Wednesday, January 21st 2015

AMD Reports 2014 Fourth Quarter and Annual Results

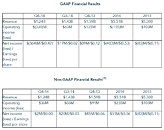

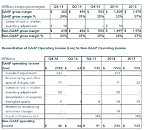

AMD (NASDAQ: AMD) today announced revenue for the fourth quarter of 2014 of $1.24 billion, operating loss of $330 million and net loss of $364 million, or $0.47 per share. Non-GAAP(1) operating income was $36 million, non-GAAP(1) net income of $2 million and breakeven non-GAAP(1) earnings per share.

"We made progress diversifying our business, ramping design wins and improving our balance sheet this past year despite challenges in our PC business," said Dr. Lisa Su, AMD president and CEO. "Annual Enterprise, Embedded and Semi-Custom segment revenue increased over 50% as customer demand for products powered by our high-performance compute and rich visualization solutions was strong. We continue to address channel headwinds in the Computing and Graphics segment and are taking steps to return it to a healthy trajectory beginning in the second quarter of 2015."2014 Annual Results

For Q1 2015, AMD expects revenue to decrease 15 percent, plus or minus 3 percent, sequentially.

For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

"We made progress diversifying our business, ramping design wins and improving our balance sheet this past year despite challenges in our PC business," said Dr. Lisa Su, AMD president and CEO. "Annual Enterprise, Embedded and Semi-Custom segment revenue increased over 50% as customer demand for products powered by our high-performance compute and rich visualization solutions was strong. We continue to address channel headwinds in the Computing and Graphics segment and are taking steps to return it to a healthy trajectory beginning in the second quarter of 2015."2014 Annual Results

- Revenue of $5.51 billion, up 4 percent year-over-year.

- Gross margin of 33 percent, down 4 percentage points year-over-year and non-GAAP(1) gross margin of 34 percent, down 3 percentage points year-over-year.

- Operating loss of $155 million and non-GAAP(1) operating income of $235 million, compared to GAAP and non-GAAP(1) operating income of $103 million in 2013.

- Net loss of $403 million, loss per share of $0.53, and non-GAAP(1) net income of $51 million, non-GAAP(1) earnings per share of $0.06, compared to a GAAP and non-GAAP(1) net loss of $83 million, loss per share of $0.11 in 2013.

- Revenue of $1.24 billion, down 13 percent sequentially and 22 percent year-over-year.

- Gross margin of 29 percent and non-GAAP(1) gross margin of 34 percent. Gross margin was down 6 percentage points sequentially, primarily due to lower of cost or market inventory adjustment of $58 million related to our second-generation APU products. Non-GAAP(1) gross margin was down 1 percentage point sequentially. Q3 2014 gross margin of 35 percent included a $27 million, or 2 percent, benefit from revenue related to technology licensing.

- Operating loss of $330 million and non-GAAP(1) operating income of $36 million, compared to operating income of $63 million and non-GAAP(1) operating income of $66 million in Q3 2014.

- Net loss of $364 million, loss per share of $0.47, and non-GAAP(1) net income of $2 million, breakeven non-GAAP(1) earnings per share, compared to net income of $17 million, earnings per share of $0.02 and non-GAAP(1) net income of $20 million, non-GAAP(1) earnings per share of $0.03 in Q3 2014.

- Cash, cash equivalents and marketable securities were $1.04 billion at the end of the quarter, up $102 million from the end of the prior quarter.

- Total debt at the end of the quarter was $2.21 billion, flat from the prior quarter.

- Computing and Graphics segment revenue decreased 15 percent sequentially and 16 percent from 2013. The sequential decrease was primarily due to lower desktop processor and GPU sales, and the annual decrease was driven by lower desktop processor and chipset sales.

- Operating loss was $56 million, compared with an operating loss of $17 million in Q3 2014 and operating loss of $15 million in Q4 2013. The sequential and year-over-year decreases were primarily driven by lower channel sales partially offset by lower operating expenses.

- Client average selling price (ASP) increased sequentially and year-over-year primarily driven by a richer mix of notebook processor sales.

- GPU ASP increased sequentially primarily due to higher desktop and notebook GPU ASPs and decreased year-over-year primarily due to a lower channel ASP.

- Enterprise, Embedded and Semi-Custom segment revenue decreased 11 percent sequentially primarily driven by lower sales of semi-custom SoCs. Annual revenue increased 51 percent from 2013 primarily driven by increased sales of semi-custom SoCs.

- Operating income was $109 million compared with $108 million in Q3 2014 and $129 million in Q4 2013. The year-over-year decrease was primarily due to lower sales of semi-custom SoCs.

