Friday, November 14th 2014

Big Swing in Market Share From AMD to NVIDIA: JPR

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, today announced estimated graphics chip shipments and suppliers' market share for 2014 2Q in its Market Watch quarterly PC graphics report, an industry reference since 1988.

Graphics processors, stand-alone discrete devices, and embedded processor-based GPUs are ubiquitous and essential components in all systems and devices today -- from handheld mobile devices, PCs, and workstations, to TVs, servers, vehicle systems, signage, game consoles, medical equipment, and wearables. New technologies and semiconductor manufacturing processes are taking advantage of the ability of GPU power to scale. The GPU drives the screen of every device we encounter -- it is the human-machine interface.

The third quarter is typically the big growth quarter, and after the turmoil of the recession, it appears that trends are following the typical seasonality cycles of the past.

Quick report highlights:

GPUs are traditionally a leading indicator of the PC market, since a GPU goes into every system before it is shipped, and most of the vendors are guiding cautiously for Q4 '14.

The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in Q3. Nvidia's new high-end Maxwell GPUs sales were strong, lifting the ASPs for the discrete GPU market.

Q3 2014 saw a flattening in tablet sales from the first decline in sales last quarter. The CAGR for total PC graphics from 2014 to 2017 is up to almost 3%. We expect the total shipments of graphics chips in 2017 to be 510 million units. In 2013, 454 million GPUs were shipped and the forecast for 2014 is 468 million.

The quarter in general

For PC and mobile device related companies small and large, new to the industry or established, it is critical to get a proper grip on this highly complex technology and understand its future direction. In this detailed 50-page data-based report, JPR provides all the data, analysis and insight needed to clearly understand where this technology is today and where it's headed. This fact and data-based report does not pull any punches: frankly, some of the analysis and insight may prove to be shocking.

Findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include the x86 game consoles, handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), or ARM-based Servers. It does include x86-based tablets, Chromebooks, and embedded systems.

Graphics processors, stand-alone discrete devices, and embedded processor-based GPUs are ubiquitous and essential components in all systems and devices today -- from handheld mobile devices, PCs, and workstations, to TVs, servers, vehicle systems, signage, game consoles, medical equipment, and wearables. New technologies and semiconductor manufacturing processes are taking advantage of the ability of GPU power to scale. The GPU drives the screen of every device we encounter -- it is the human-machine interface.

The third quarter is typically the big growth quarter, and after the turmoil of the recession, it appears that trends are following the typical seasonality cycles of the past.

Quick report highlights:

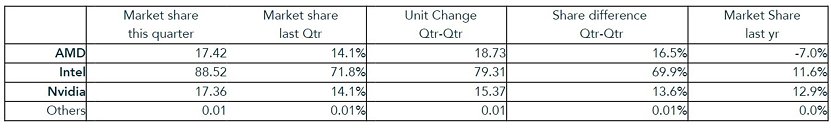

- AMD's overall unit shipments decreased 7% quarter-to-quarter, Intel's total shipments increased 11.6% from last quarter, and Nvidia's jumped 12.9%.

- The attach rate of GPUs (includes integrated and discrete GPUs) to PCs, for the quarter was 155% (up 2%) and 32% of PCs had discrete GPUs, (flat from last quarter), which means 68% of PCs today are using the embedded graphics in the CPU.

- The overall PC market increased 6.9% quarter-to-quarter, and decreased 2.6% year-to-year.

- Desktop graphics add-in boards (AIBs) that use discrete GPUs increased 7.8% from last quarter.

GPUs are traditionally a leading indicator of the PC market, since a GPU goes into every system before it is shipped, and most of the vendors are guiding cautiously for Q4 '14.

The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in Q3. Nvidia's new high-end Maxwell GPUs sales were strong, lifting the ASPs for the discrete GPU market.

Q3 2014 saw a flattening in tablet sales from the first decline in sales last quarter. The CAGR for total PC graphics from 2014 to 2017 is up to almost 3%. We expect the total shipments of graphics chips in 2017 to be 510 million units. In 2013, 454 million GPUs were shipped and the forecast for 2014 is 468 million.

The quarter in general

- AMD's shipments of desktop heterogeneous GPU/CPUs, i.e., APUs increased 10.5% from the previous quarter, and decreased 16% in notebooks. AMD's discrete desktop shipments decreased 19% and notebook discrete shipments increased 10%. The company's overall PC graphics shipments decreased 7%.

