Friday, September 7th 2018

Jon Peddie Research Releases its Q2-2018 Graphics Card Report

The add-in board market decreased in Q2'18 from last quarter, while NVIDIA gained market share. Over $3.2 billion dollars of AIBs shipped in the quarter. The market shares for the desktop discrete GPU suppliers shifted in the quarter, Nvidia increased market share from last quarter, while AMD enjoyed an increase in share year-to-year.

Add-in boards (AIBs) using discrete GPUs are found in desktop PCs, workstations, servers, rendering and mining farms, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products or are factory installed by OEMs. In all cases, AIBs represent the higher end of the graphics industry with their discrete chips and private, often large, high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.The PC AIB market now has just two chip (GPU) suppliers which also build and sell AIBs. The primary suppliers of GPUs are AMD and Nvidia. There are 48 AIB suppliers, the AIB OEM customers of the GPU suppliers, which they call "partners."

In addition to privately branded AIBs offered worldwide, about a dozen PC suppliers offer AIBs as part of a system, and/or as an option, and some that offer AIBs as separate aftermarket products. We have been tracking AIB shipments quarterly since 1987-the volume of those boards peaked in 1999, reaching 114 million units, in 2017, 52 million shipped. Since 1981, 2,070 million AIBs have been shipped.

Q2 is normally down from the previous quarter. This quarter it showed a decrease of 28.0% that is -18.2% below the ten-year average of -9.8% which is very low when compared to the desktop PC market, which decreased 3.4% quarter-to-quarter.

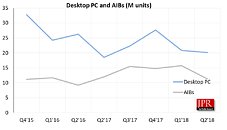

The relative changes from quarter-to-quarter are illustrated in the following chart.On a year-to-year basis, we found that total AIB shipments during the quarter fell 5.7%, while desktop PCs rose 8.8% for the same quarter a year ago, this discrepancy reflects the weakening Crypto-mining market.

Overall, AIBs shipments had been declining slightly, but not as great as the PC due to gaming and Crypto-mining. In 2015 when the use of AIB for cryptocurrency mining became widespread, AIB sales started to rise while PC sales fell. In Q1'18, the demand for AIBs for Crypto-mining ended due to a change from an Ethereum consensus based on the Proof of Work (PoW) system to one based on the so-called Proof of Stake. That change dramatically reduced the need for localized memory, and that made expensive AIBs no longer needed. Also, the price of Ethereum dropped.

However, despite the overall PC churn, somewhat due to tablets and embedded graphics, the PC gaming momentum continues to build and is the bright spot in the AIB market. The impact and influence of eSports has also contributed to the market growth and attracted new users. VR continues to be interesting but is not having a measurable influence on the AIB market.

The gaming PC (system) market is vibrant. All OEMs are investing in the gaming space because the demand for gaming PCs is robust. Intel also validated this on their earnings call when they announced a new Enthusiast CPU. However, it won't show in the overall market numbers, because like gaming GPUs, the gaming PCs are dwarfed by the general-purpose machines.

Discrete GPUs are the heart and soul of add-in boards (AIBs) and Jon Peddie Research's Add-in Board Quarterly Report covers the market activity of PC-based graphics for Q1'18.

This detailed 111-page report will provide you with all the data, analysis and insight you need to clearly understand where this technology is today and where it's headed.

JPR also publishes a series of reports on the PC Gaming Hardware Market, which covers the total market including system and accessories, and looks at 31 countries.

Pricing and Availability

Jon Peddie Research's AIB Report is available now in both electronic and hardcopy editions and sells for $2,500. The annual subscription price for JPR's AIB Report is $5,000 and includes four quarterly issues. Full subscribers to JPR services TechWatch are eligible for a 10% discount. Bundle packages are also available. For information about purchasing the AIB Report, please call 415/435-9368 or visit the Jon Peddie Research website at www.jonpeddie.com

Add-in boards (AIBs) using discrete GPUs are found in desktop PCs, workstations, servers, rendering and mining farms, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products or are factory installed by OEMs. In all cases, AIBs represent the higher end of the graphics industry with their discrete chips and private, often large, high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.The PC AIB market now has just two chip (GPU) suppliers which also build and sell AIBs. The primary suppliers of GPUs are AMD and Nvidia. There are 48 AIB suppliers, the AIB OEM customers of the GPU suppliers, which they call "partners."

