Wednesday, July 26th 2017

AMD Reports Second Quarter 2017 Financial Results

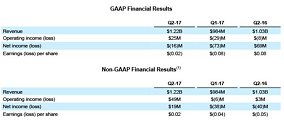

AMD today announced revenue for the second quarter of 2017 of $1.22 billion, operating income of $25 million, and net loss of $16 million, or $(0.02) per share. On a non-GAAP basis, operating income was $49 million, net income was $19 million, and earnings per share was $0.02.

"Our second quarter results demonstrate strong growth driven by leadership products and focused execution," said Dr. Lisa Su, AMD president and CEO. "Our Ryzen desktop processors, Vega GPUs, and EPYC datacenter products have received tremendous industry recognition. We are very pleased with our improved financial performance, including double digit revenue growth and year-over-year gross margin expansion on the strength of our new products."Q2 2017 Results

For the third quarter of 2017, AMD expects revenue to increase approximately 23 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in third quarter 2017 revenue increasing approximately 15 percent year-over-year. AMD now expects annual revenue to increase by a mid to high-teens percentage, compared to prior guidance of low double digit percentage revenue growth.

"Our second quarter results demonstrate strong growth driven by leadership products and focused execution," said Dr. Lisa Su, AMD president and CEO. "Our Ryzen desktop processors, Vega GPUs, and EPYC datacenter products have received tremendous industry recognition. We are very pleased with our improved financial performance, including double digit revenue growth and year-over-year gross margin expansion on the strength of our new products."Q2 2017 Results

- On a GAAP basis, revenue was $1.22 billion, up 19 percent year-over-year, driven by higher revenue in the Computing and Graphics segment. Revenue was up 24 percent sequentially, driven by increased sales in both business segments. Gross margin was 33 percent, up 2 percentage points year-over-year due to a richer product mix and a higher percentage of revenue from the Computing and Graphics segment, driven by the first full quarter of Ryzen processor sales. On a sequential basis, gross margin declined 1 percentage point due to a higher percentage of revenue from the Enterprise, Embedded and Semi-Custom segment. Operating income was $25 million compared to an operating loss of $8 million a year ago and an operating loss of $29 million in the prior quarter. Net loss was $16 million compared to net income of $69 million a year ago and a net loss of $73 million in the prior quarter. Loss per share was $0.02 compared to diluted earnings per share of $0.08 a year ago (which included a pre-tax gain of $150 million related to our ATMP JV transaction) and a loss per share of $0.08 in the prior quarter.

- On a non-GAAP(1) basis, operating income was $49 million compared to operating income of $3 million a year ago and an operating loss of $6 million in the prior quarter. Net income was $19 million compared to a net loss of $40 million a year ago and a net loss of $38 million in the prior quarter. Diluted earnings per share was $0.02 compared to a loss per share of $0.05 a year ago and a loss per share of $0.04 in the prior quarter.

- Cash, cash equivalents, and marketable securities were $844 million at the end of the quarter, compared to $943 million in the prior quarter.

- Computing and Graphics segment revenue was $659 million, up 51 percent year-over-year, driven by demand for graphics and Ryzen desktop processors.

- Operating income was $7 million, compared to an operating loss of $81 million in Q2 2016. The year-over-year improvement was driven primarily by higher revenue and improved product mix.

- Client average selling price (ASP) increased significantly year-over-year, as desktop processor ASP increased due to the first full quarter of Ryzen processor shipments.

- GPU ASP increased year-over-year.

- Enterprise, Embedded and Semi-Custom segment revenue was $563 million, down 5 percent year-over-year primarily due to lower semi-custom SoC sales. In the quarter, AMD reached an important milestone by recognizing initial revenue from EPYC datacenter processor shipments.

- Operating income was $42 million, compared to operating income of $84 million in Q2 2016. The year-over-year decrease was primarily due to lower revenue and higher datacenter related R&D investments.

- All Other operating loss was $24 million compared with an operating loss of $11 million in Q2 2016. The year-over-year difference in operating loss was related to stock-based compensation charges and a $7 million restructuring credit in Q2 2016.

- AMD launched its new "Zen" architecture-based EPYC 7000 series processors, returning innovation and choice to the x86 server market with record setting single and dual-socket performance and product introductions from 10 of the world's largest server manufacturers.

- AMD introduced its upcoming high-end desktop solution targeted at the world's fastest ultra-premium desktop systems, the Ryzen Threadripper CPU.

- AMD unveiled new details about its upcoming Ryzen 3 desktop CPUs.

- AMD launched its Ryzen PRO desktop processors, designed to bring reliability, security, and performance to enterprise desktops.

- AMD announced that Radeon Instinct accelerators, including Radeon Instinct MI25, MI8, and MI6, together with AMD's open ROCm 1.6 software platform, will ship in Q3 2017.

