Friday, July 24th 2020

In Wake of Intel's 7nm Woes, AMD's Price per Stock Vaults Over the Blue Giant

Intel's announcement today that their 7 nm node is facing difficulties is being taken one of two ways: as an unmitigated disaster by some, and with a tentative carefulness (lest we see another 10 nm repeat) from others. However one looks at this setback, which means AMD will still enjoy a process lead over Intel for some extra time, this is good news for AMD in more ways than just that one.

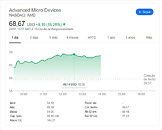

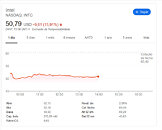

Case in point: stock price. While AMD has a much lower market cap than Intel (calculated by multiplying the value of a single stock by the number of total issued stocks), today, for the first time since 2006, AMD's shares were more valuable than Intel's on a per-share basis. AMD's $70 billion market cap still pales in comparison to Intel's $215 billion. At time of writing, AMD's stock pricing is $18 higher than Intel, at $68.67 compared to Intel's $50.79. A first in many years for the green company.

Case in point: stock price. While AMD has a much lower market cap than Intel (calculated by multiplying the value of a single stock by the number of total issued stocks), today, for the first time since 2006, AMD's shares were more valuable than Intel's on a per-share basis. AMD's $70 billion market cap still pales in comparison to Intel's $215 billion. At time of writing, AMD's stock pricing is $18 higher than Intel, at $68.67 compared to Intel's $50.79. A first in many years for the green company.

34 Comments on In Wake of Intel's 7nm Woes, AMD's Price per Stock Vaults Over the Blue Giant

This is quite a big raise. people who own these stocks can make some juicy profits. The market caps between both company isn't that big anymore and Intel does way more than just CPU and have theirs own Fabs...

it's not looking good for Intel, but they can rebound at any time if they start taking better decision.

But Stock price is one thing, that give to AMD more financing options. In the end, Intel Revenues are still way ahead of AMD by an order of magnitude.

What does NVIDIA have to do with this article? Seriously, AMD has been advertising themselves as " Team Red " for years! :p

Large corporations that are used to dominant position act like swamps when you try to change them.Lol, son.

Intel's INCOME is several times bigger than NVidia's REVENUE.

It easily makes about 100 more money than AMD who just turned profitable.

Who would have thought - the company that was facing the bankruptcy threat just mere 3 or 4 years ago, is now the market leader.

Intel is in markets and market segments where AMD just doesn't and can't operate in. So, while it's nice to acknowledge AMD right now, they made incredible jumps, they made us think 16, 32 or 64 cores can have a home on any enthusiast's desk, it only takes a small wrong step and everything can turn sour. Intel can afford to dance the Macarena with all the wrong steps several times over and still come out on top.

And we've been here before, AMD had glory days before, and yet, Intel still came out on top. So let's be happy for AMD right now, because good things always come to their end. Hopefully rather later than sooner. But stop dreaming of the underdog taking out the giant, because that's not going to happen very soon.

They are married to their x86 chips and don't see that ARM is coming.

Intel Plunges as It Weighs Exit From Manufacturing Chips

(Bloomberg) -- Intel Corp. Chief Executive Officer Bob Swan spent almost an hour on Thursday discussing an idea that would once have been unthinkable for the world’s largest semiconductor company: Not manufacturing its own chips.

finance.yahoo.com/news/intel-considers-once-heresy-not-013625863.html

ARM-based Japanese supercomputer is now the fastest in the world

www.theverge.com/2020/6/23/21300097/fugaku-supercomputer-worlds-fastest-top500-riken-fujitsu-arm

It's just the beginning of a very different world order.

If we get an ARM Macbook that say outperforms Intel \ AMD on single core by 50% and multi-core by 25-50%, it will be a seismic shift that could doom not only Intel but AMD as well along with a dozen or more PC / Server manufacturers.

This is not outside the realm of possibility given that the Developer system that Apple sent out benched very well against Intel/AMD - almost matching them even under emulation - and is based on what is now a 2 year old A12 that was made on foundry 10nm (essentially the same density / characteristics as Intel 14nm).

What happens when they put in an 5nm A14 with optimizations for desktop / server...That's exactly what I was going to say.

Share price generally doesn't mean anything as far as value because, for example, if there were only 1 share for Intel how much would it be worth.

Intel has a market cap of > 250B and revenue of ~$75B vs 66B and 7B for AMD. So AMD has about 1/10th of Intel's revenue and about 1/4th their market cap. Real big thing - Intel has a 30% profit margin and AMD has just over 6%.

This translates into Intel having 42B in gross profit and AMD having 2.9B in gross profit.

From a bean counter perspective, Intel is greatly undervalued and AMD is greatly overvalued. Those numbers don't lie, Intel has 10x the revenue 5x the profit margin and 10x the profitability. This can change but it will / would take years.

