Thursday, July 31st 2025

Samsung Electronics Announces Second Quarter 2025 Results

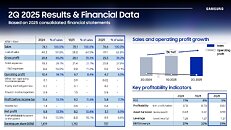

Samsung Electronics today reported financial results for the second quarter ended June 30, 2025. The Company posted KRW 74.6 trillion in consolidated revenue, a decrease of 5.8% compared to the previous quarter. Operating profit decreased to KRW 4.7 trillion.

The Device Solutions (DS) Division reported an increase in revenue on the back of expanded sales of high density, high-performance memory products, but inventory value adjustments in memory and one-off costs related to the impacts of export restrictions related to China in non-memory had an adverse effect on profit. In the Device eXperience (DX) Division, operating profit declined quarter-on-quarter due to a sequential decline in sales volume following the launch of new smartphone models in the first quarter. Looking ahead to H2, the DS Division plans to proactively meet the growing demand for high-value-added and AI-driven products and continue to strengthen competitiveness in advanced semiconductors. The DX Division will seek to minimize the impact of uncertainties stemming from tariff policies that are likely to persist.Semiconductors Expected To Proactively Meet Continued AI Demand

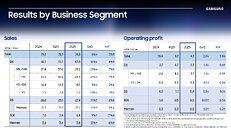

The DS Division posted KRW 27.9 trillion in consolidated revenue and KRW 0.4 trillion in operating profit for the second quarter.

In Q2 2025, the Memory Business proactively addressed robust server demand by expanding HBM3E sales and by expanding the proportion of high-density DDR5 products. Also, with the resumption of datacenter projects that were previously delayed, sales of server SSDs increased, helping NAND inventory to decrease significantly. However, earnings were impacted by one-off costs such as inventory value adjustments.

In H2 2025, AI demand is expected to remain robust due to continued investments by major cloud service providers, and therefore server demand for both DRAM and NAND is expected to stay strong.

To align with solid AI-server demand for DRAM, the Memory Business will proactively address the need for high-density products and diversify product offerings through HBM, server LPDDR5x, high-density DDR5, 24 Gb GDDR7 and other products. For NAND, the Memory Business plans to increase sales of high-density and high-performance SSDs while accelerating the transition to 8th Generation V-NAND across all applications.

The System LSI Business generated solid revenue from shipments of flagship systems-on-a-chip (SoCs) using the Gate-All-Around (GAA) process, but earnings improvement was limited due to higher costs of developing advanced products.

In H2 2025, the System LSI Business will focus on improving Exynos competitiveness to ensure its adoption in 2026 flagship mobile lineups of a major customer and expanding the sales of ultra-high-resolution and nano-prism sensors.

Despite significant growth in revenue from the first quarter, earnings for the Foundry Business remained weak due to the impact of inventory value adjustments that stemmed from US export restrictions on advanced AI chips to China, as well as a continued low utilization rates at mature nodes.

In H2 2025, the Foundry Business will ramp up mass production of a new mobile SoC with the 2 nm GAA process. It also aims to improve factory utilization and profitability through expanded sales to major customers.

SDC To Further Accelerate Leadership By Differentiating and Enhancing Display Technologies

Samsung Display Corporation (SDC) posted KRW 6.4 trillion in consolidated revenue and KRW 0.5 trillion in operating profit for the second quarter.

For the mobile display business, SDC saw a revenue increase based on the response to new smartphones of major customers as well as the expansion of sales in the IT and automotive segments. The large display business experienced continued growth in sales of QD-OLED monitor displays, driven by robust demand in the gaming market.

In H2 2025, the mobile display business expects sales growth from major customers' new smartphone launches amid ongoing market uncertainties. It also aims to strengthen market leadership with differentiated technologies and the continued expansion of sales beyond smartphone displays. The large display business will seek to maintain a stable supply of TV panels while continuing to accelerate the penetration of QD-OLED monitors by enhancing the product lineup.

MX Grows Revenue and Operating Profit YoY, Will Focus on Flagship Sales and AI Capabilities

The Mobile eXperience (MX) and Networks businesses posted KRW 29.2 trillion in consolidated revenue and KRW 3.1 trillion in operating profit for the second quarter.

In Q2 2025, the MX Business experienced a decrease in smartphone shipments compared to Q1, when new models were released, but both revenue and operating profit grew YoY through robust sales of the Galaxy S25 series, Galaxy A series and Galaxy tablets. The Business also maintained solid double-digit profitability via efficient resource management.

In H2 2025, the MX Business plans to continue a flagship-first approach for smartphone sales focusing on foldables and the Galaxy S25 series - while emphasizing the AI functionality of the Galaxy A series - to increase market share. It will also reinforce the AI capabilities of tablets and wearables and expand the Galaxy ecosystem with the launch of products with new form-factors, including extended reality (XR) and TriFold devices, and contribute to maintaining solid profitability despite market uncertainties and rising bill of materials (BOM) costs.

The Networks Business improved profitability in Q2 2025 by expanding revenue in overseas markets and enhancing cost efficiencies, and in H2 2025, it will focus on achieving revenue targets and regaining competitiveness by securing new orders with optimized costs.

Visual Display Enhances Sales Mix, Targets the Capture of Peak-Season Demand in H2

The Visual Display and Digital Appliances businesses posted KRW 14.1 trillion in consolidated revenue and KRW 0.2 trillion in operating profit in the second quarter.

In Q2 2025, the Visual Display Business improved the sales of premium products, such as Neo QLED and OLED TVs, but earnings declined due to stagnant demand and intensified competition.

