Monday, September 28th 2015

GlobalFoundries 14 nm LPP FinFET Node Taped Out, Yields Good

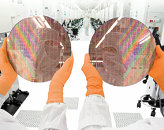

GlobalFoundries' move to leapfrog several silicon fab steps to get straight to 14 nanometer (nm) is on the verge of paying off, with the company taping out its 14 nm LPP (low-power plus) FinFET node, and claiming good yields on its test/QA chips. This takes the node one step closer to accepting orders for manufacturing of extremely complex chips, such as CPUs and GPUs.

AMD is expected to remain the company's biggest client, with plans to build its next-generation "Zen" processor on this node. The company's "Arctic Islands" graphics chips are also rumored to be built on the 14 nm node, although which foundry will handle its mass production remains unclear. A big chunk of AMD's R&D budget is allocated to getting the "Zen" architecture right, with key stages of its development being handled by Jim Keller, the brains behind some of AMD's most commercially successful CPU cores.

Source:

Expreview

AMD is expected to remain the company's biggest client, with plans to build its next-generation "Zen" processor on this node. The company's "Arctic Islands" graphics chips are also rumored to be built on the 14 nm node, although which foundry will handle its mass production remains unclear. A big chunk of AMD's R&D budget is allocated to getting the "Zen" architecture right, with key stages of its development being handled by Jim Keller, the brains behind some of AMD's most commercially successful CPU cores.

28 Comments on GlobalFoundries 14 nm LPP FinFET Node Taped Out, Yields Good

Here's my thoughts and reasoning, the rumor in most subsequent writings indicated the Holding company Government of Abu Dhabi, or is it ATIC, or is it now Mubadala Technology... didn't want to infuse cash to buy new 14nm FinFET equipment. Rather wanting to recycling where possible current 28nm equipment. Such capital expenditure didn't get decided 6 months ago, and probably not even a year ago, but those kind of decisions are long term funding to source and deliver. The idea the recent fluctuations in the revenues being garnered from oil business are what causes them to think now of cutting-back funding for tooling and equipment that was written and funded in budget 2 years ago seems far-fetched.As I said it probably had nothing with any competitor hardware company so the site being pro/bias is not as concerning.Well their track record in the early years has been fraught to be sure, but this shrink has been (or should've) been the one exercise to bring what would be a true 7 year plan to fruition. I'm not counting that GloFo can/will shake the Fab business to it core, but if they can't start pulling business in for 14nmFinFET they will miss-out on gaining true acceptance for many years.

Now I try no to get wrapped up in a tech-site speculation and rumors, rather read carefully in the corporate weasel wording of "forward-looking" statements. That's all this Discussion of 'News' wasn't about their 'announcement'... those words should've been part of article. I see nothing about AMD, Zen, Artic Samsung, etc.

"Our 14nm FinFET ramp is exceeding plan with best-in-class yield and defect density. The early-access version of the technology (14LPE) was qualified in January and is well on its way to volume production, meeting yield targets on lead customer products. The performance-enhanced version of the technology (14LPP) is set for qualification in the second half of 2015, with the volume ramp beginning in early 2016. Prototyping on test vehicles has demonstrated excellent logic and SRAM yields and performance at near 100% of target." - Jason Gorss, Senior Manager, Corporate and Technology Communications at Globalfoundries 9/26/2015

Breaking down what I say is not important, as it all boils down to...