Wednesday, February 6th 2019

Electronic Arts Reports Q3 FY19 Financial Results

Electronic Arts Inc. (NASDAQ: EA) today announced preliminary financial results for its third fiscal quarter ended December 31, 2018. "The video game industry continues to grow through a year of intense competition and transformational change," said CEO Andrew Wilson. "Q3 was a difficult quarter for Electronic Arts and we did not perform to our expectations. We are now applying the strengths of our company to sharpen our execution and focus on delivering great new games and long-term live services for our players. We're very excited about Apex Legends, the upcoming launch of Anthem, and a deep line-up of new experiences that we'll bring to our global communities next fiscal year."

"FIFA stands out as a robust franchise through a tumultuous year in the video game industry," said COO and CFO Blake Jorgensen. "Elsewhere in the business, we're making adjustments to improve execution and we're refocusing R&D. Looking forward, we're delighted to launch Anthem, our new IP, to grow Apex Legends and related Titanfall experiences, to deliver new Plants vs. Zombies and Need for Speed titles, and to add Star Wars Jedi: Fallen Order to our sports titles in the fall."Selected Operating Highlights and Metrics

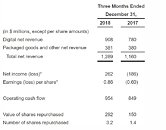

Selected Financial Highlights and Metrics

All financial measures are presented on a GAAP basis.

At the beginning of fiscal year 2019, April 1, 2018, EA adopted FASB ASU 2014-09 (Topic 606), Revenue from Contracts with Customers. For more information about the adoption of Topic 606, please refer to the Investor Accounting FAQ on our IR website. Financial data for periods prior to April 1, 2018 has not been restated.

Business Outlook as of February 5, 2019

The following forward-looking statements reflect expectations as of February 5, 2019. Electronic Arts assumes no obligation to update these statements, except as required by law. Results may be materially different and are affected by many factors detailed in this release and in EA's annual and quarterly SEC filings.

Fiscal Year 2019 Expectations - Ending March 31, 2019

Financial metrics:

Financial metrics:

"FIFA stands out as a robust franchise through a tumultuous year in the video game industry," said COO and CFO Blake Jorgensen. "Elsewhere in the business, we're making adjustments to improve execution and we're refocusing R&D. Looking forward, we're delighted to launch Anthem, our new IP, to grow Apex Legends and related Titanfall experiences, to deliver new Plants vs. Zombies and Need for Speed titles, and to add Star Wars Jedi: Fallen Order to our sports titles in the fall."Selected Operating Highlights and Metrics

- Digital net bookings for the trailing twelve months was $3.577 billion, up 6% year-over-year and represents 74% of total net bookings.

- During the quarter, launched Battlefield V and Command & Conquer : Rivals.

- On February 4, 2019, launched Apex Legends , a new battle royale experience from Respawn.

- During the quarter, FIFA Ultimate Team matches played increased 15% year-over-year.

- During calendar 2018, FIFA 19 was the highest-selling console game in Europe.

Selected Financial Highlights and Metrics

All financial measures are presented on a GAAP basis.

- Net cash from operating activities was $954 million for the quarter and $1.563 billion for the trailing twelve months, a record third quarter trailing twelve months.

- EA repurchased 3.2 million shares for $292 million during the quarter and 9.0 million shares for $1.039 billion during the trailing twelve months.

At the beginning of fiscal year 2019, April 1, 2018, EA adopted FASB ASU 2014-09 (Topic 606), Revenue from Contracts with Customers. For more information about the adoption of Topic 606, please refer to the Investor Accounting FAQ on our IR website. Financial data for periods prior to April 1, 2018 has not been restated.

Business Outlook as of February 5, 2019

The following forward-looking statements reflect expectations as of February 5, 2019. Electronic Arts assumes no obligation to update these statements, except as required by law. Results may be materially different and are affected by many factors detailed in this release and in EA's annual and quarterly SEC filings.

Fiscal Year 2019 Expectations - Ending March 31, 2019

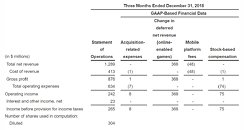

Financial metrics:

- Net revenue is expected to be approximately $4.875 billion.

- Change in deferred net revenue (online-enabled games) is expected to be approximately $65 million.

- Mobile platform fees are expected to be approximately $(190) million.

- Net income is expected to be approximately $980 million.

- Diluted earnings per share is expected to be approximately $3.20.

- Operating cash flow is expected to be approximately $1.350 billion.

- The Company estimates a share count of 306 million for purposes of calculating fiscal year 2019 diluted earnings per share.

- Net bookings is expected to be approximately $4.750 billion.

Financial metrics:

- Net revenue is expected to be approximately $1.163 billion.

- Change in deferred net revenue (online-enabled games) is expected to be approximately $56 million.

- Mobile platform fees are expected to be approximately $(49) million.

- Net income is expected to be approximately $170 million.

- Diluted earnings per share is expected to be approximately $0.56.

- The Company estimates a share count of 303 million for purposes of calculating fourth quarter fiscal year 2019 diluted earnings per share.

5 Comments on Electronic Arts Reports Q3 FY19 Financial Results

The market almost always drops after earnings reports. It's weird but it is what it is.