TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 16,067 (2.26/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/5za05v |

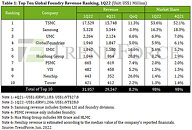

According to TrendForce research, although demand for consumer electronics remains weak, structural growth demand in the semiconductor industry including for servers, high-performance computing, automotive, and industrial equipment has not flagged, becoming a key driver for medium and long term foundry growth. At the same time, due to robust wafer production at higher pricing in 1Q22, quarterly output value hit a new high for the 11th consecutive quarter, reaching US$31.96 billion, 8.2% QoQ, marginally less than the previous quarter. In terms of ranking, the biggest change is Nexchip surpassed Tower at the ninth position.

TSMC's across the board wafer hikes in 4Q21 on batches primarily produced in 1Q22 coupled with sustained strong demand for high-performance computing and better foreign currency exchange rates pushed TSMC's 1Q22 revenue to $17.53 billion, up 11.3% QoQ. Quarterly revenue growth by node was generally around 10% and the 7/6 nm and 16/12 nm processes posted the highest growth rate due to small expansions in production. The only instance of revenue decline came at the 5/4 nm process due to Apple's iPhone 13 entering the off season for production stocking.

Demand for System LSI CIS and driver ICs has weakened as a consequence of a sluggish TV and smartphone market. In addition, 4 nm production expansion and yield improvement rate are not progressing as quickly as expected. Number two Samsung was the only foundry posting negative growth in 1Q22, with a revenue of US$5.33 billion, falling 3.9% QoQ. Samsung market share also fell to 16.3%. UMC also benefited from wafer price hikes, and its revenue hit US$2.26 billion, a QoQ increase of 6.6%, ranking third. However, UMC's new capacity has yet to come online in 1Q22, so the proportion of revenue contributed by various processes remains roughly in line with 4Q21.

GlobalFoundries, ranking fourth, reported revenue of $1.94 billion for the quarter, up 5.0% QoQ. Since wafer shipments were roughly the same as in the previous quarter, growth primarily came from ASP adjustment and product mix optimization. In addition, as one of the major wafer foundries in the United States, GlobalFoundries has helped produce "Made in America" chips for national security and aerospace-related applications for many years. In the near term, it plans to produce 45 nm SOI process products to support the operation of defense and aerospace systems. The first batch of production chip deliveries are expected to begin in 2023. SMIC has benefited from a recent increase in wafer shipments due to the smooth rollout of production capacity. At the same time, its product portfolio has gradually shifted to structurally short products such as consumer PMICs, AMOLED DDIs, and PMICs and MCUs for industrial equipment and automotive, driving continuous revenue growth with 1Q22 revenue reaching US$1.84 billion, 16.6% growth QoQ, ranking fifth.

Nexchip actively expands production squeezing out Tower, three major Chinese players account for more than 10% of the market

Sixth to eighth place HuaHong Group, PSMC, and VIS, respectively, all benefited from continuous full capacity utilization, new capacity, and ASP and products mix adjustment to grow revenue performance. Nexchip's 1Q22 revenue reached US$443 million, a quarterly increase of 26.0%, the highest growth rate among the top ten list, surpassed Tower to jump to ninth place, and narrowing the market share gap between it and eighth ranked VIS. According to TrendForce, Nexchip is currently focused on the production of 0.1X μm and 90 nm large-sized display driver ICs. In 2022, it will push production expansion, aiming to complete the capacity of its N2 factory campus. At the same time, in order to reduce the potential risk of a downturn in any individual market, Nexchip has also accelerated the development of multiple product platforms such as TDDI, CIS, MCU, and PMIC. At present, Nexchip has partnered with SmartSens to successfully develop 90 nm CIS products which will be able to contribute non-driver IC revenue after mass production.

Ranked tenth, Tower benefited from a relative shortage of analog-related chips for industrial control and automotive applications. Its revenue in 1Q22 grew to US$421 million, 2.2% growth QoQ. In order to sustain its advantages in the field of PMIC process technologies, the company is also actively exploring the application of PMIC technology in the near term, developing higher voltage tolerances and effectively reduced chip size, so as to supply high-performance computing CPUs and GPUs, as well as the needs of automotive and industrial control power management. Looking to the 2Q22 foundry market, TrendForce expects the output value of the top ten foundries to maintain a growth trend as the capacity of a small number of foundries grows to drive overall shipment growth in the second quarter. However, considering demand for consumer end products continues to wane and contributions from higher priced wafers has been largely reflected in 1Q22, quarterly growth rate will contract once more.

