TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 19,041 (2.52/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

NETGEAR, Inc. (NASDAQ: NTGR), a global leader in intelligent networking solutions designed to power extraordinary experiences, today reported financial results for the second quarter ended June 29, 2025.

Q2 2025

CJ Prober, Chief Executive Officer, commented, "In Q2 we once again delivered revenue and operating margin above the high end of our guidance, in addition to generating record gross margin. The transformation of our three business units continues to accelerate thanks to the proactive and strategic investments we've made, and we are thrilled with the strong execution by our global team this quarter. We completed our restructuring in Q1 to further streamline our operating costs and strategically reinvest in the business. The new products we've launched as part of our growth strategy are clearly generating significant improvements across both the top and bottom line. Despite a supply constrained environment, we delivered an over 500 basis point year over year increase in contribution margin across each business unit and saw strong demand for our leading products such as our ProAV and Wifi 7 connectivity solutions, all of which resulted in positive non-GAAP EPS in Q2. This momentum positions us well for further growth and profitability expansion as we continue to deliver on our transformation."

Bryan Murray, Chief Financial Officer, added, "We delivered another excellent quarter and, enabled by the improved linearity across NETGEAR's three business units, DSOs reached their lowest levels in nearly eight years at 77 days. We exited the quarter with nearly $364 million in cash and short-term investments, down $28.5 million from the prior quarter due largely to the Exium acquisition and approximately $7.5 million of common stock repurchases. The team remains focused on maximizing long-term shareholder value and we are utilizing the annual operating expense savings unlocked by the Q1 restructuring for strategic reinvestment into the business. As we make progress in growing our best-in-class portfolio of products and services, the trajectory of NETGEAR's top and bottom-line expansion remains steady, underscoring our confidence in the robust competitive advantage held by our business units and the potential for renewed growth and improved profitability moving forward."

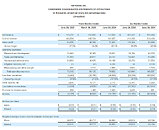

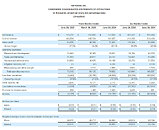

NETGEAR For Business (NFB) Segment Results

Home Networking Segment Results

Mobile Segment Results

Business Outlook

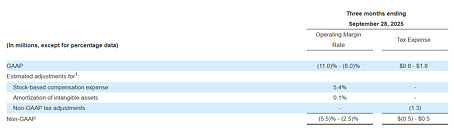

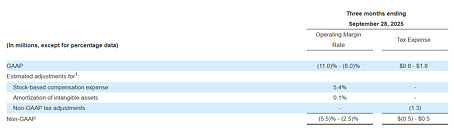

We expect to continue to see more predictable performance that is aligned with the market for all of our businesses. Within NFB, end user demand for our ProAV line of managed switches is expected to remain strong, and, although we expect to continue to make improvements in our supply position, we continue to face lengthy lead times for supply, which may limit our ability to capture the full topline potential of this growing business. On the Home Networking side, we are seeing signs of the benefit of our broader product portfolio to address the market. On the Mobile side, we expect revenue to be in line with Q2 as we await our new product introductions to round out the portfolio later in the year. Accordingly, we expect third quarter net revenue to be in the range of $165 million to $180 million. In the third quarter we expect to further ramp our planned investments, with continued focus on insourcing software development capabilities and enhancing our go to market capabilities supporting our NFB business, accordingly we expect our third quarter GAAP operating margin to be in the range of (11.0)% to (8.0)%, and non-GAAP operating margin to be in the range of (5.5)% to (2.5)%. Our GAAP tax expense is expected to be in the range of $0.8 million to $1.8 million, and our non-GAAP tax expense is expected to be in the range of $(0.5) million to $0.5 million for the third quarter of 2025.

