NAND Flash ASP Expected to Undergo 10-15% QoQ Decline in 1Q22 as Market Shifts Towards Oversupply, Says TrendForce

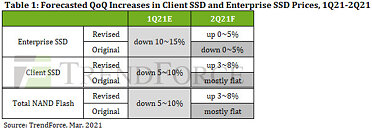

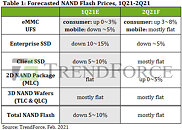

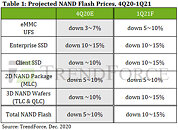

Demand for NAND Flash products will undergo a noticeable and cyclical downward correction in 1Q22 as major smartphone brands wind down their procurement activities for the peak season and ODMs prepare for the New Year holidays, according to TrendForce's latest investigations. As such, the NAND Flash market will remain in an oversupply situation, with prices continuing to undergo downward corrections accordingly. However, PC OEMs have been reinstating certain orders for client SSDs since early November in response to improvements in the supply of upstream semiconductor materials. By fulfilling these orders, suppliers are able to keep their inventory level relatively low, meaning they are not under as much pressure as previously expected to reduce inventory by lowering prices. Taking these factors into account, TrendForce expects NAND Flash ASP to undergo a 10-15% QoQ decline in 1Q22, during which NAND Flash prices will experience the most noticeable declines compared to the other quarters in 2022.

Regarding the price trend of NAND Flash products across the whole 2021, TrendForce further indicates that suppliers have actively transitioned their output to higher-layer technologies, resulting in a bit supply growth that noticeably outpaces demand, though the tight supply of components such as controller ICs and PMICs has constrained the production of NAND Flash end-products. Hence, the decline in contract prices of NAND Flash products has not been as severe as previously expected. Moving ahead to 2022, however, the supply of relevant components is expected to gradually improve, so the market for various NAND Flash products will also likely shift towards a noticeable oversupply. As a result, prices of NAND Flash products will steadily decline before the arrival of the peak season in 3Q22.

Regarding the price trend of NAND Flash products across the whole 2021, TrendForce further indicates that suppliers have actively transitioned their output to higher-layer technologies, resulting in a bit supply growth that noticeably outpaces demand, though the tight supply of components such as controller ICs and PMICs has constrained the production of NAND Flash end-products. Hence, the decline in contract prices of NAND Flash products has not been as severe as previously expected. Moving ahead to 2022, however, the supply of relevant components is expected to gradually improve, so the market for various NAND Flash products will also likely shift towards a noticeable oversupply. As a result, prices of NAND Flash products will steadily decline before the arrival of the peak season in 3Q22.