Seagate Technology Reports Fiscal Second Quarter 2024 Financial Results

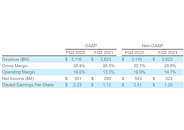

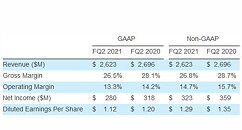

Seagate Technology Holdings plc (NASDAQ: STX) (the "Company" or "Seagate") today reported financial results for its fiscal second quarter ended December 29, 2023. "Seagate delivered strong financial results in the December quarter, marked by 7% sequential revenue growth and non-GAAP EPS returning to profitability and exceeding the high end of our guidance range," said Dave Mosley, Seagate's chief executive officer. "Results were led by improving cloud nearline demand as early signs of market recovery emerge."

"Seagate has consistently balanced financial discipline with execution on our areal density-leading product roadmap. Last week's launch of our Mozaic platform delivers a combination of technology advances, including HAMR, that collectively address data center operators' most important challenges: cost, power and space. Volume ramp for our first Mozaic product is underway, positioning Seagate to capture attractive Mass Capacity storage opportunities," Mosley concluded.

"Seagate has consistently balanced financial discipline with execution on our areal density-leading product roadmap. Last week's launch of our Mozaic platform delivers a combination of technology advances, including HAMR, that collectively address data center operators' most important challenges: cost, power and space. Volume ramp for our first Mozaic product is underway, positioning Seagate to capture attractive Mass Capacity storage opportunities," Mosley concluded.