Tuesday, April 15th 2014

Intel Reports First-Quarter Revenue of $12.8 Billion

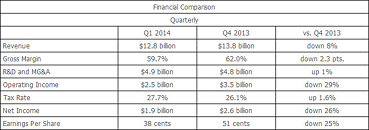

Intel Corporation today reported first-quarter revenue of $12.8 billion, operating income of $2.5 billion, net income of $1.9 billion and EPS of 38 cents. The company generated approximately $3.5 billion in cash from operations, paid dividends of $1.1 billion, and used $545 million to repurchase 22 million shares of stock.

"In the first quarter we saw solid growth in the data center, signs of improvement in the PC business, and we shipped 5 million tablet processors, making strong progress on our goal of 40 million tablets for 2014," said Intel CEO Brian Krzanich. "Additionally, we demonstrated our further commitment to grow in the enterprise with a strategic technology and business collaboration with Cloudera, we introduced our second-generation LTE platform with CAT6 and other advanced features, and we shipped our first Quark products for the Internet of Things."Q1 Key Business Unit Trends

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after April 15.

Q2 2014

"In the first quarter we saw solid growth in the data center, signs of improvement in the PC business, and we shipped 5 million tablet processors, making strong progress on our goal of 40 million tablets for 2014," said Intel CEO Brian Krzanich. "Additionally, we demonstrated our further commitment to grow in the enterprise with a strategic technology and business collaboration with Cloudera, we introduced our second-generation LTE platform with CAT6 and other advanced features, and we shipped our first Quark products for the Internet of Things."Q1 Key Business Unit Trends

- PC Client Group revenue of $7.9 billion, down 8 percent sequentially and down 1 percent year-over-year.

- Data Center Group revenue of $3.1 billion, down 5 percent sequentially and up 11 percent year-over-year.

- Internet of Things Group revenue of $482 million, down 10 percent sequentially and up 32 percent year-over-year.

- Mobile and Communications Group revenue of $156 million, down 52 percent sequentially and down 61 percent year-over-year.

- Software and services operating segments revenue of $553 million, down 6 percent sequentially and up 6 percent year-over-year.

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after April 15.

Q2 2014

- Revenue: $13.0 billion, plus or minus $500 million.

- Gross margin percentage: 63 percent, plus or minus a couple of percentage points.

- R&D plus MG&A spending: approximately $4.8 billion.

- Restructuring and asset impairment charges: approximately $100 million.

- Amortization of acquisition-related intangibles: approximately $75 million.

- Impact of equity investments and interest and other: approximately $75 million.

- Depreciation: approximately $1.9 billion.

- Revenue: approximately flat, unchanged from prior expectations.

- Gross margin percentage: 61 percent, plus or minus a few percentage points, 1 percentage point higher than prior expectations.

- R&D plus MG&A spending: $18.9 billion, plus or minus $200 million, higher than prior expectations of $18.6 billion.

- Amortization of acquisition-related intangibles: approximately $300 million, unchanged from prior expectations.

- Depreciation: approximately $7.4 billion, unchanged from prior expectations.

- Tax rate: approximately 27 percent for each of the remaining quarters of the year.

- Full-year capital spending: $11.0 billion, plus or minus $500 million, unchanged from prior expectations.

13 Comments on Intel Reports First-Quarter Revenue of $12.8 Billion

Also it apparently annoys some people here, and it's fun to wind them up.

Still, having said that, I hope they spend some profits on improving CPU performance a bit faster than the current rate.

Remember to boycott all graphics that use Samsung, Elpida, and Hynix memory IC's while you're at it.

(Taken from your link)

Since you're clearly Bashing AMD, most of the time without a clue. Let me start by saying AMD just last year made it on the (Top spot) list of honourable companies based on the semi conductor market, something Nvidia and Intel don't even make it to to the runners up list. Am not 100% sure, but I think AMD have made that list a few times now.

P.S. NET Income down 26% is really bad for Intel, and I think its going to get worse unless Intel brings something reasonable in the CPU, and not just 100mhz added to the CPU as a refresh.

...as well as reminding Jorge about who supplies the memory IC's for both Nvidia and AMD boards :rolleyes:You know what else is taken from the link:If Nvidia's share comes to $850K out of $1.7 million, what does that leave for AMD? Hint: The same amount. Hint#2: Equal culpability.

Since the article seems not to have convinced you, and rather than research anything about it, just highlight one sides culpability - here it is from AMD's own financialsSo you're comparing AMD's current conduct (so as to dismiss shady business practice from 2006-08), but having a cry about Intel's record up to and prior to the same time period. Sounds pretty hypocritical and a piss poor attempt to rewrite history TBH :rolleyes:

ATI came under AMD ownership25 October, 2006So you'd have us believe that AMD management didn't know what a substantial part of its own company were doing for 14 months :shadedshu: ...a time period where they released at least 21 new SKU's!

I feel so much better knowing that you believe AMD management to be grossly incompetent rather than shady :roll: