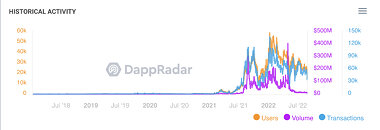

NFT Craze Hits the Brakes as OpenSea Records 99% Volume Decline in 90 days

OpenSea, one of the most widely recognized NFT markets in the cryptocurrency world, has slammed into a wall of absence. Namely, the absence of volume: the decentralized marketplace has seen a 99% drop on NFT trading volume in merely 90 days. From its high of $405.75 million on May 1, transactions on Non- Fungible Tokens have petered out to just $5 million throughout the entire month of August.

Reduced volume connects to reduced demand, which has in turn led to reducing floor prices (the lowest available price for a given NFT) for even the most recognized collections: the cheapest Bored Ape Yacht Club NFT can now be had for 72.5 ETH ($104,634 at time of writing). That's a 53% reduction in its ETH price (153.7 ETH) from May 1st. But the drop is even more massive when one takes into account the devaluation of Ethereum itself: On May 1st, the 153.7 ETH asking price for the NFT equaled $434,048 (price has thus tumbled by 76% on a dollar basis). CryptoPunks, another popular Ethereum-based NFT collection, has seen its floor price decline by a less drastic 20%.

Reduced volume connects to reduced demand, which has in turn led to reducing floor prices (the lowest available price for a given NFT) for even the most recognized collections: the cheapest Bored Ape Yacht Club NFT can now be had for 72.5 ETH ($104,634 at time of writing). That's a 53% reduction in its ETH price (153.7 ETH) from May 1st. But the drop is even more massive when one takes into account the devaluation of Ethereum itself: On May 1st, the 153.7 ETH asking price for the NFT equaled $434,048 (price has thus tumbled by 76% on a dollar basis). CryptoPunks, another popular Ethereum-based NFT collection, has seen its floor price decline by a less drastic 20%.