Friday, May 11th 2012

NVIDIA Reports Financial Results for First Quarter Fiscal Year 2013

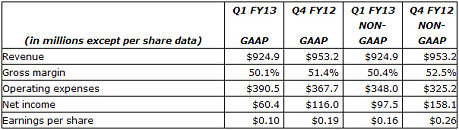

NVIDIA today reported revenue of $924.9 million for the first quarter of fiscal 2013 ended Apr. 29, 2012.

"Kepler GPUs are accelerating our business," said Jen-Hsun Huang, president and chief executive officer of NVIDIA. "Our newly launched desktop products are winning some of the best reviews we've ever had. Notebook GPUs had a record quarter. And Tegra is on a growth track again, driven by great mobile device wins and the upcoming Windows on ARM launch.

"Graphics is more important than ever. Look for exciting news next week at the GPU Technology Conference as we reveal new ways that the GPU will enhance mobile and cloud computing," he said.Outlook

Our outlook for the second quarter of fiscal 2013 is as follows:

● Revenue is expected to be between $990 million and $1.05 billion.

● GAAP gross margin is expected to be 51.2 percent, plus or minus one percentage point. Non-GAAP gross margin is expected to be 51.5 percent, plus or minus one percentage point.

● GAAP operating expenses are expected to be approximately $418 million. Non-GAAP operating expenses are expected to be approximately $354 million.

GAAP operating expenses for the second quarter are expected to include a one-time charge related to a corporate donation to Stanford Hospital of $25 million, payable over a 10-year period. We are joining Stanford's initiative, along with other corporations in the high-tech community, including Apple, eBay, HP, Intel, Intuit and Oracle, to build a leading-edge health care institution.

● GAAP and non-GAAP tax rates are expected to be approximately 20 percent, plus or minus one percent, for the second quarter and fiscal year, excluding any discrete tax events that may occur during the quarter, which, if realized, may increase or decrease our GAAP and non-GAAP tax rates. If the U.S. research tax credit is reinstated into tax law, we estimate our annual effective tax rate for the fiscal year 2013 to be approximately 16 percent.

We estimate depreciation and amortization for the second quarter to be approximately $55 million to $57 million. Capital expenditures are expected to be in the range of $35 to $45 million.

Diluted shares for the second quarter are expected to be approximately 628 million.

First Quarter Fiscal 2013 and Recent Highlights:

● NVIDIA launched its new Kepler-architecture GPUs to rave reviews. Products included the GeForce GTX 670, GeForce GTX 680, the dual-GPU GeForce GTX 690, and the notebook range of GeForce 600M GPUs.

● The first Ultrabook with an NVIDIA GPU, the Acer Aspire Timeline M3, launched on March 6.

● NVIDIA's first Tegra 3 phone launched on Feb. 26, the HTC One X, to wide acclaim in the media. Tegra 3 phones are available from 22 carriers in Europe and Asia.

"Kepler GPUs are accelerating our business," said Jen-Hsun Huang, president and chief executive officer of NVIDIA. "Our newly launched desktop products are winning some of the best reviews we've ever had. Notebook GPUs had a record quarter. And Tegra is on a growth track again, driven by great mobile device wins and the upcoming Windows on ARM launch.

"Graphics is more important than ever. Look for exciting news next week at the GPU Technology Conference as we reveal new ways that the GPU will enhance mobile and cloud computing," he said.Outlook

Our outlook for the second quarter of fiscal 2013 is as follows:

● Revenue is expected to be between $990 million and $1.05 billion.

● GAAP gross margin is expected to be 51.2 percent, plus or minus one percentage point. Non-GAAP gross margin is expected to be 51.5 percent, plus or minus one percentage point.

● GAAP operating expenses are expected to be approximately $418 million. Non-GAAP operating expenses are expected to be approximately $354 million.

GAAP operating expenses for the second quarter are expected to include a one-time charge related to a corporate donation to Stanford Hospital of $25 million, payable over a 10-year period. We are joining Stanford's initiative, along with other corporations in the high-tech community, including Apple, eBay, HP, Intel, Intuit and Oracle, to build a leading-edge health care institution.

