TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 16,093 (2.26/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

With the course of the COVID-19 pandemic constantly changing, China is sticking with its "Dynamic Zero-COVID Policy" and has been slow to lift the lockdown on its cities that have been recently affected by the outbreaks of the disease. Hence, the manufacturing industries of the major Chinese cities are facing delays in the resumption of normal operation, and a production gap has emerged in 2Q22. For the electronics ODMs, this production gap will be difficult to bridge in 2H22. Additionally, the ongoing global inflation is keeping prices of goods at a very high level, and this trend will dampen the peak-season demand surge during the second half of the year. The effect of the inflationary pressure has been especially noticeable in the demand for consumer electronics such as smartphones, notebook computers, and tablet computers. This, in turn, is also impacting the MLCC market in terms of demand and inventory. Currently, the general inventory level has risen above 90 days for MLCCs of all sizes. Therefore, TrendForce forecasts that prices of consumer-spec MLCCs will fall further by 3-6% on average in 2H22.

On the other hand, demand remains fairly strong in application segments such as high-performance computing solutions (which include servers), networking equipment, industrial automation solutions, and energy storage systems. Furthermore, IDMs in the semiconductor industry will be adjusting the allocation of production capacity as the market for consumer electronics continues to experience a slowdown in 2H22. As a result, the undersupply situation for certain ICs will ease. Moreover, demand will be propped up in the high-end segment of the MLCC market and other application segments (e.g., automotive electronics and industrial equipment). All in all, thanks to the demand related to automotive electronics, servers, networking equipment, etc., TrendForce forecasts that the annual total MLCC shipments will increase by 2% YoY to around 2.58 trillion pieces for 2022.

Shipments and Prices Have Fallen for Consumer-Spec MLCCs, While Quotes for Automotive- and Industrial-Spec MLCCs Have Held Steady

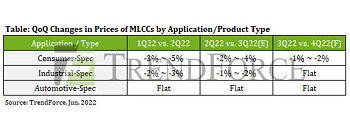

According to TrendForce's research, prices of consumer-spec MLCCs registered drops of 5-10% on average during the period from 1Q21 to 1Q22. To further spur demand, MLCC suppliers have lowered prices further by 3-5% in 2Q22. In fact, the price has dropped to the level of material cost for some low-end consumer-spec MLCCs. In the previous market cycles for MLCCs, the inflection point in the supply-demand dynamics tended to appear following continuous climb or fall in both prices and shipments. For instance, prices and shipments were on an upward trajectory from 2H20 to 2021. And as of now, prices and shipments have been on a downward slide for two consecutive quarters. Looking ahead, there will be no easing of the downward pressure, so quotes for consumer-spec MLCCs are projected to register declines of 3-6% during 2H22.

With regard to industrial-spec MLCCs for niche applications, the overall demand for these products will pick up as buyers experience a loosening of supply for some semiconductor chips. TrendForce currently projects that prices of industrial-spec MLCCs will either register more moderate declines of 1-2% during 2H22 or stay mostly flat for the period. Turning to automotive-spec MLCCs, prices and shipments will hold steady because quote offerings and contract negotiations are conducted on an annual basis for this product category.

MLCC Suppliers in Japan, South Korea, and Taiwan Expand Offerings so as to Limit Impacts Related to Demand Fluctuations in Consumer Electronics Market

Japanese MLCC suppliers Murata and TDK now control almost 80% market share for automotive MLCCs. Besides raising production capacity for automotive offerings, these two suppliers are also strengthening service offerings for various related applications. For instance, they are boosting engagement with their customers through collaborations on product design and advancing the development of service offerings to the modular level. In the fields of automotive powertrain systems and ADAS, Murata and TDK have begun to provide solutions and services for image sensor modules, intelligent parking assist (IPA) modules, etc.

South Korea's Samsung has successfully completed the qualification process for its automotive offerings this year. Moving into 3Q22, Samsung will gradually raise production capacity for automotive offerings at its plant in Tianjin. As for Taiwan's YAGEO, the new production lines at its base in Kaohsiung are expected to commence pilot production in 4Q22. Much of the additional production capacity that YAGEO will be taking on is for high-voltage MLCCs and large-sized 22u automotive MLCCs (e.g., the 0805 and 1210 products). The new production lines will enter the mass production stage near the end of 1Q23 with the initial total production capacity reaching 8-10 billion pieces per month. YAGEO is also diversifying its services and solutions in order to expand into high-end application segments such as military technologies, networking equipment, automotive electronics, medical devices, etc. Examples besides MLCCs include resistors, inductors, and antenna modules.

