China Hosts 40% of all Arm-based Servers in the World

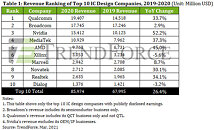

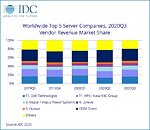

The escalating challenges in acquiring high-performance x86 servers have prompted Chinese data center companies to accelerate the shift to Arm-based system-on-chips (SoCs). Investment banking firm Bernstein reports that approximately 40% of all Arm-powered servers globally are currently being used in China. While most servers operate on x86 processors from AMD and Intel, there's a growing preference for Arm-based SoCs, especially in the Chinese market. Several global tech giants, including AWS, Ampere, Google, Fujitsu, Microsoft, and Nvidia, have already adopted or developed Arm-powered SoCs. However, Arm-based SoCs are increasingly favorable for Chinese firms, given the difficulty in consistently sourcing Intel's Xeon or AMD's EPYC. Chinese companies like Alibaba, Huawei, and Phytium are pioneering the development of these Arm-based SoCs for client and data center processors.

However, the US government's restrictions present some challenges. Both Huawei and Phytium, blacklisted by the US, cannot access TSMC's cutting-edge process technologies, limiting their ability to produce competitive processors. Although Alibaba's T-Head can leverage TSMC's latest innovations, it can't license Arm's high-performance computing Neoverse V-series CPU cores due to various export control rules. Despite these challenges, many chip designers are considering alternatives such as RISC-V, an unrestricted, rapidly evolving open-source instruction set architecture (ISA) suitable for designing highly customized general-purpose cores for specific workloads. Still, with the backing of influential firms like AWS, Google, Nvidia, Microsoft, Qualcomm, and Samsung, the Armv8 and Armv9 instruction set architectures continue to hold an edge over RISC-V. These companies' support ensures that the software ecosystem remains compatible with their CPUs, which will likely continue to drive the adoption of Arm in the data center space.

However, the US government's restrictions present some challenges. Both Huawei and Phytium, blacklisted by the US, cannot access TSMC's cutting-edge process technologies, limiting their ability to produce competitive processors. Although Alibaba's T-Head can leverage TSMC's latest innovations, it can't license Arm's high-performance computing Neoverse V-series CPU cores due to various export control rules. Despite these challenges, many chip designers are considering alternatives such as RISC-V, an unrestricted, rapidly evolving open-source instruction set architecture (ISA) suitable for designing highly customized general-purpose cores for specific workloads. Still, with the backing of influential firms like AWS, Google, Nvidia, Microsoft, Qualcomm, and Samsung, the Armv8 and Armv9 instruction set architectures continue to hold an edge over RISC-V. These companies' support ensures that the software ecosystem remains compatible with their CPUs, which will likely continue to drive the adoption of Arm in the data center space.