- Intel's desktop processor embedded graphics (EPGs) shipments decreased from last quarter by 0.3%, and notebooks increased by 18.6%. The company's overall PC graphics shipments increased 11.6%.

- Nvidia's desktop discrete shipments increased 24.3% from last quarter; and the company's notebook discrete shipments increased 3.5%. The company's overall PC graphics shipments increased 12.9%.

- Year-to-year this quarter AMD's overall PC shipments decreased 24%, Intel increased 19%, Nvidia decreased 4%, and the others essentially are too small to measure.

- Total discrete GPU (desktop and notebook) shipments from the last quarter increased 6.6%, and decreased 7.7% from last year. Sales of discrete GPUs fluctuate due to a variety of factors (timing, memory pricing, etc.), new product introductions, and the influence of integrated graphics. Overall, the trend for discrete GPUs has increased with a CAGR from 2014 to 2017 now of 3%.

- Ninety nine percent of Intel's non-server processors have graphics, and over 66% of AMD's non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).

For PC and mobile device related companies small and large, new to the industry or established, it is critical to get a proper grip on this highly complex technology and understand its future direction. In this detailed 50-page data-based report, JPR provides all the data, analysis and insight needed to clearly understand where this technology is today and where it's headed. This fact and data-based report does not pull any punches: frankly, some of the analysis and insight may prove to be shocking.

Findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include the x86 game consoles, handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), or ARM-based Servers. It does include x86-based tablets, Chromebooks, and embedded systems.

58 Comments on Big Swing in Market Share From AMD to NVIDIA: JPR

With that said I have faith that AMD will bring something to the fight before its over. Will they beat Intel...no and never will again IMO. Will they give nVidia a hard time....HELL YEAH!!!!!!!!!

@btarunr either the above is fail or your article is fail.

Quarter to quarter AMD is up 16.5% and Nvidia is up 13.6% so current sales show AMD outpacing Nvidia. The numbers you posted show up in the year over year results meaning that either AMD did awesome last year or they really screwed up the beginning of this year because this past quarter shows growth.

I also really love the fact only 1 other person commented on the graph and the rest went straight into fanboyism without reading the numbers at all.

The graph does show a major discrepancy with the market share this quarter adding up to more than 100%. My guess is that the intel numbers are off as it's really hard to see AMD and NV splitting a measly 11.47% of the market share together.

jonpeddie.com/press-releases/details/nvidia-jumps-13-from-last-quarter-intel-up-11.6-amd-slips-7-reports-jpr/

Considering all current generation consoles use AMD, and no other developer has expressed anything negative about them, and they are essentially PC hardware. Ubisoft needs to have their execs pulled out and shot. Considering the PS4 runs 1080 on many other games and has a very high spec for a console, their shit game is just an attempt to jumpstart a still born crack baby for one more fund raiser.

"AMD's shipments of desktop heterogeneous GPU/CPUs, i.e., APUs increased 10.5%". They are not focused on the dedicated GPU market right now.

1. Wider I/O means more contacts and traces. Higher cost (so you're only looking at the flagship boards anyway).

2. 4GB framebuffer isn't a good marketing point when even mainstream cards will likely sport 4GB as standard, and 8GB cards at the high end are being introduced. IIRC, the GM200 articles allude to 12GB vRAM. Assuming AMD see it the same way, they may have to adopt a tiered memory structure (HBM + GDDR5) which will be more complex (differing latencies, circuitry/traces), more expensive, and wipe out any power saving claimed by HBM alone.Doesn't really matter at this stage. The game is more about mind share than market share. Once upon a time, those of us around at the height of ATi's powers saw a company that footed it with the best - at one stage the company had the lions share of OEM contracts and annihilated S3, Matrox, 3dfx, and Nvidia in sales revenue. It was/is a hardware market driven by features and marketing because it markets directly to the end user. Processors on the other hand began as companies selling to the engineers of other companies - marketing was something you did when the product couldn't compete. AMD was founded by a salesman (and a group of analog logic circuit designers IIRC) when marketing wasn't really a thing in CPUs - by the time it was, Sanders had moved on and engineers held the reins at the company. It isn't a complete coincidence that as soon as AMD took over ATi the graphics side started to dip. All the work the company had put into a strong relationship with the gaming community went for nought - starting and stopping the Get in the Game program just as TWIMTBP was gaining traction for example. When your star is being eclipsed (by Nvidia), the response should have been a full court press, but AMD withdrew and began revelling in it's "underdog" status after R600. When you lose the customer base the OEM's soon follow since they pander to what is a saleable and easily recognizable series of brands, and without the OEMs onside a company becomes severely handicapped. The DIY discrete market is miniscule, but the OEMs control virtually all PC desktop sales, and all mobile sales. Then it becomes a vicious circle, OEMs highlight the brand of the company in ascendance both in advertising and model lines and the other companies are marginalized, thus slipping out of the consumers field of view.AMD are in the same basket. MANY systems (especially mobile) rely upon integrated graphics. If the iGP is competent enough to do the job (and a lot of people either don't game or play garbage flash based "games") then they have no need of a discrete solution.

