Phison Launches Full Range of UFS Storage Solutions for Unparalleled Mobile Storage Performance

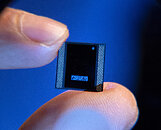

Phison Electronics, a leading provider of NAND controllers and NAND storage solutions, today announced it has introduced a full range of UFS (Universal Flash Storage) controllers (PS8325, PS8327, PS8329, PS8361). Phison's new UFS solutions support entry-level, middle, premium and flagship smartphone devices to achieve maximum performance in mobile storage and enhance user experiences.

As smartphone devices require higher performance, the storage devices of many entry-level 5G models have transitioned from eMMC to UFS 2.2 storage, and even flagship models of 4G phones have begun adopting the UFS 2.2 specification. Compared to the half-duplex mode of eMMC, the full-duplex mode of UFS 2.2 significantly increases read speeds by three times, not only handling smartphone functions that require processing large amounts of data (such as high-resolution recording and video playback), but also consuming lower power under the same performance speed as eMMC. This helps improve the battery life of smartphones and tablets, meeting the high-performance and low-power consumption needs of mobile devices.

As smartphone devices require higher performance, the storage devices of many entry-level 5G models have transitioned from eMMC to UFS 2.2 storage, and even flagship models of 4G phones have begun adopting the UFS 2.2 specification. Compared to the half-duplex mode of eMMC, the full-duplex mode of UFS 2.2 significantly increases read speeds by three times, not only handling smartphone functions that require processing large amounts of data (such as high-resolution recording and video playback), but also consuming lower power under the same performance speed as eMMC. This helps improve the battery life of smartphones and tablets, meeting the high-performance and low-power consumption needs of mobile devices.