- AMD launched the Radeon Vega Frontier Edition graphics card which expands the capacity of traditional GPU memory to 256TB by leveraging system memory.

- AMD introduced the Radeon RX 580 and Radeon RX 570 graphics cards, engineered using the 2nd generation Polaris architecture for smooth gaming in leading AAA games at HD resolutions and higher.

- Microsoft unveiled new details and branding for its Xbox One X (formerly "Project Scorpio"), which features an AMD semi-custom chip.

- AMD announced that it has been selected by the Department of Energy's Exascale Computing Project (ECP) to accelerate critical computing technology research for the development of the nation's first exascale supercomputers.

- At Financial Analyst Day, AMD detailed the next phase of its long-term growth strategy focused on delivering products and technologies for a combined $60 billion market for PCs, immersive devices, and datacenters.

- AMD announced the appointment of Abhi Y. Talwalkar to its board of directors.

For the third quarter of 2017, AMD expects revenue to increase approximately 23 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in third quarter 2017 revenue increasing approximately 15 percent year-over-year. AMD now expects annual revenue to increase by a mid to high-teens percentage, compared to prior guidance of low double digit percentage revenue growth.

43 Comments on AMD Reports Second Quarter 2017 Financial Results

www.theregister.co.uk/2017/07/25/amd_q2_fy2017/

To make things worse, Vega is a failure and Volta is around the corner. If I were a stock holder, I'd want them to sell their divisions to Intel, Nvidia, or Qualcomm, and call it a good run.

Look it up - Ryzen die size is smaller, and GF's node is cheaper. AMD is getting 80%+ yields while Intel is getting 70% yields at best, and AMD's cpu is easier to make.

This whole comment, from the misconception of performance, the misconception of costs, that weird rambling bit about outsourcing jobs, all reads like some sort of intel shillboy/fanboy dribble.

I'm not saying the results are bad, but they're far from great either. The situation improved, as everyone expected. But it's not a huge jump and - since we can't easily separate CPU and GPU impact, this could all be a result of mining boom.GS does not own a significant (>1%) share in AMD (I'd say: no share at all).I think the problem here is that people confuse 2 fundamental things: Ryzen being a good CPU and a good product.

This is not a place for discussing whether Ryzen is a good CPU for the user. But is it a good product for AMD? Especially at the price point they're currently forced to sell it? 1800X price is down $80 since launch, 1700 is -$60.

It's in italian but the numbers still show 215% over a year because ryzen is not a good product for AMD

EDIT: for my part, I'm a low post user because I set myself a goal to build an all red pc for the first time in years since my last build (Athlon XP).

I went on with laptops for more than a decade and I'm now resurfacing on the gaming side of life.

Hopefully RX Vega will be better than it seems it is right now.

AMD hemmhoraged money for so long and owed so much money that even while selling well it will take a long while to climb completely out of the red. It's a long slow process in business. Their prospects on the financials look fairly positive.

As to selling off to Intel and Nvidia, they would not be allowed to do that. They are a U.S. company and regulations preventing monopolies would kick in. Until a valid 3rd competitor to CPU's and GPU's comes along, AMD will never be allowed to fail.

AMD stock was going up for a long time and maxed at $15.2 in the last week before Ryzen launch.

The actual launch stopped the positive trend. It hasn't reached the $15.2 level since.

BTW: after a short optimistic jump, the stock is back to the price from before the Ryzen 3 announcement.Have you even read this before posting? :)

Their "prospects on the financials" is rubbish for exactly the reason you've mentioned. They've spent a lot on developing Ryzen. This could have been a huge revolution, but it turned out to be just another CPU - just cheaper than Intel's. This huge investment may not pay off.I don't think any American company would be interested in buying AMD. But there are quite a few Asian ones that could use the patents and the brand (and they can easily afford it).

I know the whole 'more cores' can be hard to grasp but with the comming 1-2 year you will see a shift for multicore utilization pushed by ryzenplatform on consoles, dx12 vulkan. Comparing the purcase of a new ryzen CPU to the used price is not and argument as it can be used against ANY new CPU. (my 4770K for instance decimates 7700K in cost/performance if we take mine used and 7700K as a new CPU. And trust me; the stock did not go up 639% for fun last year. It is possible that you and your friends dont attribute any progress to what is happening with AMD, but they are strong-arming intel to complete and utter panic (partly intel own fault) right now AMD can spit out CPUs cheaper than intel can. And everything in intel lineup have undergone pricedrops. 7700K cost 66% lower compare to before ryzen (eventhough 4770,4790,6700 did not move on inch during their complete cycle.) Do you think intel have decided to drop prices because they just love their customers? :D You gotta read up on alot of stuff if you dont wanna get battered on the forum :)