Thursday, October 16th 2014

AMD Reports 2014 Third Quarter Results

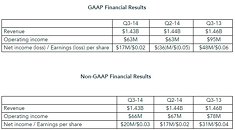

AMD today announced revenue for the third quarter of 2014 of $1.43 billion, operating income of $63 million and net income of $17 million, or $0.02 per share. Non-GAAP operating income was $66 million and non-GAAP net income was $20 million, or $0.03 per share.

"AMD's third quarter financial performance reflects progess in diversifying our business," said Dr. Lisa Su, AMD president and CEO. "Our Enterprise, Embedded and Semi-Custom segment results were strong; however, performance in our Computing and Graphics segment was mixed based on challenging market conditions that require us to take further steps to evolve and strengthen the financial performance of this business. Our top priority is to deliver leadership technologies and products as we continue to transform AMD."Effective July 1, 2014, AMD reorganized into two business groups, one focused on the traditional PC market and the second focused on adjacent high-growth opportunities.

Accordingly, AMD has two reportable segments:

As a part of AMD's ongoing transformation work, the company has developed a targeted restructuring plan to better position AMD for profitability and long-term growth while aligning investments and resources with high-priority opportunities.

The restructuring plan, which will be largely implemented in Q4 2014, is expected to:

Recent Highlights

For Q4 2014, AMD expects revenue to decrease 13 percent, plus or minus 3 percent, sequentially.

"AMD's third quarter financial performance reflects progess in diversifying our business," said Dr. Lisa Su, AMD president and CEO. "Our Enterprise, Embedded and Semi-Custom segment results were strong; however, performance in our Computing and Graphics segment was mixed based on challenging market conditions that require us to take further steps to evolve and strengthen the financial performance of this business. Our top priority is to deliver leadership technologies and products as we continue to transform AMD."Effective July 1, 2014, AMD reorganized into two business groups, one focused on the traditional PC market and the second focused on adjacent high-growth opportunities.

Accordingly, AMD has two reportable segments:

- Computing and Graphics, which primarily includes desktop and notebook processors and chipsets, discrete GPUs and professional graphics; and

- Enterprise, Embedded and Semi-Custom, which primarily includes server and embedded processors, dense servers, semi-custom SoC products, engineering services and royalties.

- Gross margin was 35 percent in Q3 2014.

Gross margin was flat sequentially and included a $27 million, or 2 percent benefit, from revenue related to technology licensing. - Cash, cash equivalents and marketable securities were $938 million at the end of the quarter, essentially flat from the prior quarter.

- Total debt at the end of the quarter was $2.20 billion.

- Computing and Graphics segment revenue decreased 6 percent sequentially and decreased 16 percent year-over-year. The sequential decrease was primarily driven by lower chipset and GPU sales. The year-over-year decline was primarily due to decreased notebook processor and chipset sales.

Operating loss was $17 million, compared with an operating loss of $6 million in Q2 2014 and operating income of $9 million in Q3 2013. The sequential decrease was primarily driven by lower revenue while the year-over-year decrease was primarily driven by lower revenue partially offset by lower operating expenses.

Client average selling price (ASP) increased sequentially and year-over-year primarily driven by a richer mix of notebook processor sales.

GPU ASP decreased sequentially due to lower desktop GPU ASP and increased year-over-year. - Enterprise, Embedded and Semi-Custom segment revenue increased 6 percent sequentially and 21 percent year-over-year primarily driven by increased sales of semi-custom SoCs.

Operating income was $108 million compared with $97 million in Q2 2014 and $92 million in Q3 2013. The sequential and year-over-year increase was primarily due to increased sales of semi-custom SoCs.

Embedded revenue grew by double digits on a percentage basis sequentially.

As a part of AMD's ongoing transformation work, the company has developed a targeted restructuring plan to better position AMD for profitability and long-term growth while aligning investments and resources with high-priority opportunities.

The restructuring plan, which will be largely implemented in Q4 2014, is expected to:

- Reduce global headcount by 7 percent, largely expected to be completed by the end of Q4 2014;

- Align AMD's real estate footprint with its reduced headcount;

- Result in a restructuring and impairment charge of approximately $57 million in Q4 2014, primarily related to severance, and a restructuring charge of approximately $13 million in 1H 2015, primarily related to real estate actions;

- The company expects to make cash payments related to these actions of approximately $34 million in Q4 2014 and $20 million in 1H 2015;

- Result in operational savings, primarily in operating expenses, of approximately $9 million in Q4 2014 and approximately $85 million in 2015.

