductor R&D expenditures as a percentage of worldwide industry sales slipped to 14.2% in 2020 compared to 14.6% in 2019, when research and development spending declined 1% and total semiconductor revenue fell 12%. Figure 1 plots semiconductor R&D spending levels and the spending-to-sales ratios over the past two decades and IC Insights' forecast through 2025.

Total semiconductor R&D spending has declined in only four years since the end of the 1970s (-1% in 2019 during an economic slowdown, -10% in 2009 after the industry was hit by a major global recession, and back-to-back drops of -1% in 2002 and -10% in 2001 when an economic downturn coincided with the implosion of the Internet "dot-com" bubble at the turn of the century). In the aftermath of the global recession of 2008-2009, R&D spending recovered strongly in 2010 and 2011, but then outlays slowed during the rest of the last decade for a variety of reasons, including ongoing uncertainty about the global economy and an historic wave of acquisitions in the chip industry.

Since the year 2000, total semiconductor R&D spending as a percent of worldwide sales has exceeded the four-decade historical average of 14.6% in all but five years (2000, 2010, 2017, 2018, and 2020). In these five years, lower R&D-to-sales ratios had more to do with the strength of total revenue growth than weakness in research and development spending by semiconductor suppliers.

Intel continued to top all other semiconductor suppliers in R&D expenditures in 2020, accounting for about 19% of the industry's total. However, cost cuts, the elimination some product categories, and a drive to maximize efficiencies resulted in a 4% decrease in Intel's R&D outlays in 2020 to an estimated $12.9 billion after its spending declined 1% in 2019, when its share was 22% of the industry's total. The 2019-2020 drops in Intel R&D expenditures were the first consecutive annual declines for the company since 2008 and 2009. The 4% decrease in 2020 was the largest R&D decline for Intel since the mid 1990s. Second-ranked Samsung increased its R&D spending by 19% in 2020 to $5.6 billion partly because the South Korean memory giant stepped up development of leading-edge logic processes (of 5 nm and below) to compete in the advanced IC foundry business with market leader Taiwan Semiconductor Manufacturing Co., which raised its expenditures on research and development by 24% to nearly $3.7 billion last year.

The McClean Report shows the top 10 R&D spenders (Intel, Samsung, Broadcom, Qualcomm, Nvidia, TSMC, MediaTek, Micron, SK Hynix, and AMD) collectively increased their research and development expenditures by 11% in 2020 to $43.5 billion, which was 64% of the industry's total. Moving up in the 2020 top-10 R&D ranking were Nvidia (up one place to fifth), MediaTek (up two places to seventh), and Advanced Micro Devices (at 10th place up from 11th in 2019). The top 10's R&D investment ratio for R&D/sales was 14.5% in 2020 versus 15.0% in 2019, says the new IC Insights' report.

Report Details: The 2021 McClean Report

The 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry, will be released in January 2021. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only pre-recorded webcasts through November. An individual user license to the 2021 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2021.

View at TechPowerUp Main Site

When the world was hit by the Covid-19 virus health crisis in 2020, wary semiconductor suppliers kept a lid on R&D spending increases, even though total semiconductor industry revenue grew by a surprising 8% in the year despite the economic fallout from the deadly pandemic. Semiconductor R&D expenditures as a percentage of worldwide industry sales slipped to 14.2% in 2020 compared to 14.6% in 2019, when research and development spending declined 1% and total semiconductor revenue fell 12%. Figure 1 plots semiconductor R&D spending levels and the spending-to-sales ratios over the past two decades and IC Insights' forecast through 2025.

Total semiconductor R&D spending has declined in only four years since the end of the 1970s (-1% in 2019 during an economic slowdown, -10% in 2009 after the industry was hit by a major global recession, and back-to-back drops of -1% in 2002 and -10% in 2001 when an economic downturn coincided with the implosion of the Internet "dot-com" bubble at the turn of the century). In the aftermath of the global recession of 2008-2009, R&D spending recovered strongly in 2010 and 2011, but then outlays slowed during the rest of the last decade for a variety of reasons, including ongoing uncertainty about the global economy and an historic wave of acquisitions in the chip industry.

Since the year 2000, total semiconductor R&D spending as a percent of worldwide sales has exceeded the four-decade historical average of 14.6% in all but five years (2000, 2010, 2017, 2018, and 2020). In these five years, lower R&D-to-sales ratios had more to do with the strength of total revenue growth than weakness in research and development spending by semiconductor suppliers.

Intel continued to top all other semiconductor suppliers in R&D expenditures in 2020, accounting for about 19% of the industry's total. However, cost cuts, the elimination some product categories, and a drive to maximize efficiencies resulted in a 4% decrease in Intel's R&D outlays in 2020 to an estimated $12.9 billion after its spending declined 1% in 2019, when its share was 22% of the industry's total. The 2019-2020 drops in Intel R&D expenditures were the first consecutive annual declines for the company since 2008 and 2009. The 4% decrease in 2020 was the largest R&D decline for Intel since the mid 1990s. Second-ranked Samsung increased its R&D spending by 19% in 2020 to $5.6 billion partly because the South Korean memory giant stepped up development of leading-edge logic processes (of 5 nm and below) to compete in the advanced IC foundry business with market leader Taiwan Semiconductor Manufacturing Co., which raised its expenditures on research and development by 24% to nearly $3.7 billion last year.

The McClean Report shows the top 10 R&D spenders (Intel, Samsung, Broadcom, Qualcomm, Nvidia, TSMC, MediaTek, Micron, SK Hynix, and AMD) collectively increased their research and development expenditures by 11% in 2020 to $43.5 billion, which was 64% of the industry's total. Moving up in the 2020 top-10 R&D ranking were Nvidia (up one place to fifth), MediaTek (up two places to seventh), and Advanced Micro Devices (at 10th place up from 11th in 2019). The top 10's R&D investment ratio for R&D/sales was 14.5% in 2020 versus 15.0% in 2019, says the new IC Insights' report.

Report Details: The 2021 McClean Report

The 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry, will be released in January 2021. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only pre-recorded webcasts through November. An individual user license to the 2021 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2021.

View at TechPowerUp Main Site