Wednesday, May 19th 2021

Cryptocurrency Market Bleeds Trillions in Less Than 24 Hours; Did the Bubble Pop?

The cryptocurrency market is experiencing another major shakedown in pricing, with the overall crypto market valuation dropping by more than a trillion dollars in less than 24 hours. As of time of writing, leading cryptocurrency by market cap Bitcoin has lost more than 30% in value, dropping to $31,000. Ethereum is down by 40% to $2,424, and memecoin Dogecoin has fallen by 45% - one would think a memecoin would have had its value dropped to zero from the instant of its conception, but that's not the world we live in.

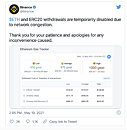

As the market tries to staunch the bleeding, major cryptocurrency platforms Coinbase and Binance are down, citing "network congestion" issues stemming from the unexpected volatility. As investors see their attempts to sell neutered by these network congestion issues, this seems like a way to reduce the amount of cryptocurrencies available in the market, which would feed the descending value cycle even more. Whether or not this is the bubble popping, it's yet another foundational shock to the trust that was already achieved by these platforms and the cryptocurrency market as a whole. How this will affect market availability and demand for graphics cards and hardware is anyone's guess, but even if it does, it'll take some time until we see availability in the main and secondary channels.

As the market tries to staunch the bleeding, major cryptocurrency platforms Coinbase and Binance are down, citing "network congestion" issues stemming from the unexpected volatility. As investors see their attempts to sell neutered by these network congestion issues, this seems like a way to reduce the amount of cryptocurrencies available in the market, which would feed the descending value cycle even more. Whether or not this is the bubble popping, it's yet another foundational shock to the trust that was already achieved by these platforms and the cryptocurrency market as a whole. How this will affect market availability and demand for graphics cards and hardware is anyone's guess, but even if it does, it'll take some time until we see availability in the main and secondary channels.

136 Comments on Cryptocurrency Market Bleeds Trillions in Less Than 24 Hours; Did the Bubble Pop?

In PoW: you choose the longer blockchain. Its unambiguous (but the threat of a 51% attack forces everyone to constantly waste electricity). In PoS, you have a circular logic: you need to trust a blockchain before you can calculate the number of funds staked.

Either way good point.

Crazy thing is that you could beat that overclock with overclocked FX 6300 and you only need Cooler Master Hyper 103 air cooler.

But who gives a nut. BTC and everything around it is based on a bubble. All we know tesla pulled the perfect trick out of the hat with a classic pump and dump.

www.tomshardware.com/news/china-establishes-cryptocurrency-mining-hotlineProbably because not many, like me, are personally invested in crypto? I've never, dont plan to, nor looking forward to ever investing in crypto. That of course doesn't mean I support our "free money (i.e. debt) for all" printing system of today!

en.wikipedia.org/wiki/Cryptocurrency_bubble

But anyway, Tether just printed another $1 Billion USDT. whale-alert.io/transaction/tron/93fcdbc3485b24934e88b7c942baabaa47d5466ade64d457153121d396a2e6e0

These people come to forums discussing all the problems of "printing money" or whatever with the US Fed system (which is strictly regulated to ensure that banking participants make no more than a certain % of their official reserves). Then they turn around and buy USDT, which as far as I can tell, can decide to print literally a $Billion overnight without anyone so much as blinking at them.

That $Billion in USDT is then used to prop up Bitcoin's price (it obviously occurred as BTC's price was declining). There are ton of people who don't even know the difference from USDT and USD anymore. Its kind of insane.

Supposedly for every print of tether, there is a dollar backing it owned by the company that prints it. I'm not sure if any audits of them have been done however, they have always struck me as the most suspucious "dollarlike coin"

There are hard rules in crypto. Like block halvings. They happen because the designers of the chain said they would, whether the users like it or not.

These rules are litterally in the code. Humans can't mess with them. In many ways they are stronger than legislation. They haven't used this power for much besides coin issuance control, but it's certainly there.

Eth-classic vs Ethereum vs Eth2.0 for example. DAO contract was on the original, largely abandoned Eth-classic Blockchain. But the community was able to migrate (and plans to migrate again for proof of stake)