Thursday, July 23rd 2020

Intel Reports Second-Quarter 2020 Financial Results

Intel Corporation today reported second-quarter 2020 financial results. "It was an excellent quarter, well above our expectations on the continued strong demand for computing performance to support cloud-delivered services, a work- and learn-at-home environment, and the build-out of 5G networks," said Bob Swan, Intel CEO. "In our increasingly digital world, Intel technology is essential to nearly every industry on this planet. We have an incredible opportunity to enrich lives and grow this company with a continued focus on innovation and execution."

Intel achieved record second-quarter revenue with 34 percent data-centric revenue growth and 7 percent PC-centric revenue growth YoY. These results were driven by strong sales of cloud, notebook, memory and 5G products in an environment where digital services and computing performance are essential to how we live, work and stay connected.News Summary:

The PC-centric business (CCG) was up 7 percent YoY in the second quarter on notebook strength driven by the continued work- and learn at home dynamics of COVID-19, which also contributed to a volume decline in desktop form factors as demand shifted to notebooks. In the second quarter, Intel expanded its 10th Gen Intel Core processor line-up with the launch of new Core S and H series processors for desktop and mobile gaming as well as the new 10th Gen Intel Core vPro processors, which deliver uncompromised productivity and hardware-based security features for commercial PCs. The second quarter also marked the launch of Intel Core processors with Intel Hybrid Technology, code-named "Lakefield," which utilize Foveros 3D packaging technology and feature a hybrid CPU architecture for power and performance scalability.

Intel is accelerating its transition to 10 nm products this year with increasing volumes and strong demand for an expanding line up. This includes a growing portfolio of 10 nm-based Intel Core processors with "Tiger Lake" launching soon, and the first 10 nm-based server CPU "Ice Lake," which remains planned for the end of this year. In the second half of 2021, Intel expects to deliver a new line of client CPU's (code-named "Alder Lake"), which will include its first 10 nm-based desktop CPU, and a new 10 nm-based server CPU (code-named "Sapphire Rapids"). The company's 7 nm-based CPU product timing is shifting approximately six months relative to prior expectations. The primary driver is the yield of Intel's 7 nm process, which based on recent data, is now trending approximately twelve months behind the company's internal target.

Intel achieved record second-quarter revenue with 34 percent data-centric revenue growth and 7 percent PC-centric revenue growth YoY. These results were driven by strong sales of cloud, notebook, memory and 5G products in an environment where digital services and computing performance are essential to how we live, work and stay connected.News Summary:

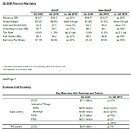

- Second-quarter revenue of $19.7 billion was up 20 percent year-over-year (YoY). Data-centric revenue grew 34 percent, accounting for 52 percent of total revenue; PC-centric revenue grew 7 percent YoY.

- Second-quarter GAAP earnings-per-share (EPS) was $1.19, up 29 percent YoY; non-GAAP EPS of $1.23 was up 16 percent.

- Year-to-date, generated $17.3 billion cash from operations and $10.6 billion of free cash flow and paid dividends of $2.8 billion.

- Accelerating 10 nm product transition; 7 nm product transition delayed versus prior expectations.

- Expecting full-year revenue of $75 billion; GAAP EPS of $4.53 and non-GAAP EPS of $4.85.

The PC-centric business (CCG) was up 7 percent YoY in the second quarter on notebook strength driven by the continued work- and learn at home dynamics of COVID-19, which also contributed to a volume decline in desktop form factors as demand shifted to notebooks. In the second quarter, Intel expanded its 10th Gen Intel Core processor line-up with the launch of new Core S and H series processors for desktop and mobile gaming as well as the new 10th Gen Intel Core vPro processors, which deliver uncompromised productivity and hardware-based security features for commercial PCs. The second quarter also marked the launch of Intel Core processors with Intel Hybrid Technology, code-named "Lakefield," which utilize Foveros 3D packaging technology and feature a hybrid CPU architecture for power and performance scalability.

Intel is accelerating its transition to 10 nm products this year with increasing volumes and strong demand for an expanding line up. This includes a growing portfolio of 10 nm-based Intel Core processors with "Tiger Lake" launching soon, and the first 10 nm-based server CPU "Ice Lake," which remains planned for the end of this year. In the second half of 2021, Intel expects to deliver a new line of client CPU's (code-named "Alder Lake"), which will include its first 10 nm-based desktop CPU, and a new 10 nm-based server CPU (code-named "Sapphire Rapids"). The company's 7 nm-based CPU product timing is shifting approximately six months relative to prior expectations. The primary driver is the yield of Intel's 7 nm process, which based on recent data, is now trending approximately twelve months behind the company's internal target.

2 Comments on Intel Reports Second-Quarter 2020 Financial Results

I am hoping this is not going to end up like their 10nm. This was the same trend where they kept pushing the dates back until they finally came clean to say that there are issues with 10nm. While they mentioned a 6 months delay here, I believe they have already mentioned a delay of 6 months earlier. So that is 1 year gone.Doing ok as in their Q2 results? I feel they are doin better than expected in 1H 2020 likely due to pandemic lockdown pretty much worldwide, which prompted accelerated sales of consumer and enterprise level hardware to facilitate people working from home. Every single PC maker is posting good sales/ revenue, which will surely contribute to Intel's revenue. Enterprise will continue to contribute to Intel's numbers, but with ARM and AMD chipping away at their market share, it will be a matter of time the numbers will start declining if their damage control solutions are not enough to keep their existing clients happy.