Fancy Your Hardware? TV Pricing Sees 30% Increase, Could Escalate Further

We've all been beating dead consumer horses for a while now in most product areas that require semiconductors to operate - and that applies to almost anything, really. Whether CPU shortages from the AMD camp, GPU shortages from both AMD and NVIDIA, increasing prices of storage due to a new cryptocurrency boom, scalpers left and right on the most recent PC and console hardware, shortages on semiconductors for car manufacturers and technological companies like Bosch... It's a wild ride in the semiconductor world right now. And if you were looking at upgrading your media-consumption living room with a fancy new TV, you will also have to cope with increased pricing now, and perhaps further price climbs and shortages in the future.

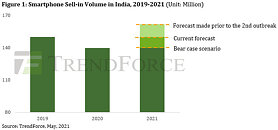

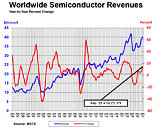

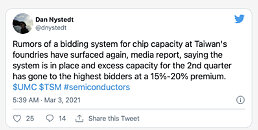

Market research company NPD has said as much in its most recent market analysis; they've concluded that Smart TV prices have already increased 30% comparatively to the first months of 2020. The price increases are expected to hit anything with a screen - whether smartphones, TVs, laptops, or any other product that has to take up a portion of the world's panel output. This is the market correcting itself when it comes to the supply/demand equation - increased demand post-COVID-19 and global supply chain issues have set up a series of network effects that have led manufacturers to increase product pricing according to demand, passing on additional supply costs on to the customer, and simultaneously attaching the highest possible profits on the existing (and insufficient) supply. It's highly unlikely that this semiconductor supply shortage will see a turnaround throughout 2021.

Market research company NPD has said as much in its most recent market analysis; they've concluded that Smart TV prices have already increased 30% comparatively to the first months of 2020. The price increases are expected to hit anything with a screen - whether smartphones, TVs, laptops, or any other product that has to take up a portion of the world's panel output. This is the market correcting itself when it comes to the supply/demand equation - increased demand post-COVID-19 and global supply chain issues have set up a series of network effects that have led manufacturers to increase product pricing according to demand, passing on additional supply costs on to the customer, and simultaneously attaching the highest possible profits on the existing (and insufficient) supply. It's highly unlikely that this semiconductor supply shortage will see a turnaround throughout 2021.