Count AMD's blessings. I'm pretty sure when Mercury and JPR release the discrete graphics numbers next week the figures will look even more dismal given that it's a two horse race for a smaller market. It's also pretty safe to assume that the ASP (average selling prices) of the two companies are heading in opposite directions coming into the busiest sales period of the year.The original chart in the JPR press release had the flawed numbers. I checked a few sites and JPR itself just after the article was published and all the sites carried the same borked chart numbers - which was, along with the wording, repeated verbatim from JPR's PR.

That shows both neck and neck after AMD's dominance from last years R9/7/5 series launch. This quarter shows a slight uptick for NV but .5% is hardly a dominant change, especially when intel nearly quadrupled that growth at 1.9%. Overall this shows discreet sales down against on-board/on-chip solutions, especially considering the AMD APU's are included in their market share.

My Guess is the lack of new mid and lowend options from NV make the growth marginal as few people actually buy prebuilts or solo cards of highend chips. As a full range of 9 series NV's come out we could see better growth Q3 and into Q4 (barring a full series AMD release during that time) Overall AMD's in a tock year so it's not suprising NV is making gains during their tick. Just surprising how small those gains are. NV couldn't even match last years tock numbers with this tick while AMD not being able to match a tick with a tock shouldn't shock anyone. (especially being that said tock has what the R9 285 and little else)

overall AMD is only down 2.4% since the launch of the 980 and 970 and NV is only up .5% during that same time intel did the most damage. Year over year BOTH AMD and NV are down. Discreet sales overall are taking a hit. This is not surprising at all considering where pc gaming has been going.

A GPU launch my cause a slight spike in sales but generally is not going to shake everything to pieces no matter what it is unless its a complete failure. Even if the cards were amazing in performance, efficiency, etc the cards would sell at the same rate as they do year to year (With slight variations). Normally the biggest changes that would effect this in a substantial way would be something that becomes a flop or does not live up to what a next generation card is which so far has not happened recently enough to make a difference.

Even so we do not influence the market much, it still goes back to OEMs being the reason for things like this which is why when we see changes on these numbers its generally OEMs purchasing for the new generation machines that get the numbers flowing (or similar) more than the community buying the GTX 980 or the 290X for the power house gaming machine.

One thing that gets left out of these reports from companies are the consoles which to me would paint a different picture (As someone else pointed out). Like I said though it depends on what gets counted into these reports as to how they come out.

nVidia has a massive advantage with Maxwell that will likely take AMD a few generations to catch up.

AMD is currently a second-rate product in both GPU and CPU markets. They need to do something really special to change that image... sooner, rather than later. Whilst I won't be going AMD (their success grew from Intels success; cloning early chips and becoming second-source manufacturer for IBM) anytime soon, mainly due to past experiences of them with CPUs (a long time back, however) and GPUs, I do hope they succeed in both markets, because competition leads to innovation and lower prices.

In all seriousness, I think AMD CPUs have plenty of umfph. The problem is that they suck down too much electricity to do an okay job. I think the module idea was a good one (for the long term) because it saves on die space but the simple fact is that they'll never make up for the insane power consumption figures.

AMD is hamstrung by immature processes creating higher power consumption despite good overall performance in CPU and great in GPU, also costing more in silicon due to size.

Nvidia doesn't make a CPU, so then it becomes a complex add in card that doubles up resources either CPU maker already is working on.

or at least same gaming performances with NV but Cheaper than gtx9xx family. End of the day, we customer who will benefit from this all...