- All Other category operating loss was $383 million compared with $28 million in Q3 2014 and operating income of $21 million in Q4 2013. The sequential and year-over-year decreases are primarily due to a $233 million goodwill impairment charge, $71 million restructuring and other special charges, net and a $58 million lower of cost or market inventory adjustment.

- Strong demand continued for AMD-based game consoles, with Microsoft and Sony having shipped nearly 30 million consoles to-date. Sony also recently announced plans to release PlayStation4 in the People's Republic of China.

- AMD added "Carrizo" and "Carrizo-L" to its 2015 Mobile APU roadmap, giving customers a single platform that scales from high-performance notebook gaming PCs to mainstream laptops. With new energy efficiency features, next generation CPU cores and the latest GCN graphics, "Carrizo" will be AMD's most advanced APU ever when it comes to market in the first half of 2015.

- AMD drove continued adoption of high-performance APUs into new embedded markets with key new customer design wins, including:

- Two new solutions from QNAP, a leading provider of network attached storage (NAS) systems, powered by AMD's Embedded G-Series SoC.

- Gizmosphere's Gizmo 2, a second-generation, open source development board, powered by the AMD Embedded G-Series SoC, which offers outstanding compute and graphics performance on a single platform for a wide range of Linux and Windows based development projects.

- AMD-based systems continued building momentum in the commercial client market with the adoption of AMD PRO APU-based commercial systems -- like the HP Elite 700-Series and Lenovo ThinkCentre M79 and M78 desktops -- by companies worldwide, including China Mobile Communications Corporation, Dr. Pepper Snapple Group and Telcel (Mexico).

- AMD demonstrated continued progress developing the ecosystem for both 64-bit ARM-based servers and APU-based servers targeting next-generation workloads, with notable developments including:

- SUSE Linux's release of openSUSE version 13.2, marking the first generally available Linux distribution offering direct support for AMD's upcoming ARM-based processor, the AMD Opteron A1100 Series processor (codenamed "Seattle").

- Penguin, in collaboration with AMD, announced the first application optimized APU clusters, enabling seamless GPU and CPU memory sharing on clusters based on heterogeneous system architecture (HSA).

- HP announced new HP ZBook 14 and HP ZBook 15u mobile workstations powered by AMD FirePro professional graphics at the 2015 International Consumer Electronics Show.

- AMD launched its Catalyst Omega driver suite, delivering performance increases of up to 19 percent on AMD Radeon graphics(2) and up to 29 percent on AMD APUs,(3) more than 20 new features, like Virtual Super Resolution, and improvements based on user feedback, as well as a set of new developer tools and Linux optimizations. Downloads to date total 8.8 million.

- Demonstrating thought leadership in gaming and graphics, AMD introduced AMD FreeSync technology,(4) an innovative, open-standards-based screen synching technology that maximizes the reduction of input latency and reduces or fully eliminates stuttering and tearing during gaming and video playback on select AMD Radeon graphics cards and current and future generation APUs. FreeSync-enabled displays from BenQ, LG Electronics, Nixeus, Samsung and Viewsonic were showcased at the 2015 International Consumer Electronics Show and are expected to be available in market starting in the first quarter of 2015.

- AMD announced, for the third straight year, research grants totaling more than $32 million for the development of critical technologies needed for extreme-scale computing in conjunction with projects associated with the U.S. Department of Energy (DOE). The two DOE awards will fund research on exascale applications for AMD APUs based on the open-standard HSA, as well as future memory systems to power a generation of exascale supercomputers.

- AMD achieved recognition as a world leader in energy efficiency and compute power with AMD FirePro professional graphics being awarded the top spot on the Green500 List, a ranking of the world's most energy-efficient supercomputers, and the AMD Opteron server CPU receiving the number two spot on the latest TOP500 List, a ranking of the 500 most powerful supercomputers in the world.

For Q1 2015, AMD expects revenue to decrease 15 percent, plus or minus 3 percent, sequentially.

For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

31 Comments on AMD Reports 2014 Fourth Quarter and Annual Results

And q1 is going to be even worse, another 15% revenue decrease!

Here's hoping AMD makes it into 2016.

Technically, if you're blaming anyone it should be the Board of Directors - they signed off on the strategy, and every other decision.Yup. Q4 was in line with expectation, but the projected 15% loss (± 3%) in Q1 2015 is a big kick in the teeth.They'll get there. They might not be in good shape...but they'll be there.

$360 million in loses is too much for AMD.

All my pc using intel chips, but i want AMD to success. I don't want to see intel to charge customer "i7-4770k" for $999 if there is no more competition.

