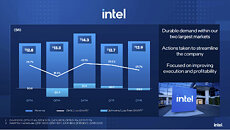

Intel Reports Second-Quarter 2025 Financial Results

Intel Corporation today reported second-quarter 2025 financial results.

"Our operating performance demonstrates the initial progress we are making to improve our execution and drive greater efficiency," said Lip-Bu Tan, Intel CEO. "We are laser-focused on strengthening our core product portfolio and our AI roadmap to better serve customers. We are also taking the actions needed to build a more financially disciplined foundry. It's going to take time, but we see clear opportunities to enhance our competitive position, improve our profitability and create long-term shareholder value."

"Our operating performance demonstrates the initial progress we are making to improve our execution and drive greater efficiency," said Lip-Bu Tan, Intel CEO. "We are laser-focused on strengthening our core product portfolio and our AI roadmap to better serve customers. We are also taking the actions needed to build a more financially disciplined foundry. It's going to take time, but we see clear opportunities to enhance our competitive position, improve our profitability and create long-term shareholder value."