View at TechPowerUp Main Site | Source

TSMC's across the board wafer hikes in 4Q21 on batches primarily produced in 1Q22 coupled with sustained strong demand for high-performance computing and better foreign currency exchange rates pushed TSMC's 1Q22 revenue to $17.53 billion, up 11.3% QoQ. Quarterly revenue growth by node was generally around 10% and the 7/6 nm and 16/12 nm processes posted the highest growth rate due to small expansions in production. The only instance of revenue decline came at the 5/4 nm process due to Apple's iPhone 13 entering the off season for production stocking.

Demand for System LSI CIS and driver ICs has weakened as a consequence of a sluggish TV and smartphone market. In addition, 4 nm production expansion and yield improvement rate are not progressing as quickly as expected. Number two Samsung was the only foundry posting negative growth in 1Q22, with a revenue of US$5.33 billion, falling 3.9% QoQ. Samsung market share also fell to 16.3%. UMC also benefited from wafer price hikes, and its revenue hit US$2.26 billion, a QoQ increase of 6.6%, ranking third. However, UMC's new capacity has yet to come online in 1Q22, so the proportion of revenue contributed by various processes remains roughly in line with 4Q21.

GlobalFoundries, ranking fourth, reported revenue of $1.94 billion for the quarter, up 5.0% QoQ. Since wafer shipments were roughly the same as in the previous quarter, growth primarily came from ASP adjustment and product mix optimization. In addition, as one of the major wafer foundries in the United States, GlobalFoundries has helped produce "Made in America" chips for national security and aerospace-related applications for many years. In the near term, it plans to produce 45 nm SOI process products to support the operation of defense and aerospace systems. The first batch of production chip deliveries are expected to begin in 2023. SMIC has benefited from a recent increase in wafer shipments due to the smooth rollout of production capacity. At the same time, its product portfolio has gradually shifted to structurally short products such as consumer PMICs, AMOLED DDIs, and PMICs and MCUs for industrial equipment and automotive, driving continuous revenue growth with 1Q22 revenue reaching US$1.84 billion, 16.6% growth QoQ, ranking fifth.

Nexchip actively expands production squeezing out Tower, three major Chinese players account for more than 10% of the market

Sixth to eighth place HuaHong Group, PSMC, and VIS, respectively, all benefited from continuous full capacity utilization, new capacity, and ASP and products mix adjustment to grow revenue performance. Nexchip's 1Q22 revenue reached US$443 million, a quarterly increase of 26.0%, the highest growth rate among the top ten list, surpassed Tower to jump to ninth place, and narrowing the market share gap between it and eighth ranked VIS. According to TrendForce, Nexchip is currently focused on the production of 0.1X μm and 90 nm large-sized display driver ICs. In 2022, it will push production expansion, aiming to complete the capacity of its N2 factory campus. At the same time, in order to reduce the potential risk of a downturn in any individual market, Nexchip has also accelerated the development of multiple product platforms such as TDDI, CIS, MCU, and PMIC. At present, Nexchip has partnered with SmartSens to successfully develop 90 nm CIS products which will be able to contribute non-driver IC revenue after mass production.

Ranked tenth, Tower benefited from a relative shortage of analog-related chips for industrial control and automotive applications. Its revenue in 1Q22 grew to US$421 million, 2.2% growth QoQ. In order to sustain its advantages in the field of PMIC process technologies, the company is also actively exploring the application of PMIC technology in the near term, developing higher voltage tolerances and effectively reduced chip size, so as to supply high-performance computing CPUs and GPUs, as well as the needs of automotive and industrial control power management. Looking to the 2Q22 foundry market, TrendForce expects the output value of the top ten foundries to maintain a growth trend as the capacity of a small number of foundries grows to drive overall shipment growth in the second quarter. However, considering demand for consumer end products continues to wane and contributions from higher priced wafers has been largely reflected in 1Q22, quarterly growth rate will contract once more.

View at TechPowerUp Main Site | Source