Revenue of Top 10 Foundries Expected to Increase by 20% YoY in 1Q21 in Light of Fully Loaded Capacities, Says TrendForce

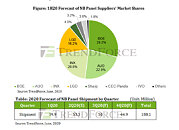

Demand in the global foundry market remains strong in 1Q21, according to TrendForce's latest investigations. As various end-products continue to generate high demand for chips, clients of foundries in turn stepped up their procurement activities, which subsequently led to a persistent shortage of production capacities across the foundry industry. TrendForce therefore expects foundries to continue posting strong financial performances in 1Q21, with a 20% YoY growth in the combined revenues of the top 10 foundries, while TSMC, Samsung, and UMC rank as the top three in terms of market share. However, the future reallocation of foundry capacities still remains to be seen, since the industry-wide effort to accelerate the production of automotive chips may indirectly impair the production and lead times of chips for consumer electronics and industrial applications.

TSMC has been maintaining a steady volume of wafer inputs at its 5 nm node, and these wafer inputs are projected to account for 20% of the company's revenue. On the other hand, owing to chip orders from AMD, Nvidia, Qualcomm, and MediaTek, demand for TSMC's 7 nm node is likewise strong and likely to account for 30% of TSMC's revenue, a slight increase from the previous quarter. On the whole, TSMC's revenue is expected to undergo a 25% increase YoY in 1Q21 and set a new high on the back of surging demand for 5G, HPC, and automotive applications.

TSMC has been maintaining a steady volume of wafer inputs at its 5 nm node, and these wafer inputs are projected to account for 20% of the company's revenue. On the other hand, owing to chip orders from AMD, Nvidia, Qualcomm, and MediaTek, demand for TSMC's 7 nm node is likewise strong and likely to account for 30% of TSMC's revenue, a slight increase from the previous quarter. On the whole, TSMC's revenue is expected to undergo a 25% increase YoY in 1Q21 and set a new high on the back of surging demand for 5G, HPC, and automotive applications.