Graphics Add-in Board Market Down in Q1, NVIDIA Holds Market Share

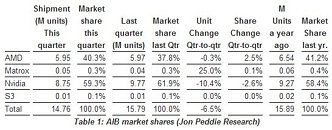

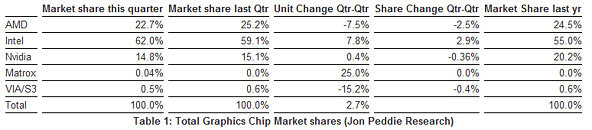

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, announced estimated graphics add-in-board (AIB) shipments and suppliers' market share for 2014 1Q.

JPR's AIB Report tracks computer add-in graphics boards, which carry discrete graphics chips. AIBs are used in desktop PCs, workstations, servers, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed. In all cases, AIBs represent the higher end of the graphics industry using discrete chips and private high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.

JPR's AIB Report tracks computer add-in graphics boards, which carry discrete graphics chips. AIBs are used in desktop PCs, workstations, servers, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed. In all cases, AIBs represent the higher end of the graphics industry using discrete chips and private high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.