Friday, January 22nd 2021

Seagate Technology Reports Fiscal Second Quarter 2021 Financial Results

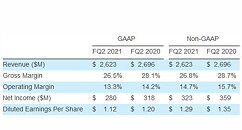

Seagate Technology plc (NASDAQ: STX) (the "Company" or "Seagate") today reported financial results for its fiscal second quarter ended January 1, 2021. "Seagate delivered strong, double-digit revenue, earnings and free cash flow growth in the December quarter supported by broad-based improvement across nearly every served market and geography, and we had solid customer demand for our mass capacity products," said Dave Mosley, Seagate's chief executive officer.

"We also achieved our technology milestone by shipping 20-terabyte HAMR drives in calendar 2020, paving the way for Seagate's continued success for years to come. As demand for data increases in both the cloud and at the edge, Seagate's new Lyve Storage Platform complements our HDD portfolio to help businesses address both the secular demand for mass capacity storage and the increasing complexity of managing data from edge-to-core cloud. We are well positioned to benefit from the tremendous opportunities we foresee ahead and remain focused on enhancing value for our customers, employees and shareholders."Quarterly Financial Results

The Company generated $473 million in cash flow from operations and $314 million in free cash flow during the fiscal second quarter 2021. Seagate maintained a healthy balance sheet and during the fiscal second quarter 2021, the Company paid cash dividends of $167 million and repurchased 18 million ordinary shares for $1 billion. Additionally, the Company raised $1 billion of debt and ended the fiscal second quarter with cash and cash equivalents totaling $1.8 billion. There were 240 million ordinary shares issued and outstanding as of the end of the quarter.

For a detailed reconciliation of GAAP to non-GAAP results, see accompanying financial tables.

Seagate has issued a Supplemental Financial Information document, which is available on Seagate's Investor Relations website at investors.seagate.com.

Quarterly Cash Dividend

The Board of Directors of the Company (the "Board") declared a quarterly cash dividend of $0.67 per share, which will be payable on April 7, 2021 to shareholders of record as of the close of business on March 24, 2021. The payment of any future quarterly dividends will be at the discretion of the Board and will be dependent upon Seagate's financial position, results of operations, available cash, cash flow, capital requirements, distributable reserves, and other factors deemed relevant by the Board.

Business Outlook

The business outlook for the fiscal third quarter 2021 is based on our current assumptions and expectations; actual results may differ materially, as a result of, among other things, the important factors discussed in the Cautionary Note Regarding Forward-Looking Statements section of this release.

The Company is providing the following guidance for its fiscal third quarter 2021:

Revenue of $2.65 billion, plus or minus $200 million

Non-GAAP diluted EPS of $1.30, plus or minus $0.15

Guidance regarding non-GAAP diluted EPS excludes known charges related to amortization of acquired intangible assets of $0.02 per share and estimated share-based compensation expenses of $0.13 per share.

We have not reconciled our non-GAAP diluted EPS guidance for fiscal third quarter 2021 to the most directly comparable GAAP measure because material items that may impact these measures are out of our control and/or cannot be reasonably predicted, including, but not limited to, accelerated depreciation, impairment and other charges related to cost saving efforts, restructuring charges, strategic investment losses or impairment recognized, income tax adjustments on these measures, and other charges or benefits that may arise. The amounts of these measures are not currently available, but may be material to future results. A reconciliation of the non-GAAP diluted EPS guidance for fiscal third quarter 2021 to the corresponding GAAP measures is not available without unreasonable effort. A reconciliation of our historical non-GAAP financial measures to their nearest GAAP equivalent is contained in this release.

"We also achieved our technology milestone by shipping 20-terabyte HAMR drives in calendar 2020, paving the way for Seagate's continued success for years to come. As demand for data increases in both the cloud and at the edge, Seagate's new Lyve Storage Platform complements our HDD portfolio to help businesses address both the secular demand for mass capacity storage and the increasing complexity of managing data from edge-to-core cloud. We are well positioned to benefit from the tremendous opportunities we foresee ahead and remain focused on enhancing value for our customers, employees and shareholders."Quarterly Financial Results

The Company generated $473 million in cash flow from operations and $314 million in free cash flow during the fiscal second quarter 2021. Seagate maintained a healthy balance sheet and during the fiscal second quarter 2021, the Company paid cash dividends of $167 million and repurchased 18 million ordinary shares for $1 billion. Additionally, the Company raised $1 billion of debt and ended the fiscal second quarter with cash and cash equivalents totaling $1.8 billion. There were 240 million ordinary shares issued and outstanding as of the end of the quarter.

For a detailed reconciliation of GAAP to non-GAAP results, see accompanying financial tables.

Seagate has issued a Supplemental Financial Information document, which is available on Seagate's Investor Relations website at investors.seagate.com.

Quarterly Cash Dividend

The Board of Directors of the Company (the "Board") declared a quarterly cash dividend of $0.67 per share, which will be payable on April 7, 2021 to shareholders of record as of the close of business on March 24, 2021. The payment of any future quarterly dividends will be at the discretion of the Board and will be dependent upon Seagate's financial position, results of operations, available cash, cash flow, capital requirements, distributable reserves, and other factors deemed relevant by the Board.

Business Outlook

The business outlook for the fiscal third quarter 2021 is based on our current assumptions and expectations; actual results may differ materially, as a result of, among other things, the important factors discussed in the Cautionary Note Regarding Forward-Looking Statements section of this release.

The Company is providing the following guidance for its fiscal third quarter 2021:

Revenue of $2.65 billion, plus or minus $200 million

Non-GAAP diluted EPS of $1.30, plus or minus $0.15

Guidance regarding non-GAAP diluted EPS excludes known charges related to amortization of acquired intangible assets of $0.02 per share and estimated share-based compensation expenses of $0.13 per share.

We have not reconciled our non-GAAP diluted EPS guidance for fiscal third quarter 2021 to the most directly comparable GAAP measure because material items that may impact these measures are out of our control and/or cannot be reasonably predicted, including, but not limited to, accelerated depreciation, impairment and other charges related to cost saving efforts, restructuring charges, strategic investment losses or impairment recognized, income tax adjustments on these measures, and other charges or benefits that may arise. The amounts of these measures are not currently available, but may be material to future results. A reconciliation of the non-GAAP diluted EPS guidance for fiscal third quarter 2021 to the corresponding GAAP measures is not available without unreasonable effort. A reconciliation of our historical non-GAAP financial measures to their nearest GAAP equivalent is contained in this release.

3 Comments on Seagate Technology Reports Fiscal Second Quarter 2021 Financial Results

I'd venture to guess, based on the article I linked above, her and at least another 150+ folks were laid off just from the Shakopee location since the article says about 700 employees are employed before the layoffs and the building office they're moving to is only for 500 folks.

It feels like Seagate is slowly dwindling out of the competition.