● GAAP and non-GAAP tax rates are expected to be approximately 20 percent, plus or minus one percent, for the second quarter and fiscal year, excluding any discrete tax events that may occur during the quarter, which, if realized, may increase or decrease our GAAP and non-GAAP tax rates. If the U.S. research tax credit is reinstated into tax law, we estimate our annual effective tax rate for the fiscal year 2013 to be approximately 16 percent.

We estimate depreciation and amortization for the second quarter to be approximately $55 million to $57 million. Capital expenditures are expected to be in the range of $35 to $45 million.

Diluted shares for the second quarter are expected to be approximately 628 million.

First Quarter Fiscal 2013 and Recent Highlights:

● NVIDIA launched its new Kepler-architecture GPUs to rave reviews. Products included the GeForce GTX 670, GeForce GTX 680, the dual-GPU GeForce GTX 690, and the notebook range of GeForce 600M GPUs.

● The first Ultrabook with an NVIDIA GPU, the Acer Aspire Timeline M3, launched on March 6.

● NVIDIA's first Tegra 3 phone launched on Feb. 26, the HTC One X, to wide acclaim in the media. Tegra 3 phones are available from 22 carriers in Europe and Asia.

24 Comments on NVIDIA Reports Financial Results for First Quarter Fiscal Year 2013

First point is "Recent Highlights", second and third is "First Quarter Fiscal 2013".

:laugh:

Yea I deleted that becuase the title is NVIDIA Reports Financial Results for First Quarter Fiscal Year 2013

Are they are already reporting earnings for 2013!

I'd like to show "Results" for my 2013 earnings, this is just screwy!

That's what I expect from Nvidia anyway..

Nvidia responded by blaming the flood disaster in Thailand limiting HDD supply along with its poor performance on the Tegra 2 to Tegra 3 transition.

They have a lot of cash on hand slightly under 3 Billion but they havent experience any sustained growth in awhile.

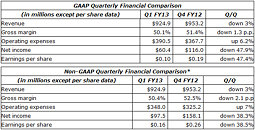

"NVIDIA today reported revenue of $924.9 million and GAAP net income of $60.4 million, 48% lower than Q4 FY12, for the first quarter of fiscal 2013 ended Apr. 29, 2012."

P.S. I love how last table, with the losses, gets put in at such small size that it is unreadable unless clicked on...

still waiting for the correct price while previous gen card is just enough, no point to hurry.

Well served, over 1 years, first time I keep a card as long as this one!

:shadedshu

P.S. Pardon for derailment by responding to trolls, had to vent a bit

And surely the expenses related to wafer allocation for chips released very late or in Q2 and whose revenue will not really show up until next quarter surely has nothing to do with the higher expenses and lower revenue either.

And there's no loss anywhere, so your post is FAIL. Christian is not trying to hide any loss since there's none. Maybe if you could read... But well that is an argument I can agree with: maybe if the charts were bigger people like you would be able to actually read them and stupid posts could be avoided.

And then NV fanboyz arrived and...things went downhill (not you Benetanegia)

And when it comes to the results, they are not bad. Maybe not very good either but are up when compared to last year's Q1 results. Q4 is usually the strongest quarter for nearly every company. For Nvidia Q4 is even slightly better and Q1 even worse since their Q4 ends in January so Q1 also excludes the January-sales. And like I said they are introducing many chips now that will not be reflected until Q2.

54.5% drop in net income QoQ forecastfrom the "guys who supposedly know things"

47.9% actual drop in net income QoQ

Strange that the guesswork piece is longer than the item dealing with the actuality. Maybe the forecasters get paid by the word- like pulp fiction SF writers in the 30's and 40's.

When the actual, factual figures come in all that has to be done is put them in a nice table and say 'well, here's what actually happened.'

I know I fall into that category. I get so busy with life , practicing on my motocross bike , yard work , running , flying planes.....just a lot of stuff. Hell , I'm hardly ever home over the months of April - November. Couldn't take advantage of that big ol' nice video card even if I wanted to.

Don't think I'll be buying much PC stuff until about Novemeber- Dec.

Just my $.02 here anyways.