Overall GPU Shipments Increased 7.2% From Last Quarter, Boosted by Mining - JPR

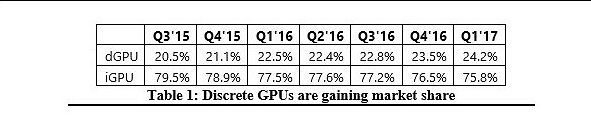

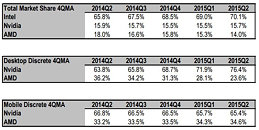

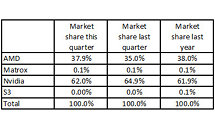

This is the latest report from Jon Peddie Research on the GPUs used in PCs. It is reporting on the results of Q2'17 GPU shipments world-wide. Overall GPU shipments increased 7.2% from last quarter, AMD increased 8% Nvidia increased 10% and Intel, increased 6%. Year-to-year total GPU shipments increased 6.4%, desktop graphics increased 5%, notebooks increased 7%.

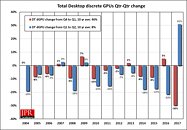

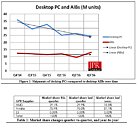

Up to now, the GPU and PC market had been showing a return to what has been normal seasonality. That pattern is typically flat to down in Q1, a significant drop in Q2 as OEMs and the channel deplete inventory before the summer months. A restocking with the latest products in Q3 in anticipation of the holiday season, and mild increase to flat change in Q4. All, of that subject to an overall decline in the PC market since the great recession of '07 and the influx of tablets and smartphones. However, this year, Q2 dGPU shipments were completely out of sync, and remarkably high, as shown in the following chart.

Up to now, the GPU and PC market had been showing a return to what has been normal seasonality. That pattern is typically flat to down in Q1, a significant drop in Q2 as OEMs and the channel deplete inventory before the summer months. A restocking with the latest products in Q3 in anticipation of the holiday season, and mild increase to flat change in Q4. All, of that subject to an overall decline in the PC market since the great recession of '07 and the influx of tablets and smartphones. However, this year, Q2 dGPU shipments were completely out of sync, and remarkably high, as shown in the following chart.