View at TechPowerUp Main Site | Source

Q2 2025

- Net revenue of $170.5 million, up 18.5% from Q2 prior year

- GAAP gross margin of 37.5%, up 1,540 basis points from 22.1% in Q2 prior year

- Non-GAAP gross margin of 37.8%, up 1,540 basis points from 22.4% in Q2 prior year

- GAAP operating income of $(9.5) million compared to $(46.9) million from Q2 prior year

- Non-GAAP operating income of $(1.2) million compared to $(31.1) million from Q2 prior year

- GAAP EPS of $(0.22) compared to $(1.56) from Q2 prior year

- Non-GAAP EPS of $0.06 compared to $(0.74) from Q2 prior year

CJ Prober, Chief Executive Officer, commented, "In Q2 we once again delivered revenue and operating margin above the high end of our guidance, in addition to generating record gross margin. The transformation of our three business units continues to accelerate thanks to the proactive and strategic investments we've made, and we are thrilled with the strong execution by our global team this quarter. We completed our restructuring in Q1 to further streamline our operating costs and strategically reinvest in the business. The new products we've launched as part of our growth strategy are clearly generating significant improvements across both the top and bottom line. Despite a supply constrained environment, we delivered an over 500 basis point year over year increase in contribution margin across each business unit and saw strong demand for our leading products such as our ProAV and Wifi 7 connectivity solutions, all of which resulted in positive non-GAAP EPS in Q2. This momentum positions us well for further growth and profitability expansion as we continue to deliver on our transformation."

Bryan Murray, Chief Financial Officer, added, "We delivered another excellent quarter and, enabled by the improved linearity across NETGEAR's three business units, DSOs reached their lowest levels in nearly eight years at 77 days. We exited the quarter with nearly $364 million in cash and short-term investments, down $28.5 million from the prior quarter due largely to the Exium acquisition and approximately $7.5 million of common stock repurchases. The team remains focused on maximizing long-term shareholder value and we are utilizing the annual operating expense savings unlocked by the Q1 restructuring for strategic reinvestment into the business. As we make progress in growing our best-in-class portfolio of products and services, the trajectory of NETGEAR's top and bottom-line expansion remains steady, underscoring our confidence in the robust competitive advantage held by our business units and the potential for renewed growth and improved profitability moving forward."

NETGEAR For Business (NFB) Segment Results

- Revenue was $82.6 million, up 38.0% year over year

- Non-GAAP gross margin was 46.7%, up 1,300 basis points year over year

- Non-GAAP contribution margin was 19.3%, up 1,590 basis points year over year

Home Networking Segment Results

- Revenue was $67.5 million, up 13.1% year over year

- Non-GAAP gross margin was 29.5%, up 1,800 basis points year over year

- Non-GAAP contribution margin was 4.7%, up 2,590 basis points year over year

Mobile Segment Results

- Revenue was $20.4 million, down 16.1% year over year

- Non-GAAP gross margin was 29.1%, up 750 basis points year over year

- Non-GAAP contribution margin was 0.7%, up 550 basis points year over year

Business Outlook

We expect to continue to see more predictable performance that is aligned with the market for all of our businesses. Within NFB, end user demand for our ProAV line of managed switches is expected to remain strong, and, although we expect to continue to make improvements in our supply position, we continue to face lengthy lead times for supply, which may limit our ability to capture the full topline potential of this growing business. On the Home Networking side, we are seeing signs of the benefit of our broader product portfolio to address the market. On the Mobile side, we expect revenue to be in line with Q2 as we await our new product introductions to round out the portfolio later in the year. Accordingly, we expect third quarter net revenue to be in the range of $165 million to $180 million. In the third quarter we expect to further ramp our planned investments, with continued focus on insourcing software development capabilities and enhancing our go to market capabilities supporting our NFB business, accordingly we expect our third quarter GAAP operating margin to be in the range of (11.0)% to (8.0)%, and non-GAAP operating margin to be in the range of (5.5)% to (2.5)%. Our GAAP tax expense is expected to be in the range of $0.8 million to $1.8 million, and our non-GAAP tax expense is expected to be in the range of $(0.5) million to $0.5 million for the third quarter of 2025.

View at TechPowerUp Main Site | Source