New Intel DG2 HPG GPU Surface, Could Power a Family of Products

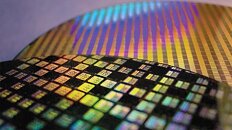

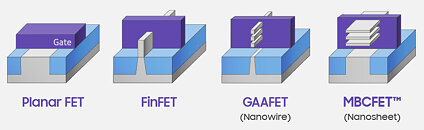

It appears that Intel's DG2 refers to a number of HPG (High Performance Graphics) products within the same family, with rumors surfacing around a possible total of six different graphics products based on the company's latest high performance graphics architecture - and its debut on the high performance discrete market. It's been confirmed that Intel's DG2 products will not be manufactured in-house, via Intel's 10 nm SuperFin technology, but with recourse to foundry partner TSMC's 6 nm fabrication technology.

It seems that DG2 is currently slated for launch based on three different chip configurations: the first is the DG2 512EU, which will power the highest-performance, 4096 shading unit, 8 GB / 16 GB GDDR6 and 192-bit bus graphics card. Another chip is the DG12 384EU, estimated to come in at ~190 mm², available in three different shading unit configurations: 3072 shading units, with an accompanying 6/12 GB of GDDR6 memory and 192-bit bus; 2048 shading units, which reduces allotted memory to 4/8 GB configurations and a 128-bit memory bus; and finally, the further cut-down 1536 shading unit configuration, with a maximum of 4 GB of GDDR6 memory over the same 128-bit bus. The final (current) chip in the DG2 family is the DG2 128EU, with both 128EU and 96EU configurations (1024 and 768 shading units, respectively) carrying 4 GB VRAM over a pretty tight 64-bit bus. We'll see if these leaks actually materialize into final Intel products, and if these design choices are the possible best, considering Intel's technology, so as to assail the two-player party that is the discrete, high performance graphics market.

It seems that DG2 is currently slated for launch based on three different chip configurations: the first is the DG2 512EU, which will power the highest-performance, 4096 shading unit, 8 GB / 16 GB GDDR6 and 192-bit bus graphics card. Another chip is the DG12 384EU, estimated to come in at ~190 mm², available in three different shading unit configurations: 3072 shading units, with an accompanying 6/12 GB of GDDR6 memory and 192-bit bus; 2048 shading units, which reduces allotted memory to 4/8 GB configurations and a 128-bit memory bus; and finally, the further cut-down 1536 shading unit configuration, with a maximum of 4 GB of GDDR6 memory over the same 128-bit bus. The final (current) chip in the DG2 family is the DG2 128EU, with both 128EU and 96EU configurations (1024 and 768 shading units, respectively) carrying 4 GB VRAM over a pretty tight 64-bit bus. We'll see if these leaks actually materialize into final Intel products, and if these design choices are the possible best, considering Intel's technology, so as to assail the two-player party that is the discrete, high performance graphics market.