TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,931 (2.51/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

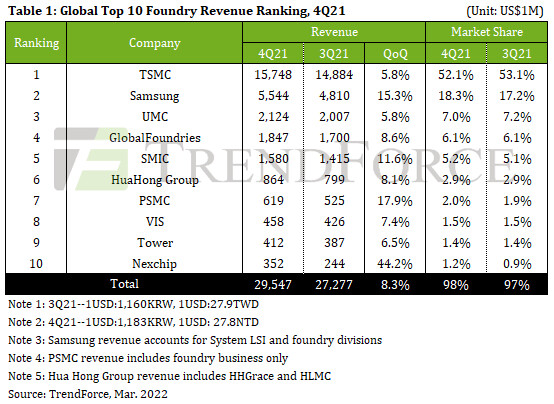

You're not going to get an award for guessing who TSMC's biggest customer is, but based on details in TSMC's latest earnings report, its biggest customer stands for no less than 26 percent of TSMC's total revenue. That's up a whole percentage in 2021 over 2020 and as you most likely have already guessed, that company should be Apple. TSMC doesn't, for obvious reasons, reveal who their customers are, but it's no secret that Apple is spending a lot of money with the company. TSMC had a consolidated revenue of NT$1.587 trillion (US$55.73 billion) in 2021, or up 18.53 percent from 2020. The second largest source of revenue for TSMC might surprise some, at least based on the kind of information that the usual analysts tend to claim in their reports.

Although second place in terms of revenue only accounts for another 10 percent of TSMC's total revenue, we're still looking at some serious money here. However, as both Qualcomm and NVIDIA departed for Samsung in 2021, second place is said to be taken by AMD, which might not have been everyone's first guess. Unsurprisingly, 64 percent of TSMC's revenue is coming from companies in the USA, with Taiwan being the second largest source of revenue at 12.8 percent. As far as the PRC is concerned, revenue is said to be down by 29.6 percent and only makes up 10.3 percent of TSMC's revenues for 2021. This is largely due to the US sanctions against Huawei, according to the Taipei Times. The 7 nm node is still the big money maker for TSMC, which pulled in over NT$440 billion, followed by the 5 nm node at over NT$262 billion. However, the 5 nm node revenue grew by 188 percent in 2021, while the 7 nm node only had a revenue growth of 11.5 percent.

View at TechPowerUp Main Site | Source

Although second place in terms of revenue only accounts for another 10 percent of TSMC's total revenue, we're still looking at some serious money here. However, as both Qualcomm and NVIDIA departed for Samsung in 2021, second place is said to be taken by AMD, which might not have been everyone's first guess. Unsurprisingly, 64 percent of TSMC's revenue is coming from companies in the USA, with Taiwan being the second largest source of revenue at 12.8 percent. As far as the PRC is concerned, revenue is said to be down by 29.6 percent and only makes up 10.3 percent of TSMC's revenues for 2021. This is largely due to the US sanctions against Huawei, according to the Taipei Times. The 7 nm node is still the big money maker for TSMC, which pulled in over NT$440 billion, followed by the 5 nm node at over NT$262 billion. However, the 5 nm node revenue grew by 188 percent in 2021, while the 7 nm node only had a revenue growth of 11.5 percent.

View at TechPowerUp Main Site | Source