- Joined

- Aug 19, 2017

- Messages

- 3,253 (1.13/day)

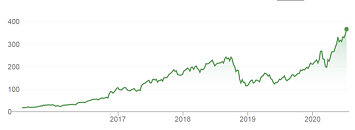

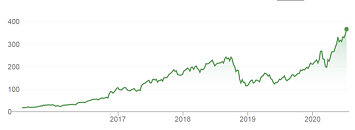

Yesterday after the stock market has closed, NVIDIA has officially reached a bigger market cap compared to Intel. After hours, the price of the NVIDIA (ticker: NVDA) stock is $411.20 with a market cap of 251.31B USD. It marks a historic day for NVIDIA as the company has historically been smaller than Intel (ticker: INTC), with some speculating that Intel could buy NVIDIA in the past while the company was much smaller. Intel's market cap now stands at 248.15B USD, which is a bit lower than NVIDIA's. However, the market cap is not an indication of everything. NVIDIA's stock is fueled by the hype generated around Machine Learning and AI, while Intel is not relying on any possible bubbles.

If we compare the revenues of both companies, Intel is having much better performance. It had a revenue of 71.9 billion USD in 2019, while NVIDIA has 11.72 billion USD of revenue. No doubt that NVIDIA has managed to do a good job and it managed to almost double revenue from 2017, where it went from $6.91 billion in 2017 to $11.72 billion in 2019. That is an amazing feat and market predictions are that it is not stopping to grow. With the recent acquisition of Mellanox, the company now has much bigger opportunities for expansion and growth.

View at TechPowerUp Main Site

If we compare the revenues of both companies, Intel is having much better performance. It had a revenue of 71.9 billion USD in 2019, while NVIDIA has 11.72 billion USD of revenue. No doubt that NVIDIA has managed to do a good job and it managed to almost double revenue from 2017, where it went from $6.91 billion in 2017 to $11.72 billion in 2019. That is an amazing feat and market predictions are that it is not stopping to grow. With the recent acquisition of Mellanox, the company now has much bigger opportunities for expansion and growth.

View at TechPowerUp Main Site