TrendForce: Annual Foundry Revenue Expected to Reach Historical High Again in 2022 with 13% YoY Increase with Chip Shortage Showing Sign of Easing

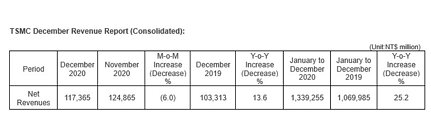

While the global electronics supply chain experienced a chip shortage, the corresponding shortage of foundry capacities also led various foundries to raise their quotes, resulting in an over 20% YoY increase in the total annual revenues of the top 10 foundries for both 2020 and 2021, according to TrendForce's latest investigations. The top 10 foundries' annual revenue for 2021 is now expected to surpass US$100 billion. As TSMC leads yet another round of price hikes across the industry, annual foundry revenue for 2022 will likely reach US$117.69 billion, a 13.3% YoY increase.

TrendForce indicates that the combined CAPEX of the top 10 foundries surpassed US$50 billion in 2021, a 43% YoY increase. As new fab constructions and equipment move-ins gradually conclude next year, their combined CAPEX for 2022 is expected to undergo a 15% YoY increase and fall within the US$50-60 billion range. In addition, now that TSMC has officially announced the establishment of a new fab in Japan, total foundry CAPEX will likely increase further next year. TrendForce expects the foundry industry's total 8-inch and 12-inch wafer capacities to increase by 6% YoY and 14% YoY next year, respectively.

TrendForce indicates that the combined CAPEX of the top 10 foundries surpassed US$50 billion in 2021, a 43% YoY increase. As new fab constructions and equipment move-ins gradually conclude next year, their combined CAPEX for 2022 is expected to undergo a 15% YoY increase and fall within the US$50-60 billion range. In addition, now that TSMC has officially announced the establishment of a new fab in Japan, total foundry CAPEX will likely increase further next year. TrendForce expects the foundry industry's total 8-inch and 12-inch wafer capacities to increase by 6% YoY and 14% YoY next year, respectively.