TrendForce's latest investigation on the COVID-19 lockdowns in China finds that the manufacturing industries residing in the eastern part of the country are starting to recover. Looking specifically at Shanghai, the transportation of goods out of its seaports and airports is gradually returning to normal. Therefore, ODMs' production sites that are located within the region will be able to again ramp up shipments of finished products. Furthermore, the issue of component mismatch will ease significantly as the logistics system, on the whole, is returning to normal operation. The improvement in logistics will thus inject growth momentum into shipments of finished products in 3Q22. On another hand, several major variables will be influencing the MLCC market during 2H22. These include geopolitical tensions, the maintenance of the zero-COVID policy by the Chinese government, and the potential of inflation turning to stagflation.

View at TechPowerUp Main Site | Source

On the other hand, demand remains fairly strong in application segments such as high-performance computing solutions (which include servers), networking equipment, industrial automation solutions, and energy storage systems. Furthermore, IDMs in the semiconductor industry will be adjusting the allocation of production capacity as the market for consumer electronics continues to experience a slowdown in 2H22. As a result, the undersupply situation for certain ICs will ease. Moreover, demand will be propped up in the high-end segment of the MLCC market and other application segments (e.g., automotive electronics and industrial equipment). All in all, thanks to the demand related to automotive electronics, servers, networking equipment, etc., TrendForce forecasts that the annual total MLCC shipments will increase by 2% YoY to around 2.58 trillion pieces for 2022.

Shipments and Prices Have Fallen for Consumer-Spec MLCCs, While Quotes for Automotive- and Industrial-Spec MLCCs Have Held Steady

According to TrendForce's research, prices of consumer-spec MLCCs registered drops of 5-10% on average during the period from 1Q21 to 1Q22. To further spur demand, MLCC suppliers have lowered prices further by 3-5% in 2Q22. In fact, the price has dropped to the level of material cost for some low-end consumer-spec MLCCs. In the previous market cycles for MLCCs, the inflection point in the supply-demand dynamics tended to appear following continuous climb or fall in both prices and shipments. For instance, prices and shipments were on an upward trajectory from 2H20 to 2021. And as of now, prices and shipments have been on a downward slide for two consecutive quarters. Looking ahead, there will be no easing of the downward pressure, so quotes for consumer-spec MLCCs are projected to register declines of 3-6% during 2H22.

With regard to industrial-spec MLCCs for niche applications, the overall demand for these products will pick up as buyers experience a loosening of supply for some semiconductor chips. TrendForce currently projects that prices of industrial-spec MLCCs will either register more moderate declines of 1-2% during 2H22 or stay mostly flat for the period. Turning to automotive-spec MLCCs, prices and shipments will hold steady because quote offerings and contract negotiations are conducted on an annual basis for this product category.

MLCC Suppliers in Japan, South Korea, and Taiwan Expand Offerings so as to Limit Impacts Related to Demand Fluctuations in Consumer Electronics Market

Japanese MLCC suppliers Murata and TDK now control almost 80% market share for automotive MLCCs. Besides raising production capacity for automotive offerings, these two suppliers are also strengthening service offerings for various related applications. For instance, they are boosting engagement with their customers through collaborations on product design and advancing the development of service offerings to the modular level. In the fields of automotive powertrain systems and ADAS, Murata and TDK have begun to provide solutions and services for image sensor modules, intelligent parking assist (IPA) modules, etc.

South Korea's Samsung has successfully completed the qualification process for its automotive offerings this year. Moving into 3Q22, Samsung will gradually raise production capacity for automotive offerings at its plant in Tianjin. As for Taiwan's YAGEO, the new production lines at its base in Kaohsiung are expected to commence pilot production in 4Q22. Much of the additional production capacity that YAGEO will be taking on is for high-voltage MLCCs and large-sized 22u automotive MLCCs (e.g., the 0805 and 1210 products). The new production lines will enter the mass production stage near the end of 1Q23 with the initial total production capacity reaching 8-10 billion pieces per month. YAGEO is also diversifying its services and solutions in order to expand into high-end application segments such as military technologies, networking equipment, automotive electronics, medical devices, etc. Examples besides MLCCs include resistors, inductors, and antenna modules.

TrendForce's latest investigation on the COVID-19 lockdowns in China finds that the manufacturing industries residing in the eastern part of the country are starting to recover. Looking specifically at Shanghai, the transportation of goods out of its seaports and airports is gradually returning to normal. Therefore, ODMs' production sites that are located within the region will be able to again ramp up shipments of finished products. Furthermore, the issue of component mismatch will ease significantly as the logistics system, on the whole, is returning to normal operation. The improvement in logistics will thus inject growth momentum into shipments of finished products in 3Q22. On another hand, several major variables will be influencing the MLCC market during 2H22. These include geopolitical tensions, the maintenance of the zero-COVID policy by the Chinese government, and the potential of inflation turning to stagflation.

View at TechPowerUp Main Site | Source