Recent Highlights

- AMD appointed Dr. Lisa Su as president and CEO and a member of the board of directors, succeeding Mr. Rory Read who will remain with the company through 2014 to advise on the transition. Mr. Joseph Householder was also appointed to the company's board. Mr. Householder currently serves as executive vice president and chief financial officer of Sempra Energy.

- AMD and Synopsys announced a multi-year agreement, with Synopsys acquiring rights to AMD's interface and foundation IP. The IP partnership will provide AMD with access to a range of Synopsys tools and IP for advanced FinFET process nodes.

- AMD expanded its award-winning AMD Radeon R9 series graphics family with the launch of the AMD Radeon R9 285 graphics card designed to run the most demanding games at the highest settings.

- AMD completed its most advanced APU lineup to-date for the component channel with the introduction of new AMD A-Series APUs with HSA features and GCN architecture for the system builder and DIY market, along with new APUs designed for smaller form factor gaming and home theater PC (HTPC) systems.

- Demonstrating its leadership in building a robust software ecosystem for 64-bit ARM servers, AMD announced immediate availability of the AMD Opteron A1100-Series development kit, featuring AMD's first 64-bit ARM-based processor, and showcased the first public demonstration of Apache Hadoop running on an ARM Cortex-A57-based AMD Opteron A-Series processor. AMD is the first company to provide a standard ARM Cortex-A57-based server platform for software developers and integrators.

- AMD expanded its AMD FirePro professional graphics offerings with the introduction of 4 new next-generation AMD FirePro W-series professional graphics cards that deliver at least 2x2 more graphics memory over the previous generation, multi-display 4K capability and increased compute performance. AMD secured several new design wins with tier-1 OEMs, including multiple HP mobile and desktop workstations. AMD also introduced the most powerful server GPU ever built for High Performance Computing with the AMD FirePro S91503.

- Mentor Graphics announced the availability of commercial Embedded Linux software enabling developers to easily migrate to new commercially-supported versions for the AMD Embedded G-Series SoC and CPU, and the AMD Embedded R-Series APU.

- AMD announced a new technology partnership with OCZ Storage Solutions, a Toshiba Group Company, for AMD Radeon-branded Solid State Drives (SSDs).

- In collaboration with Canonical, AMD announced a ready-to-deploy OpenStack private cloud based on the SeaMicro SM15000 server. The "out of the box" experience is meant to ease the complexities of deploying OpenStack technology and automates complex configuration tasks, simplifies management, and provides a graphical user interface to dynamically deploy new services on demand.

- Dow Jones named AMD to the Dow Jones Sustainability Index (DJSI) North America, marking more than a decade-long appearance on the list and exemplifying the company's legacy of corporate responsibility and commitment to social, economic and environmental issues.

For Q4 2014, AMD expects revenue to decrease 13 percent, plus or minus 3 percent, sequentially.

46 Comments on AMD Reports 2014 Third Quarter Results

- Reduce global headcount by 7 percent, largely expected to be completed by the end of Q4 2014;

- For Q4 2014, AMD expects revenue to decrease 13 percent, plus or minus 3 percent, sequentially.

Great, AMD! Keep doing this and shortly you will declare bankruptcy which actually won't be a so bad thing, honestly. :laugh:For the record the naysayers have been claiming AMD was going out of business for the past 35+ years and they still continue to deliver some of the best PC products in the industry and move forward on new technology so I wouldn't be too concerned about them going bankrupt or bust any time soon.

Those who desire to see AMD proper and deliver more enthusiast products would be smart to vote with their wallet. The last thing most consumers would want is a reincarnation of the bad old Intel days when they were the only CPU choice and you paid a $1000 for a P90 CPU. Competition is what has lowered PC component costs and driven better engineering and products. You can vote with your purchases for AMD or the other guys who have been convicted for screwing consumers and AMD. It ain't a difficult decision if you have a moral compass.

If AMD want to give away their technology for peanuts that is their problem.

The GPU segment is fine and will start showing with the fact consoles have them inside and their recent attempts at listening have really brought them to a better view and standing. They have made mistakes but if anything it seems they are on the right path and are playing their cards a little better than the last few years.

5960X ($999)........4960X ($990)......3960X ($999)......965XE ($999).....QX9770 ($1399)

5930K ($583)........4930K ($555)......3930K ($583)......940 ($562).....Q9550 ($530)

5820K ($389)........4820K ($310)......3820K ($294)......920 ($284).....Q9450 ($316)

Intel don't price according to what AMD is doing - never really have. If anything, the reverse is true. When AMD had a truly competitive architecture with no proviso's, their pricing reflected that (remember the days of $1K K8's ? )

On a side note. this result answers why AMD's directors have been selling their shares in such large quantities for the last few weeks.