Intel have AMD on life support because it serves their purpose. AMD likely can't be acquired by anyone other than a U.S. company, and any potential buyer (including taking on the debt) would still be faced with taking on Intel. The other side of the coin is that Intel can't grind AMD down to dust without the DoJ and the FTC starting antitrust proceedings...so they do what they're doing - keeping AMD viable enough to maintain their business without growing so large that they represent any kind of threat. You think Intel couldn't price AMD out of existencein the consumer space if they wanted to? Thankfully there are laws to stop Intel slashing prices, even if contra revenue walks a fine line in the ultra portable market.

If lack of competition was a key to skyrocketing prices, why are Intel's Xeon line holding steady in pricing architecture after architecture? The company holds almost 98% of the x86 server market - that's about as close to a monopoly as it gets. Intel also has no competition in HEDT, yet the 5960X isn't appreciably more expensive than the launch price of the 4960X, or 3960X/3970X before that, or the 980X/990X before that.

I wouldn't even say that the 4770K has that much competition - AMD's 990X/FX platform is pretty long in the tooth, and is steadily losing ground, yet the 4770K/4790K isn't appreciably more expensive than the 3770K, or the 2600K prior to that.

I have seen some rumors floating around the net that Samsung might be interested in buying AMD. If they did they could put enough cash into AMD for R&D to turn them around.

AMD needs to put money into getting OEM's and offering things competitively. The more they get in their pocket, the better they can then start actually working to make things much more profitable for them.

may be AMD need new and advance setup for their research division. to make sure what users really wanted to get cuz AMd seriously need to work on consumption section.

1. AsRock 970 Pro3 Rev. 2.0, AMD 970 , DDR3 2100+(OC), AM3+;

AMD FX-8350 X8, 4.0GHz, 16MB, AM3+, Black Edition;

GEIL 2X4GB DDRIII 2133 EVO POTENZA

for ¬330 EUR

or

2. AsRock Z87M PRO4, DDR3 2800+(OC), LGA1150;

Core i5 4690K, 3.50GHz, 6MB, LGA1150

GEIL 2X4GB DDRIII 2133 EVO POTENZA

for ¬420 EUR

If customers realised that with AMD they receive quite a lot for their money, then AMD would be in much better shape.

But, of course, ignorance and lack of vision drive only Intel sales. :rolleyes:

in our country, there is totally monopoly of INTEL. not a single distrubuter is dealing in AMD CPUs so we have to go with INTEL.

Price breakdown by merchant: uk.pcpartpicker.com/p/yLTgbv/by_merchant/

CPU: AMD FX-8350 4.0GHz 8-Core Processor (£125.00 @ Amazon UK)

Motherboard: Gigabyte GA-970A-UD3P ATX AM3+ Motherboard (£63.54 @ Aria PC)

Memory: G.Skill Ripjaws X Series 8GB (2 x 4GB) DDR3-1866 Memory (£68.99 @ Aria PC)

Total: £257.53

Prices include shipping, taxes, and discounts when available

Generated by PCPartPicker 2015-01-21 17:20 GMT+0000

PCPartPicker part list: uk.pcpartpicker.com/p/hTm223

Price breakdown by merchant: uk.pcpartpicker.com/p/hTm223/by_merchant/

CPU: Intel Core i5-4460 3.2GHz Quad-Core Processor (£130.94 @ Aria PC)

Motherboard: ASRock H97 PRO4 ATX LGA1150 Motherboard (£69.56 @ Scan.co.uk)

Memory: G.Skill Ripjaws Series 8GB (2 x 4GB) DDR3-1600 Memory (£57.60 @ Kustom PCs)

Total: £258.10

Prices include shipping, taxes, and discounts when available

Generated by PCPartPicker 2015-01-21 17:22 GMT+0000

intel has good value options too especially if your talking 1080p since you only need one gpu.

To throw more money, when you can save and get the same. That's what happens in the 'smart' companies optimising every single penny of their costs...

Especially when you introduce the completely unnecessary "help" of OEMs and big stores who inflate prices and you actually do not need them.

One of the biggest obstacles to overcoming this is one of AMD's own making. They and their more avid fans perpetuate the plucky underdog status. Sure, some people root the underdog, but many, many more like a winner- and just like sports, winning breeds bandwagoners and frontrunners. The second obstacle is that AMD positions itself as the value proposition, so they deliberately target low margins and a customer base both mindful of how much they spend, and unlikely to buy/upgrade as often as other market segments.She now has less incentive to do so thanks to those pesky shareholders