In addition to privately branded AIBs offered worldwide, about a dozen PC suppliers offer AIBs as part of a system, and/or as an option, and some that offer AIBs as separate aftermarket products. We have been tracking AIB shipments quarterly since 1987-the volume of those boards peaked in 1999, reaching 114 million units, in 2017, 52 million shipped. Since 1981, 2,070 million AIBs have been shipped.

Q2 is normally down from the previous quarter. This quarter it showed a decrease of 28.0% that is -18.2% below the ten-year average of -9.8% which is very low when compared to the desktop PC market, which decreased 3.4% quarter-to-quarter.

The relative changes from quarter-to-quarter are illustrated in the following chart.On a year-to-year basis, we found that total AIB shipments during the quarter fell 5.7%, while desktop PCs rose 8.8% for the same quarter a year ago, this discrepancy reflects the weakening Crypto-mining market.

Overall, AIBs shipments had been declining slightly, but not as great as the PC due to gaming and Crypto-mining. In 2015 when the use of AIB for cryptocurrency mining became widespread, AIB sales started to rise while PC sales fell. In Q1'18, the demand for AIBs for Crypto-mining ended due to a change from an Ethereum consensus based on the Proof of Work (PoW) system to one based on the so-called Proof of Stake. That change dramatically reduced the need for localized memory, and that made expensive AIBs no longer needed. Also, the price of Ethereum dropped.

However, despite the overall PC churn, somewhat due to tablets and embedded graphics, the PC gaming momentum continues to build and is the bright spot in the AIB market. The impact and influence of eSports has also contributed to the market growth and attracted new users. VR continues to be interesting but is not having a measurable influence on the AIB market.

The gaming PC (system) market is vibrant. All OEMs are investing in the gaming space because the demand for gaming PCs is robust. Intel also validated this on their earnings call when they announced a new Enthusiast CPU. However, it won't show in the overall market numbers, because like gaming GPUs, the gaming PCs are dwarfed by the general-purpose machines.

Discrete GPUs are the heart and soul of add-in boards (AIBs) and Jon Peddie Research's Add-in Board Quarterly Report covers the market activity of PC-based graphics for Q1'18.

This detailed 111-page report will provide you with all the data, analysis and insight you need to clearly understand where this technology is today and where it's headed.

JPR also publishes a series of reports on the PC Gaming Hardware Market, which covers the total market including system and accessories, and looks at 31 countries.

Pricing and Availability

Jon Peddie Research's AIB Report is available now in both electronic and hardcopy editions and sells for $2,500. The annual subscription price for JPR's AIB Report is $5,000 and includes four quarterly issues. Full subscribers to JPR services TechWatch are eligible for a 10% discount. Bundle packages are also available. For information about purchasing the AIB Report, please call 415/435-9368 or visit the Jon Peddie Research website at www.jonpeddie.com

26 Comments on Jon Peddie Research Releases its Q2-2018 Graphics Card Report

So much for 'targeting the midrange' and it being a great idea. Duh.

If that happens, I hope Intel finds a place in the market. Nvidia monopoly would not be good... not even for Nvidia fans.

Remember your statement, because I will remind you a year from now!

:shadedshu:

The console market is not the dedicated GPU market...

:toast:

As the new head of GPU was hired in early 2018, I would expect a new architecture to be out in 2020-2022.

But in fact, does AMD care about the discrete GPU market? The CPU server market is larger than the entire GPU market. Why would AMD prioritize GPU market over CPU server market in 2015-2017?

Also AMD bought ATi to counter Intel's own integrated GPU project, but not voluntarily.

But I didn't know anything about their APU ambitions. I was out of the loop with PC hardware for awhile.