"Project Sirius" Witcher Spin-Off Back on Track, CD Projekt Confirms Staff Layoffs at American and Polish Studios

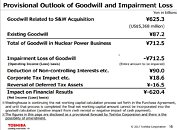

CD Projekt declared in an investor regulatory announcement (issued on May 11) that its troubled "Project Sirius" multiplayer game was back on track with a renewed development focus. Their briefing is titled: "New framework for Project Sirius, decision concerning partial reversal of the impairment allowance for 2022, and write-off of part of the development expenditures incurred in Q1 2023." As reported back in March, the Polish gaming group made the difficult choice to reboot its multiplayer focused Witcher title and write-off a significant chunk of the development budget. Last week's update seems to indicate that their North American studio, The Molasses Flood, is still involved in the making of Project Sirius and that a smaller chunk of project expenditure has been written off in the mean time.

The company's investor announcement coincided with emerging rumors of employee layoffs - gaming news outlets started to pick up on social media declarations last Friday (May 12). Yesterday CD Projekt confirmed that the refocused and restarted development process has resulted in a round of headcount cuts on both sides of the Atlantic. In a statement issued to PC Gamer, a company spokesperson says: "Because the project changed, so has the composition of the team that's working on it - mainly on The Molasses Flood's side. The concrete number of employees we parted ways with is 21 team members in the US and 8 in Poland (working on the project outside of the US)."

The company's investor announcement coincided with emerging rumors of employee layoffs - gaming news outlets started to pick up on social media declarations last Friday (May 12). Yesterday CD Projekt confirmed that the refocused and restarted development process has resulted in a round of headcount cuts on both sides of the Atlantic. In a statement issued to PC Gamer, a company spokesperson says: "Because the project changed, so has the composition of the team that's working on it - mainly on The Molasses Flood's side. The concrete number of employees we parted ways with is 21 team members in the US and 8 in Poland (working on the project outside of the US)."