TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 16,175 (2.27/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

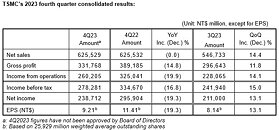

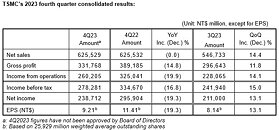

TSMC (TWSE: 2330, NYSE: TSM) today announced consolidated revenue of NT$625.53 billion, net income of NT$238.71 billion, and diluted earnings per share of NT$9.21 (US$1.44 per ADR unit) for the fourth quarter ended December 31, 2023.

Year-over-year, fourth quarter revenue was essentially flat while net income and diluted EPS both decreased 19.3%. Compared to third quarter 2023, fourth quarter results represented a 14.4% increase in revenue and a 13.1% increase in net income. All figures were prepared in accordance with TIFRS on a consolidated basis. In US dollars, fourth quarter revenue was $19.62 billion, which decreased 1.5% year-over-year but increased 13.6% from the previous quarter.

Gross margin for the quarter was 53.0%, operating margin was 41.6%, and net profit margin was 38.2%.

In the fourth quarter, shipments of 3-nanometer accounted for 15% of total wafer revenue; 5-nanometer accounted for 35%; 7-nanometer accounted for 17%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 67% of total wafer revenue.

"Our fourth quarter business was supported by the continued strong ramp of our industry-leading 3-nanometer technology," said Wendell Huang, VP and Chief Financial Officer of TSMC. "Moving into first quarter 2024, we expect our business to be impacted by smartphone seasonality, partially offset by continued HPC-related demand."

Based on the Company's current business outlook, management expects the overall performance for first quarter 2024 to be as follows:

View at TechPowerUp Main Site | Source

Year-over-year, fourth quarter revenue was essentially flat while net income and diluted EPS both decreased 19.3%. Compared to third quarter 2023, fourth quarter results represented a 14.4% increase in revenue and a 13.1% increase in net income. All figures were prepared in accordance with TIFRS on a consolidated basis. In US dollars, fourth quarter revenue was $19.62 billion, which decreased 1.5% year-over-year but increased 13.6% from the previous quarter.

Gross margin for the quarter was 53.0%, operating margin was 41.6%, and net profit margin was 38.2%.

In the fourth quarter, shipments of 3-nanometer accounted for 15% of total wafer revenue; 5-nanometer accounted for 35%; 7-nanometer accounted for 17%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 67% of total wafer revenue.

"Our fourth quarter business was supported by the continued strong ramp of our industry-leading 3-nanometer technology," said Wendell Huang, VP and Chief Financial Officer of TSMC. "Moving into first quarter 2024, we expect our business to be impacted by smartphone seasonality, partially offset by continued HPC-related demand."

Based on the Company's current business outlook, management expects the overall performance for first quarter 2024 to be as follows:

- Revenue is expected to be between US$18.0 billion and US$18.8 billion;

- Gross profit margin is expected to be between 52% and 54%;

- Operating profit margin is expected to be between 40% and 42%.

View at TechPowerUp Main Site | Source