Today, ASML Holding NV (ASML) has published its 2024 first-quarter results.

CEO statement and outlook

"Our first-quarter total net sales came in at €5.3 billion, at the midpoint of our guidance, with a gross margin of 51.0% which is above guidance, primarily driven by product mix and one-offs. We expect second-quarter total net sales between €5.7 billion and €6.2 billion with a gross margin between 50% and 51%. ASML expects R&D costs of around €1,070 million and SG&A costs of around €295 million. Our outlook for the full year 2024 is unchanged, with the second half of the year expected to be stronger than the first half, in line with the industry's continued recovery from the downturn. We see 2024 as a transition year with continued investments in both capacity ramp and technology, to be ready for the turn in the cycle," said ASML President and Chief Executive Officer Peter Wennink.

Update share buyback program and dividend proposal

ASML intends to declare a total dividend for the year 2023 of €6.10 per ordinary share, which is a 5.2% increase compared to 2022. Recognizing the three interim dividends of €1.45 per ordinary share paid in 2023 and 2024, this leads to a final dividend proposal to the Annual General Meeting of €1.75 per ordinary share.

In the first quarter, we purchased around €400 million worth of shares under the current 2022-2025 share buyback program.

Details of the share buyback program as well as transactions pursuant thereto, and details of the dividend proposal are published on ASML's website.

Quarterly video interview and investor call

With this press release, ASML has published a video interview in which CFO Roger Dassen discusses the 2024 first-quarter results and outlook for 2024. This video and the transcript can be viewed on www.asml.com.

An investor call for both investors and the media will be hosted by CEO Peter Wennink, CFO Roger Dassen and incoming CEO Christophe Fouquet on April 17, 2024 at 15:00 Central European Time / 09:00 US Eastern Time. Details can be found on our website.

View at TechPowerUp Main Site | Source

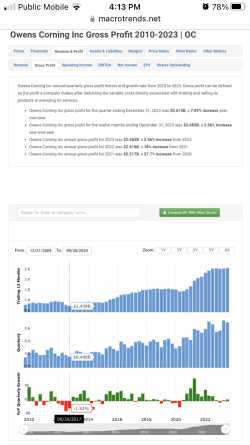

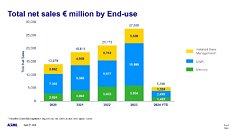

- Q1 total net sales of €5.3 billion, gross margin of 51.0%, net income of €1.2 billion

- Quarterly net bookings in Q1 of €3.6 billion of which €656 million is EUV

- ASML expects Q2 2024 total net sales between €5.7 billion and €6.2 billion, and a gross margin between 50% and 51%

- ASML expects 2024 total net sales to be similar to 2023

CEO statement and outlook

"Our first-quarter total net sales came in at €5.3 billion, at the midpoint of our guidance, with a gross margin of 51.0% which is above guidance, primarily driven by product mix and one-offs. We expect second-quarter total net sales between €5.7 billion and €6.2 billion with a gross margin between 50% and 51%. ASML expects R&D costs of around €1,070 million and SG&A costs of around €295 million. Our outlook for the full year 2024 is unchanged, with the second half of the year expected to be stronger than the first half, in line with the industry's continued recovery from the downturn. We see 2024 as a transition year with continued investments in both capacity ramp and technology, to be ready for the turn in the cycle," said ASML President and Chief Executive Officer Peter Wennink.

Update share buyback program and dividend proposal

ASML intends to declare a total dividend for the year 2023 of €6.10 per ordinary share, which is a 5.2% increase compared to 2022. Recognizing the three interim dividends of €1.45 per ordinary share paid in 2023 and 2024, this leads to a final dividend proposal to the Annual General Meeting of €1.75 per ordinary share.

In the first quarter, we purchased around €400 million worth of shares under the current 2022-2025 share buyback program.

Details of the share buyback program as well as transactions pursuant thereto, and details of the dividend proposal are published on ASML's website.

Quarterly video interview and investor call

With this press release, ASML has published a video interview in which CFO Roger Dassen discusses the 2024 first-quarter results and outlook for 2024. This video and the transcript can be viewed on www.asml.com.

An investor call for both investors and the media will be hosted by CEO Peter Wennink, CFO Roger Dassen and incoming CEO Christophe Fouquet on April 17, 2024 at 15:00 Central European Time / 09:00 US Eastern Time. Details can be found on our website.

View at TechPowerUp Main Site | Source