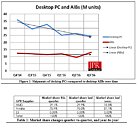

JPR: Global PC Gaming Hardware Market Forecast to Surge by $3.6 billion in 2020 due to COVID-19

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, reported its newest gaming market study regarding the PC Gaming Hardware Market, which consists of personal computers, upgrades, and peripherals used for gaming. The market is booming globally due to shelter in place orders as gamers upgrade and buy new PCs and accessories. Perhaps more importantly, the current situation has actually created millions of new PC gamers looking for immersive, exciting, and economically efficient forms of home entertainment.

Ted Pollak, Senior Analyst Gaming Industry, said "The PC Gaming Hardware market is in a rare scenario where every segment is going up. We see a lot of people buying and upgrading personal and company subsidized computers with better parts, with the intention of playing video games. In the Entry-Level, much of this revenue comes from new gamers.

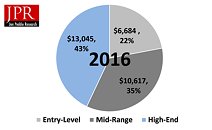

The 2020 Entry-Level category is forecast to grow 21.7% which is unprecedented and totally unexpected. The Mid-Range has bounced back from a slide; now in positive territory. At the High-End, 1440p+ display sales (spurred by more affordable offerings) created a chain reaction of upgrades as gamers configure rigs for 60+ frames per second.

Ted Pollak, Senior Analyst Gaming Industry, said "The PC Gaming Hardware market is in a rare scenario where every segment is going up. We see a lot of people buying and upgrading personal and company subsidized computers with better parts, with the intention of playing video games. In the Entry-Level, much of this revenue comes from new gamers.

The 2020 Entry-Level category is forecast to grow 21.7% which is unprecedented and totally unexpected. The Mid-Range has bounced back from a slide; now in positive territory. At the High-End, 1440p+ display sales (spurred by more affordable offerings) created a chain reaction of upgrades as gamers configure rigs for 60+ frames per second.