AMD needs cash to continue their R&D for years to come, unless they get a big breakthrough in process changes from their former foundry or they manage to beg Intel or some other place for some space they and we are at an impasse, AMD will not provide the CPU competition to Intel to push for better faster processors, Nvidia and AMD will be deadlocked in the 6month to a year cycle of who can make the most of a older process.

So in short, we the customers are the ones getting screwed.

I think Rory gone early because of Maxwell. It seems that Rory cut so much from R&D to maintain profitability, never expecting Nvidia's 900 series at the same nanometers and at that aggressive pricing, that the board felt they where going to suffer a second bulldozer in the GPU market, if they continue his plan. Most people where expecting Read for one or two years more on the helm.

But they probably wont, x86-64 license (this is funny thing, both Intel and AMD are dependant on each other on this one), dominance for few years on the console market, plus, IIRC, some antimonopoly laws will keep them up.

I still want my next PC in few years to have AMD CPU...

So they don't compete on HEDT but they do have a CPU solution and their GPU solutions have been competent, if not brilliant (5870, 7970, 290x). Being 2nd to Intel or Nvidia in performance doesn't need to mean a loss making business.

I really want to be optimistic, I truly do, but I still think the next product from AMD will be something like 3840sp. It doesn't matter if that's the rumored 500mm+ design or they are using 20nm. That could be ~1ghz/7ghz GDDR5/512-bit, and/or a smaller process and up to ~1200mhz or so with 4xHBM, but either way...when your competitor is essentially already doing 2560sp @ 1500mhz (equivalent to 3840 @ 1ghz) now, and your future unreleased product looks to be using a water-cooler at stock when the competition has headroom and is currently under 225w...these are not good signs. They. Just. Are. Not.

Even past that, it's clear nvidia is waiting until HBM-like stacks are above 1GB (Hynix roadmap pins that as a couple years from now), as that makes sense. If a chip is strong-enough to support a resolution where it will use a large buffer, or trying to reach some kind of parity/scalability to the 8GB in consoles, HBM is not where it's at currently, and probably why nvidia delayed that design. It would be better to build adequet cache into your die and use a larger gddr5 buffer. Nvidia is seemingly doing that. AMD looks to be taking advantage of HBM for bandwidth, seemingly out of necessity for their unit structure, but that will limit their buffer size. It is not encouraging...

It hurts me to say these things, because how I feel about amd/ati is the way many people do; I have a strong attachment to their former engineering prowess, underdog status, value-oriented designs, and open-engineer/software mentality...but they're simply in a bad, bad place. The people I respected and largely impacted their former products, like Eric Demers, are gone. They very apparently now outsource their designs to Synapse, and that obviously is/was a gigantic fuck-up. You can call it financially necessary, but the reality is it's just not good-enough. Their innovation has largely died, and the coasting has been evident. If this is a disconnect because of new management, I don't know, but it is the reality.

Don't get me wrong, I don't like nvidia, not one bit, but AMD (and ATi) has come so far from the company(s) we once knew, nvidia actually has done enough to convince me it isn't worth waiting for them to come around in the short term, and that's saying a lot. They (AMD) may conceivably still do that, and surely will slot themselves in with new products (realistically a product like I mentioned earlier could do just that above 980), but with the current leadership lacking attachment to the former greatness, lack of former engineers pushing for radical changes, and all their other problems, it probably won't be soon. I applaud their steps in Mantle, Freesync, and the rest...but they need the R&D (and related brain-trust) in core products to back it up, and I'm just not seeing it.

First AMD must bankrupt, only then we could confirm or deny your prognosis.Now there is competition but AMD's CPU don't get any better. :laugh:

While I must add, I find the discrepancy from top to bottom abhorrent in large companies. I hereby declare if I win the Euromillions jackpot tonight, I'll donate £5million to a TPU sponsored charity. Maybe Rory Read?

Why do you think R9-290 prices dropped? Not out of AMD's kindness but because GTX 900 series forced them to do that just like so many AMD's products forced NVIDIA to lower prices in order to be competitive. And that's how market works. If you take competition out, you can inflate prices, because there is no one else to force you to lower them via their product being better positioned in terms of price or performance (or both). Its' what i call logic.