In H2 2025, the Business plans to reinforce revenue growth by capturing peak-season demand, based on a strengthened lineup of high-value-added TVs offering superior viewing experiences with enhanced AI features. In addition, the Business will drive solid profitability and growth through its differentiated experiences and services including SmartThings, Samsung Knox, Samsung Art Store and Samsung TV Plus.

Source:

Samsung

The Device Solutions (DS) Division reported an increase in revenue on the back of expanded sales of high density, high-performance memory products, but inventory value adjustments in memory and one-off costs related to the impacts of export restrictions related to China in non-memory had an adverse effect on profit. In the Device eXperience (DX) Division, operating profit declined quarter-on-quarter due to a sequential decline in sales volume following the launch of new smartphone models in the first quarter. Looking ahead to H2, the DS Division plans to proactively meet the growing demand for high-value-added and AI-driven products and continue to strengthen competitiveness in advanced semiconductors. The DX Division will seek to minimize the impact of uncertainties stemming from tariff policies that are likely to persist.Semiconductors Expected To Proactively Meet Continued AI Demand

The DS Division posted KRW 27.9 trillion in consolidated revenue and KRW 0.4 trillion in operating profit for the second quarter.

In Q2 2025, the Memory Business proactively addressed robust server demand by expanding HBM3E sales and by expanding the proportion of high-density DDR5 products. Also, with the resumption of datacenter projects that were previously delayed, sales of server SSDs increased, helping NAND inventory to decrease significantly. However, earnings were impacted by one-off costs such as inventory value adjustments.

In H2 2025, AI demand is expected to remain robust due to continued investments by major cloud service providers, and therefore server demand for both DRAM and NAND is expected to stay strong.

To align with solid AI-server demand for DRAM, the Memory Business will proactively address the need for high-density products and diversify product offerings through HBM, server LPDDR5x, high-density DDR5, 24 Gb GDDR7 and other products. For NAND, the Memory Business plans to increase sales of high-density and high-performance SSDs while accelerating the transition to 8th Generation V-NAND across all applications.

The System LSI Business generated solid revenue from shipments of flagship systems-on-a-chip (SoCs) using the Gate-All-Around (GAA) process, but earnings improvement was limited due to higher costs of developing advanced products.

In H2 2025, the System LSI Business will focus on improving Exynos competitiveness to ensure its adoption in 2026 flagship mobile lineups of a major customer and expanding the sales of ultra-high-resolution and nano-prism sensors.

Despite significant growth in revenue from the first quarter, earnings for the Foundry Business remained weak due to the impact of inventory value adjustments that stemmed from US export restrictions on advanced AI chips to China, as well as a continued low utilization rates at mature nodes.

In H2 2025, the Foundry Business will ramp up mass production of a new mobile SoC with the 2 nm GAA process. It also aims to improve factory utilization and profitability through expanded sales to major customers.

SDC To Further Accelerate Leadership By Differentiating and Enhancing Display Technologies

Samsung Display Corporation (SDC) posted KRW 6.4 trillion in consolidated revenue and KRW 0.5 trillion in operating profit for the second quarter.

For the mobile display business, SDC saw a revenue increase based on the response to new smartphones of major customers as well as the expansion of sales in the IT and automotive segments. The large display business experienced continued growth in sales of QD-OLED monitor displays, driven by robust demand in the gaming market.

In H2 2025, the mobile display business expects sales growth from major customers' new smartphone launches amid ongoing market uncertainties. It also aims to strengthen market leadership with differentiated technologies and the continued expansion of sales beyond smartphone displays. The large display business will seek to maintain a stable supply of TV panels while continuing to accelerate the penetration of QD-OLED monitors by enhancing the product lineup.

MX Grows Revenue and Operating Profit YoY, Will Focus on Flagship Sales and AI Capabilities

The Mobile eXperience (MX) and Networks businesses posted KRW 29.2 trillion in consolidated revenue and KRW 3.1 trillion in operating profit for the second quarter.

In Q2 2025, the MX Business experienced a decrease in smartphone shipments compared to Q1, when new models were released, but both revenue and operating profit grew YoY through robust sales of the Galaxy S25 series, Galaxy A series and Galaxy tablets. The Business also maintained solid double-digit profitability via efficient resource management.

In H2 2025, the MX Business plans to continue a flagship-first approach for smartphone sales focusing on foldables and the Galaxy S25 series - while emphasizing the AI functionality of the Galaxy A series - to increase market share. It will also reinforce the AI capabilities of tablets and wearables and expand the Galaxy ecosystem with the launch of products with new form-factors, including extended reality (XR) and TriFold devices, and contribute to maintaining solid profitability despite market uncertainties and rising bill of materials (BOM) costs.

The Networks Business improved profitability in Q2 2025 by expanding revenue in overseas markets and enhancing cost efficiencies, and in H2 2025, it will focus on achieving revenue targets and regaining competitiveness by securing new orders with optimized costs.

Visual Display Enhances Sales Mix, Targets the Capture of Peak-Season Demand in H2

The Visual Display and Digital Appliances businesses posted KRW 14.1 trillion in consolidated revenue and KRW 0.2 trillion in operating profit in the second quarter.

In Q2 2025, the Visual Display Business improved the sales of premium products, such as Neo QLED and OLED TVs, but earnings declined due to stagnant demand and intensified competition.

In H2 2025, the Business plans to reinforce revenue growth by capturing peak-season demand, based on a strengthened lineup of high-value-added TVs offering superior viewing experiences with enhanced AI features. In addition, the Business will drive solid profitability and growth through its differentiated experiences and services including SmartThings, Samsung Knox, Samsung Art Store and Samsung TV Plus.

Comments on Samsung Electronics Announces Second Quarter 2025 Results

There are no comments yet.