NVIDIA to Acquire Arm for $40 Billion, Creating World's Premier Computing Company for the Age of AI

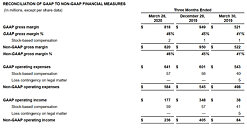

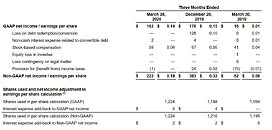

NVIDIA and SoftBank Group Corp. (SBG) today announced a definitive agreement under which NVIDIA will acquire Arm Limited from SBG and the SoftBank Vision Fund (together, "SoftBank") in a transaction valued at $40 billion. The transaction is expected to be immediately accretive to NVIDIA's non-GAAP gross margin and non-GAAP earnings per share.

The combination brings together NVIDIA's leading AI computing platform with Arm's vast ecosystem to create the premier computing company for the age of artificial intelligence, accelerating innovation while expanding into large, high-growth markets. SoftBank will remain committed to Arm's long-term success through its ownership stake in NVIDIA, expected to be under 10 percent.

The combination brings together NVIDIA's leading AI computing platform with Arm's vast ecosystem to create the premier computing company for the age of artificial intelligence, accelerating innovation while expanding into large, high-growth markets. SoftBank will remain committed to Arm's long-term success through its ownership stake in NVIDIA, expected to be under 10 percent.