Friday, April 16th 2010

AMD Reports Record First Quarter Revenue

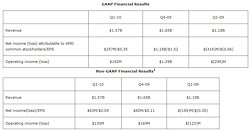

AMD (NYSE:AMD) announced revenue for the first quarter of 2010 of $1.57 billion, net income of $257 million, or $0.35 per share, and operating income of $182 million. The company reported non-GAAP net income of $63 million, or $0.09 per share, and non-GAAP operating income of $130 million.

"Strong product offerings and solid operating performance resulted in record first quarter revenue," said Dirk Meyer, AMD President and CEO. "We continue to strengthen our product offerings. We launched our latest generation of server platforms, expanded our family of DirectX 11-compatible graphics offerings, and commenced shipments of our next-generation notebook platforms to customers."

Quarterly Summary

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

AMD expects revenue to be down seasonally for the second quarter of 2010.

AMD Teleconference

AMD will hold a conference call for the financial community at 2:00 p.m. PT (5:00 p.m. ET) today to discuss its first quarter financial results. AMD will provide a real-time audio broadcast of the teleconference on the Investor Relations page of its Web site at AMD. The webcast will be available for 10 days after the conference call.

"Strong product offerings and solid operating performance resulted in record first quarter revenue," said Dirk Meyer, AMD President and CEO. "We continue to strengthen our product offerings. We launched our latest generation of server platforms, expanded our family of DirectX 11-compatible graphics offerings, and commenced shipments of our next-generation notebook platforms to customers."

Quarterly Summary

- Gross margin was 47% in the first quarter.

o Non-GAAP gross margin was 43%, a sequential increase of two percentage points. This excludes a benefit of $69 million, or four percentage points, related to an inventory adjustment resulting from the deconsolidation of GLOBALFOUNDRIES as compared to Q4-09. - Cash, cash equivalents and marketable securities balance at the end of the quarter was $1.93 billion, a sequential increase from $1.77 billion for AMD excluding GLOBALFOUNDRIES.

- Computing Solutions segment revenue decreased 5% sequentially and increased 23% year-over-year. The sequential decrease was driven by lower microprocessor unit shipments, partially offset by an increase in microprocessor average selling price (ASP). The year-over-year increase was driven by an increase in microprocessor unit shipments.

o Operating income was $146 million, compared with $161 million in Q4-09 and a loss of $34 million in Q1-09.

o Acer, Asus, Dell, HP, Lenovo and Toshiba broadened their AMD-based client offerings with the expanded AMD Athlon II and Phenom II desktop processors and latest AMD Turion mobile processors.

o HP, Dell, Acer Group, Cray and SGI and other leading computer manufacturers announced plans for more than 25 new platforms based on the AMD Opteron 6000 Series server platform, featuring the world's first 8- and 12-core x86 processor for the high-volume 2P and value 4P server market. - Graphics segment revenue decreased 3% sequentially and increased 88% year-over-year. The sequential decrease was driven primarily by a seasonal decline in royalties received in connection with the sale of game console systems, largely offset by an increase in graphics processor unit (GPU) revenue. The year-over-year increase was driven primarily by an increase in GPU shipments.

o Operating income was $47 million, compared with $50 million in Q4-09 and breakeven in Q1-09.

o GPU shipments increased sequentially, primarily driven by record mobile discrete graphics unit shipments.

o GPU ASP increased sequentially and decreased year-over-year.

o AMD expanded the industry-leading ATI Radeon HD 5000 family of graphics cards with seven product introductions. AMD is the only company shipping Microsoft DirectX 11 capable graphics cards with ATI Eyefinity technology spanning the desktop, notebook and workstation markets. New products introduced include:

+ The ATI Radeon HD 5870 Eyefinity 6 Edition, the world's first graphics card capable of enabling up to 12 times HD resolution across six monitors,

+ The ATI FirePro V8800, the industry's most powerful professional graphics card ever created for the professional workstation market,

+ The ATI Mobility Radeon HD 5870, the first mobile graphics solution that supports Microsoft DirectX 11 technology. - As a result of deconsolidating GLOBALFOUNDRIES, AMD recognized a non-cash, one-time gain of $325 million in Other income (expense), net in AMD's Consolidated Statement of Operations.

- AMD entered into an agreement with the Ontario Ministry of Economic Development and Trade to receive up to $56.4 million CAD grant award under Ontario's Next Generation of Jobs Fund to bolster R&D spend for AMD Fusion processors.

- AMD was named to Corporate Responsibility Officer Magazine's 2010 list of 100 Best Corporate Citizens and a Top 10 leader on the inaugural Maplecroft Climate Innovation Index.

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

AMD expects revenue to be down seasonally for the second quarter of 2010.

AMD Teleconference

AMD will hold a conference call for the financial community at 2:00 p.m. PT (5:00 p.m. ET) today to discuss its first quarter financial results. AMD will provide a real-time audio broadcast of the teleconference on the Investor Relations page of its Web site at AMD. The webcast will be available for 10 days after the conference call.

27 Comments on AMD Reports Record First Quarter Revenue

if the new PHII X6 be compatible whit am2+ motherboards, it will be :rockout:

Too bad it failed to impress the market, shares are down 6.5% right now. P/E seems pretty low @ 23 or so. They've got more convincing to do.

My first CPU was a K6 @300 MHz back in 1999 :cry: AMD made possible I owned a PC for the first time :)

Go AMD!!!

Next to the $2+ billion Intel made, AMD's profit looks pretty damn good, considering its size.

But seriously, what did you expect. Intel also has some of the worst business practices in the game (not worse than nvidia, but close).

Seriously, AMD needs to get the word out so their name is at least as well as say General Mills. While most people will go, "I am not sure why I know that name." they still know it. And if you name a product they make, people will know exactly who they are. That is what AMD needs to aim for right now.

Insult? No, just putting things in perspective.I buy the best bang for the buck. AMD has been short on bang for almost 4 years now. :( I have an Opteron 180 system upstairs that used to be mine...until it wasn't fast enough for my needs.I agree AMD needs more brand recognition. Intel's been advertising a lot lately.

But, I also plan to grab a 6 core AMD chip when possible.

To me, the more cores/threads, the happier I am. :D

At any rate, AMD being on an upswing is good news. They are still doing lousy compared to their heyday, but any improvement is welcome.