TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,543 (2.48/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

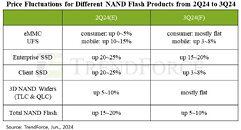

TrendForce reports that while the enterprise sector continues to invest in server infrastructure—especially with the rising adoption of AI driving demand for enterprise SSDs—the consumer electronics market remains lackluster. This, combined with NAND suppliers aggressively ramping up production in the second half of the year, is expected to push the NAND Flash sufficiency ratio up to 2.3% in the third quarter, curbing the blended price hike to a modest 5-10%.

This year, NAND Flash prices saw a robust rebound as manufacturers kept production in check during the first half, helping them regain profitability. However, with a noticeable ramp-up in production and sluggish retail demand, wafer spot prices have dropped significantly. Some wafer prices are now over 20% below contract prices, casting doubts on the sustainability of future price hikes.

For client SSDs, even though notebook sales are entering the traditional peak season, customer stocking behavior remains conservative. The prices of PC end products have yet to fully absorb the price hikes from last year, and procurement volumes haven't shown significant growth in the second half. As suppliers upgrade PC client SSD processes to 2XX layers, production capacity is climbing, but weak demand continues to suppress price increases. Additionally, the considerable price gap between QLC and TLC products has led more PC buyers to opt for QLC solutions, heightening price competition. Consequently, the price increase for PC client SSDs in Q3 is expected to be a restrained 3-8%.

On the enterprise front, the expansion of AI server deployments is driving significant investments in IT infrastructure, with server OEM orders rising sharply in Q3. Despite conservative orders from smartphones and notebooks, the NAND Flash market is becoming more balanced. High-capacity QLC Enterprise SSDs are mainly supplied by two dominant module makers, while others are fiercely competing for enterprise SSD orders to optimize their capacity utilization in the latter half of the year. As a result, the price increase for enterprise SSDs in Q3 is expected to be a substantial 15-20%.

For eMMC, the third quarter lacks significant demand drivers, but module makers are determined to push for higher prices. This determination is expected to result in minimal price increases, with contract prices remaining roughly flat.

In the UFS segment, ample inventory levels and slow depletion by smartphone OEMs, along with increased supply options from module makers, are creating more choice for buyers. As module makers aim for significant price hikes in Q3, resistance is expected. Given ample buyer inventories and weak market demand, suppliers might need to compromise, with Q3 UFS contract prices expected to rise by only 3-8%.

View at TechPowerUp Main Site | Source

This year, NAND Flash prices saw a robust rebound as manufacturers kept production in check during the first half, helping them regain profitability. However, with a noticeable ramp-up in production and sluggish retail demand, wafer spot prices have dropped significantly. Some wafer prices are now over 20% below contract prices, casting doubts on the sustainability of future price hikes.

For client SSDs, even though notebook sales are entering the traditional peak season, customer stocking behavior remains conservative. The prices of PC end products have yet to fully absorb the price hikes from last year, and procurement volumes haven't shown significant growth in the second half. As suppliers upgrade PC client SSD processes to 2XX layers, production capacity is climbing, but weak demand continues to suppress price increases. Additionally, the considerable price gap between QLC and TLC products has led more PC buyers to opt for QLC solutions, heightening price competition. Consequently, the price increase for PC client SSDs in Q3 is expected to be a restrained 3-8%.

On the enterprise front, the expansion of AI server deployments is driving significant investments in IT infrastructure, with server OEM orders rising sharply in Q3. Despite conservative orders from smartphones and notebooks, the NAND Flash market is becoming more balanced. High-capacity QLC Enterprise SSDs are mainly supplied by two dominant module makers, while others are fiercely competing for enterprise SSD orders to optimize their capacity utilization in the latter half of the year. As a result, the price increase for enterprise SSDs in Q3 is expected to be a substantial 15-20%.

For eMMC, the third quarter lacks significant demand drivers, but module makers are determined to push for higher prices. This determination is expected to result in minimal price increases, with contract prices remaining roughly flat.

In the UFS segment, ample inventory levels and slow depletion by smartphone OEMs, along with increased supply options from module makers, are creating more choice for buyers. As module makers aim for significant price hikes in Q3, resistance is expected. Given ample buyer inventories and weak market demand, suppliers might need to compromise, with Q3 UFS contract prices expected to rise by only 3-8%.

View at TechPowerUp Main Site | Source