When the Ryzen 9 3900X destroys Core i9-10900K.

Cinebench R15 Multi (higher is better):

Ryzen 9 3900X: 3159

Core i9-10900K: 2624

Cinebench R20 Multi (higher is better):

Ryzen 9 3900X: 7155

Core i9-10900K: 6155

Blender 2.81a - BMW27 (lower is better):

Ryzen 9 3900X: 116

Core i9-10900K: 139

Ryzen 9 3900X: 350

Core i9-10900K: 454

POVRay 3.7 1920x1080 AA 0.3 (lower is better):

Ryzen 9 3900X: 200

Core i9-10900K: 251

SPECworkstation 3 (higher is better):

Ryzen 9 3900X: 1.13

Core i9-10900K: 1.09

Ryzen 9 3900X: 4.38

Core i9-10900K: 3.51

Ryzen 9 3900X: 1.61

Core i9-10900K: 0.92

CPU-Z Multi (higher is better):

Ryzen 9 3900X: 8397

Core i9-10900K: 7159

7-Zip Compressing (higher is better):

Ryzen 9 3900X: 62

Core i9-10900K: 54

7-Zip Decompressing (higher is better):

Ryzen 9 3900X: 1547

Core i9-10900K: 1221

Google Chrome - Mozilla Kraken (lower is better):

Ryzen 9 3900X: 719

Core i9-10900K: 747

FryBench x64 (lower is better):

Ryzen 9 3900X: 82

Core i9-10900K: 87

www.guru3d.com/articles-pages/intel-core-i9-10900k-processor-review,15.html

VRayNEXT 4.10.7 Multi (higher is better):

Ryzen 9 3900X: 19987

Core i9-10900K: 17621

www.guru3d.com/articles-pages/intel-core-i9-10900k-processor-review,16.html

IndigoBench 4.0.64 (higher is better):

Ryzen 9 3900X: 4.462

Core i9-10900K: 4.301

Corona Benchmark (lower is better):

Ryzen 9 3900X: 74

Core i9-10900K: 79

Handbrake 2017 (higher is better):

Ryzen 9 3900X: 68.7

Core i9-10900K: 60.02

Magix Vega Pro 14.0 Ultra HD Video Render (lower is better):

Ryzen 9 3900X: 675

Core i9-10900K: 694

WPrime 1024M (lower is better):

Ryzen 9 3900X: 56

Core i9-10900K: 70

www.guru3d.com/articles-pages/intel-core-i9-10900k-processor-review,20.html

PassMark (higher is better):

Ryzen 9 3900X: 32868 www.cpubenchmark.net/cpu.php?cpu=AMD+Ryzen+9+3900X&id=3493

Core i9-10900K: 24014 www.cpubenchmark.net/cpu.php?cpu=Intel+Core+i9-10900K+@+3.70GHz&id=3730

Price (lower is better):

Ryzen 9 3900X: $419

Core i9-10900K: $550

TDP (lower is better):

Ryzen 9 3900X: 105 watts

Core i9-10900K: 125 watts?

Security vulnerabilities (no is better):

Ryzen 9 3900X: No

Core i9-10900K: Yes

Process node:

Ryzen 9 3900X: TSMC N7

Core i9-10900K: Intel 14nm

And this is without mentioning the Ryzen 9 3950X and the Ryzen 9 4900H.

I mean yes, AMD fanboy-ism might be strong in some places, but I built several systems and bought several laptops for acquaintances in the past few months, with just one request for an AMD system and rest being based on Intel. Most consumers just buy whatever is on a shelf and has names they heard previously, ones who care enough to check benchmarks just look at gaming and see Intel on top. The rest is just a tiny minority barely worth a mention in a footnote. Personally, I don't care is a video converts an hour longer. I care if I get 10fps more or less in a game, which is a more immediate problem.

One needs to turn it into CISC for that to happen, in my opinion, and there is a number of issues with that way.

ARM chips are so laughably cheap, you could as well kiss goodbye to AMD/Intel CPU divisions, if it is to take over x86.AMD is trouncing Intel in DIY market.

But the said market is, at best, one fifth of the total, so it's imprtant for AMD to penetrate OEM lineups. Which seems to just have happened with 4xxx series.

Zen 3 should come soon.

That's just stupid, if you rethink it. How ON EARTH can an 5 year old 14nm CPU be premium compared to the cutting edge and best available N7 ?

well ...their recent attitude does not help me to like them (i.e.: locking features that were available to all chipset and CPU before to the higher end only or the whole "in real life performances we are better than AMD, FOOLS!" )

Just quad-cores for life.... :kookoo:

I hope AMD does good too. We need better AMD for more competition considering how far ahead Nvidia is.

Intel to soon go semi fabless to address this.